Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Niles and Marsha adopted an infant boy (a U.S. citizen). They paid $15,500 in 2021 for adoption-related expenses. The adoption was finalized in early 2022.

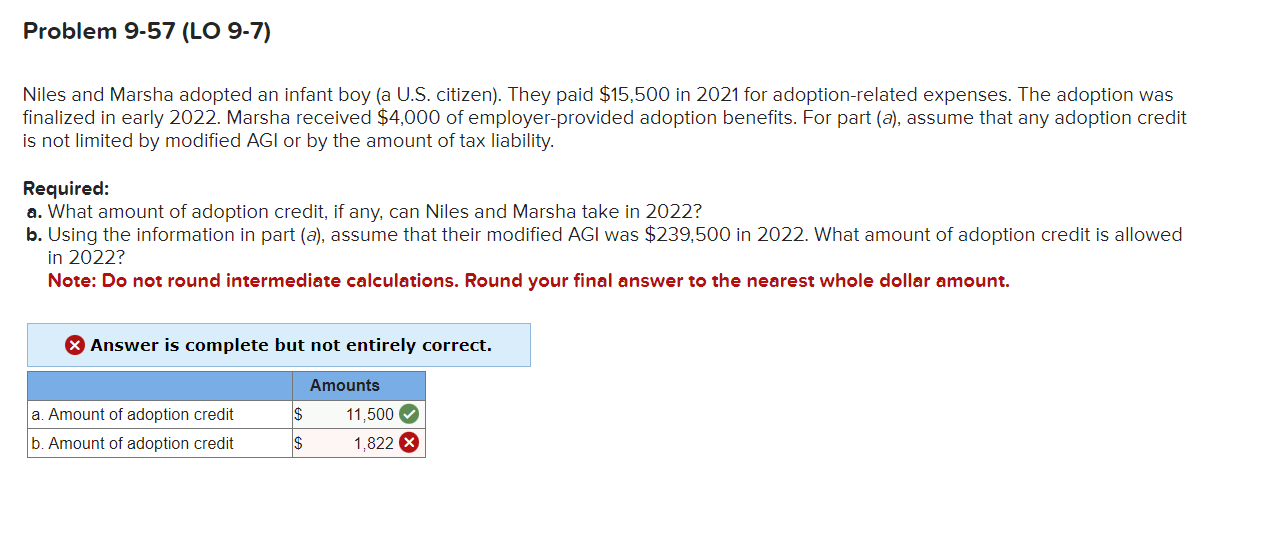

Niles and Marsha adopted an infant boy (a U.S. citizen). They paid \\$15,500 in 2021 for adoption-related expenses. The adoption was finalized in early 2022. Marsha received \\( \\$ 4,000 \\) of employer-provided adoption benefits. For part (a), assume that any adoption credit is not limited by modified AGI or by the amount of tax liability. Required: a. What amount of adoption credit, if any, can Niles and Marsha take in 2022? b. Using the information in part (a), assume that their modified AGI was \\( \\$ 239,500 \\) in 2022 . What amount of adoption credit is allowed in 2022? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. Answer is complete but not entirely correct

Niles and Marsha adopted an infant boy (a U.S. citizen). They paid \\$15,500 in 2021 for adoption-related expenses. The adoption was finalized in early 2022. Marsha received \\( \\$ 4,000 \\) of employer-provided adoption benefits. For part (a), assume that any adoption credit is not limited by modified AGI or by the amount of tax liability. Required: a. What amount of adoption credit, if any, can Niles and Marsha take in 2022? b. Using the information in part (a), assume that their modified AGI was \\( \\$ 239,500 \\) in 2022 . What amount of adoption credit is allowed in 2022? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. Answer is complete but not entirely correct Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started