Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nikola Corp. (NC) is trying to decide whether to lease or buy a new computer-assisted manufacturing system from Finland. Management has decided that it

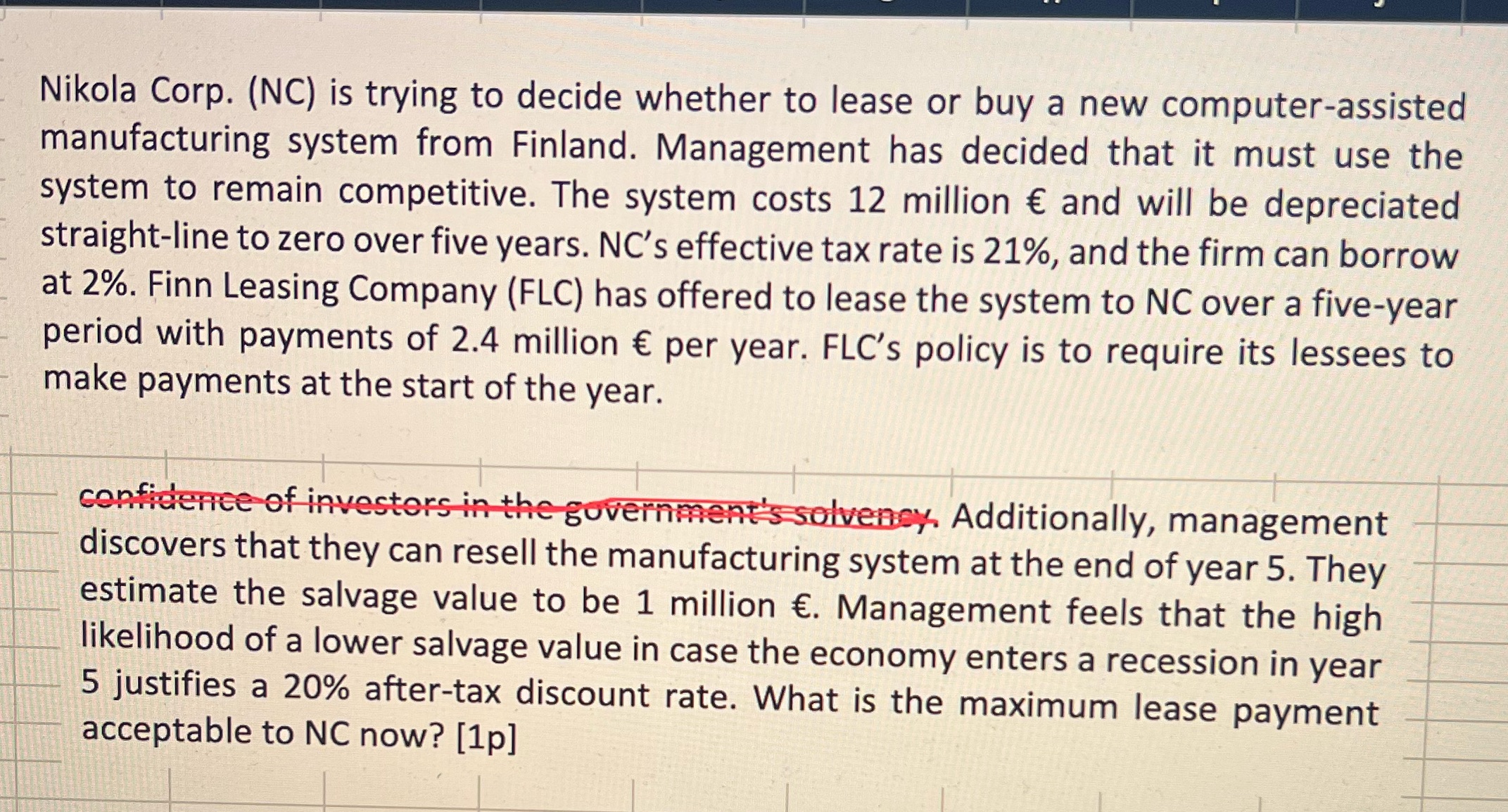

Nikola Corp. (NC) is trying to decide whether to lease or buy a new computer-assisted manufacturing system from Finland. Management has decided that it must use the system to remain competitive. The system costs 12 million and will be depreciated straight-line to zero over five years. NC's effective tax rate is 21%, and the firm can borrow at 2%. Finn Leasing Company (FLC) has offered to lease the system to NC over a five-year period with payments of 2.4 million per year. FLC's policy is to require its lessees to make payments at the start of the year. confidence of investors in the government's solvency. Additionally, management discovers that they can resell the manufacturing system at the end of year 5. They estimate the salvage value to be 1 million . Management feels that the high likelihood of a lower salvage value in case the economy enters a recession in year 5 justifies a 20% after-tax discount rate. What is the maximum lease payment acceptable to NC now? [1p]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

There are two parts to consider Owning vs Leasing Part 1 Owning the System Annual Depreciation Cost Useful Life 12000000 5 years 2400000 per year Tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started