Question

Nilestown Corp. currently sells 30,000 motor homes per year at $73,000 each, and 14,000 luxury motor coaches per year at $120,000 each. The company wants

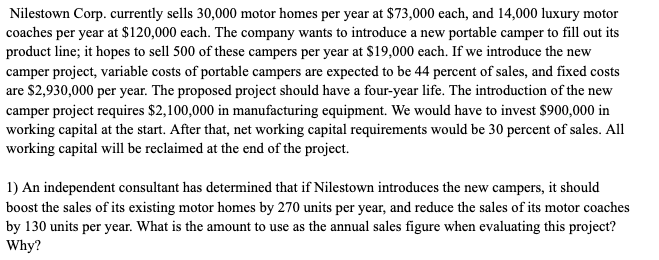

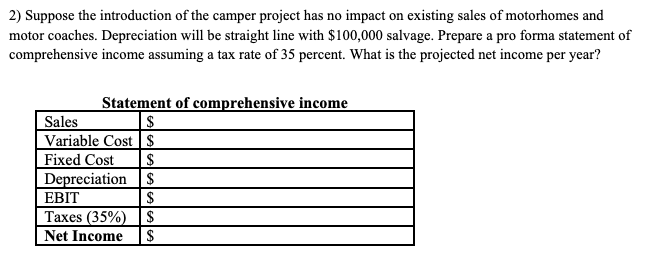

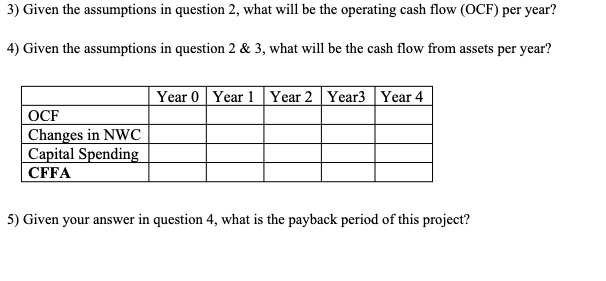

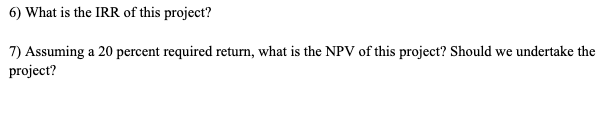

Nilestown Corp. currently sells 30,000 motor homes per year at $73,000 each, and 14,000 luxury motor coaches per year at $120,000 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 500 of these campers per year at $19,000 each. If we introduce the new camper project, variable costs of portable campers are expected to be 44 percent of sales, and fixed costs are $2,930,000 per year. The proposed project should have a four-year life. The introduction of the new camper project requires $2,100,000 in manufacturing equipment. We would have to invest $900,000 in working capital at the start. After that, net working capital requirements would be 30 percent of sales. All working capital will be reclaimed at the end of the project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started