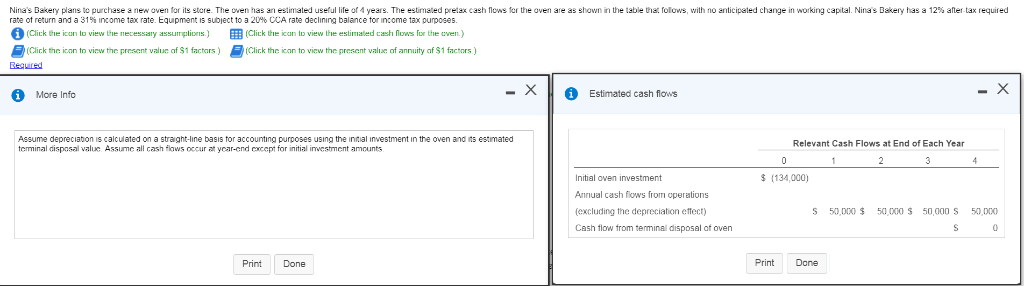

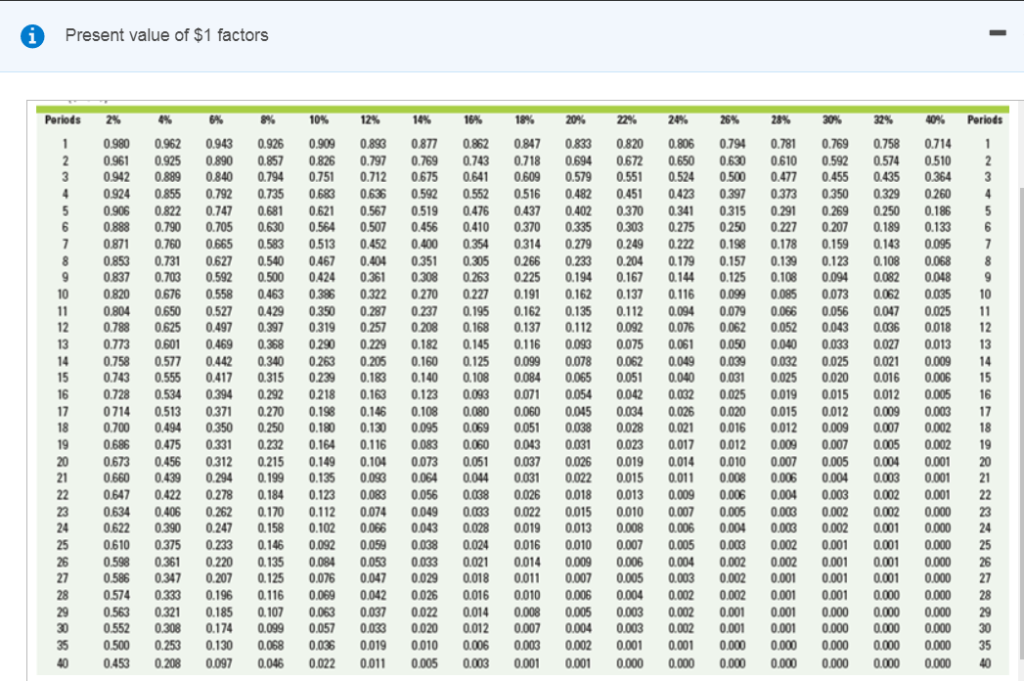

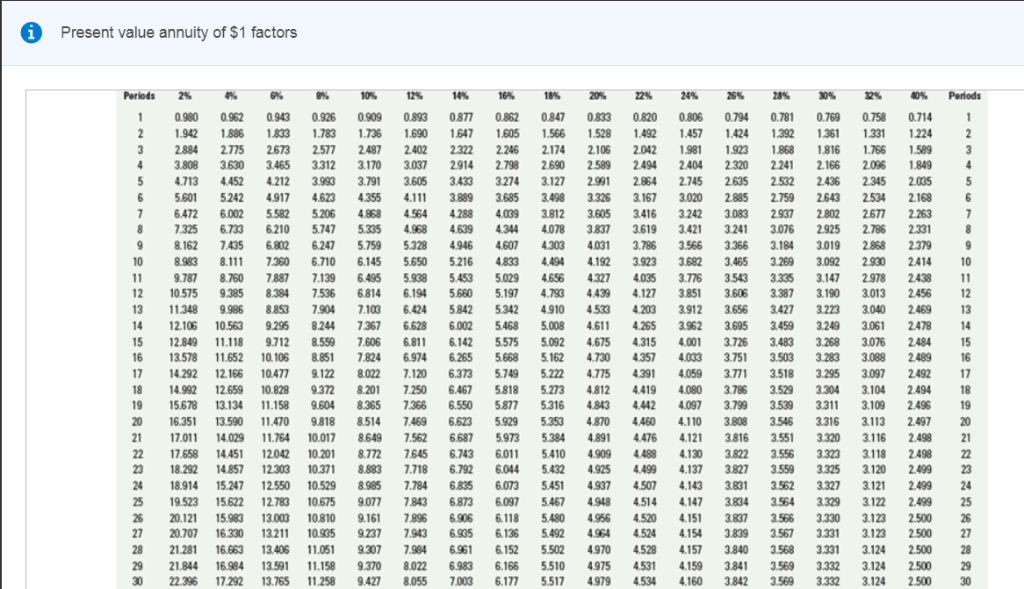

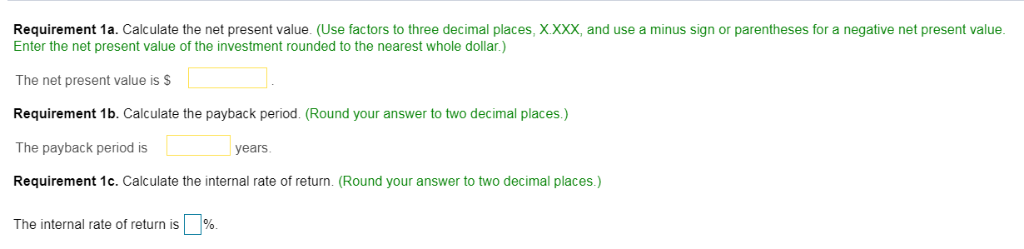

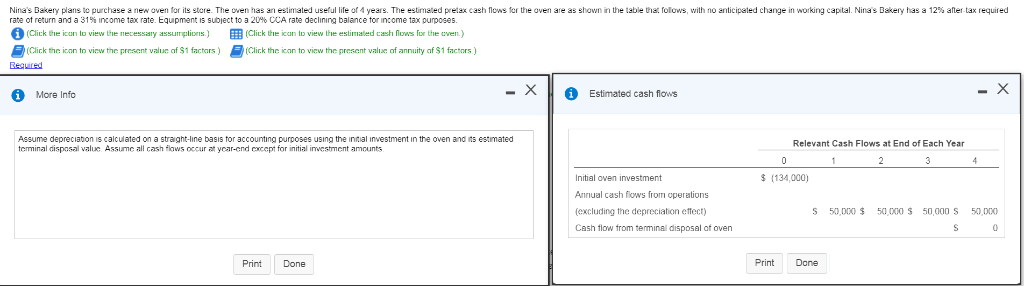

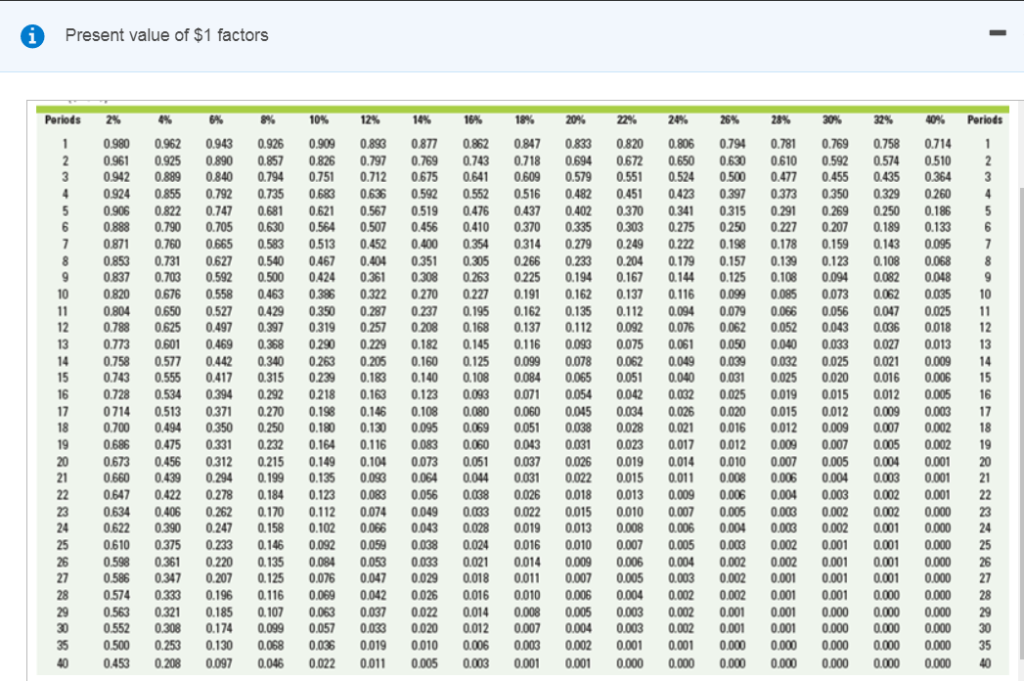

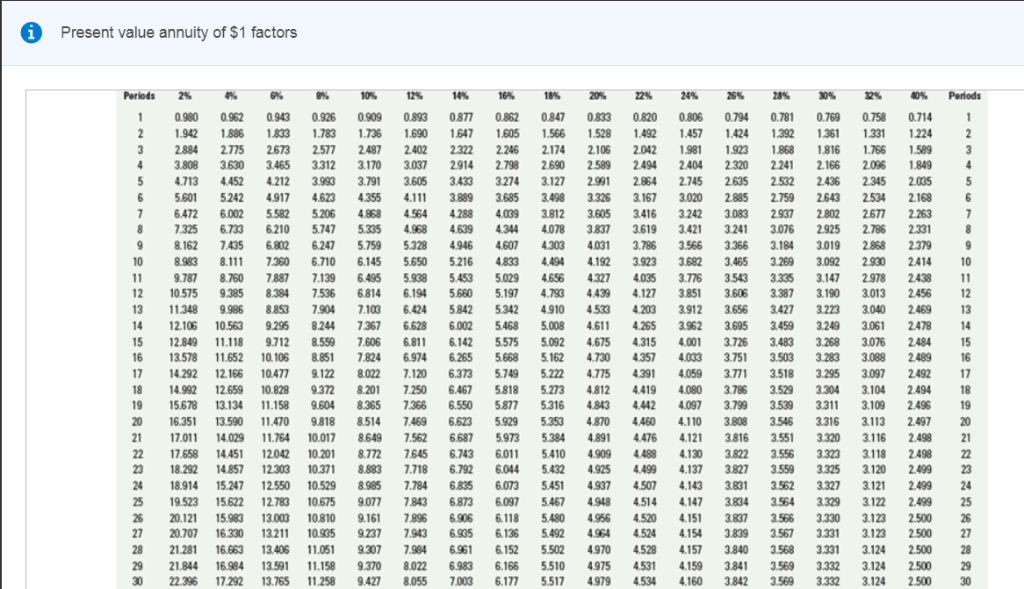

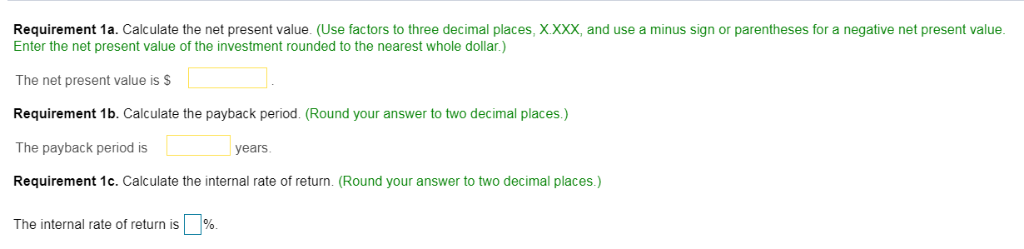

Nina's Bakery plans to purchase a new oven for its stere. The oven has an estimated useful life of 4 years. The estimated pretax cash flows for the oven are as shown in the table that folows, wilth no anticipated change in working capital. Nina's Bakery has a 12 % after tax required rate of return and a 31% income tax rate. Equipment is SUbject to a 20%% CA rae declining baldnce for in.erie l pupoa (Click e icon to view the mecessary assulnglionis ik te can lt view the estimald cash flows fun re even) EClirk the icon to view f (Clic k the icon to vicw the present value of $1 factors) e present value of annuity af $1 factors) Required X X More Info Estimated cash flows Assume depreciation is calculated on a straight-line basis tor accounting purposes using the intial investment in the oven and terminal dispasal value Assumc all cash flows occur at vcar-cnd.cxcent f estimated Relevant Cash Flows at End of Each Year r initial investment amcunts 0 1 2 3 4 Initial oven investment $(134,000) Annual cash flows from operations 50,000 $ 50 000 S (excluding the depreciation ettect) 50,000 S 50,000 Cash flow from terminal disposal of oven S Print Done Print Done i Present value of $1 factors 18% 28% 6% 16% 32% Periods 2% 4% 8% 10% 12% 14% 20% 22% 24% 26% 30% 40% Periods 0.980 0.893 0.797 0847 0.833 0,694 0.962 0.943 0.926 0.909 0.877 0.862 0.820 0.672 0.806 0.794 0.781 0610 0.769 0.758 0.714 1 1 0.890 0.840 0.826 0.769 0.650 0.524 0,630 0.592 2 0.961 0.942 0.925 0.889 0.857 0.743 0.641 0.718 0.609 0516 0.574 0.435 0.510 0364 0,794 0.751 0.712 0. 0.579 0.551 0.500 0.477 0.455 0.855 0.683 0.592 0.924 0.792 0735 0.552 0.482 0.402 0335 4 0.636 0.451 0.423 0.397 0.373 0.350 0.329 0.260 0.906 0.888 0.747 0.519 0.476 0.250 0.822 0.681 0.621 0.567 0.437 0.370 0.341 0.315 0.291 0.269 0.186 5 0370 6 6 0.790 0.705 0.630 0.564 0.507 0.456 0.410 0.303 0.275 0.250 0.227 0.207 0.189 0.133 7 0.871 0.760 0.665 0.583 0.513 0.452 0.400 0.354 0314 0.279 0.249 0.222 0.198 0.178 0.159 0.143 0,095 7 8 0.853 0.179 8 0.731 0.627 0.540 0.467 0.404 0.351 0.305 0266 0.233 0.204 0.157 0.139 0.108 0.123 0.108 0.068 0.837 0.703 0.592 0.500 0.424 0.361 0.308 0.263 0225 0.194 0.167 0.144 0.125 0.094 0.082 0.048 10 0.820 0.676 0.558 0.463 0.386 0.322 0.270 0.227 0.191 0.162 0.137 0.116 0.099 0.085 0.073 0.062 0,035 10 11 0.804 0.650 0.527 0.429 0.350 0.287 0.257 0.237 0.208 0.195 0.162 0.137 0.135 0.112 0.112 0.094 0.079 0.066 0.052 0.056 0.047 0.025 11 12 0.788 0,625 0.497 0.397 0319 0.168 0.092 0.076 0.062 0.043 0.036 0.018 12 13 0.027 0.773 0.601 0.469 0.368 0.290 0.229 0.182 0.145 0.116 0.093 0.075 0.061 0.050 0.040 0.033 0.013 13 0.039 14 0.758 0.577 0.555 0.442 0.417 0.340 0.263 0.239 0.205 0.160 0.140 0.125 0.108 0.099 0.078 0.065 0.062 0.051 0.049 0.040 0.032 0.026 0.032 0.025 0.025 0.020 0.021 0.016 0.012 0.009 0.007 0.009 14 15 0.743 0.315 0.183 0.084 0.031 0.006 15 16 0728 0.534 0.394 0.292 0218 0.163 0.123 0.093 0071 0.054 0.042 0.025 0.019 0.015 0.005 16 17 0714 0.700 0.513 0.494 0.371 0.350 0.270 0.250 0.198 0.146 0.130 0.108 0.095 0.080 0.069 0.060 0.051 0.045 0.038 0.034 0.028 0.020 0.016 0.015 0.012 0.012 0.009 0.003 0.002 17 18 0.180 0.021 18 0.009 19 19 0.686 0.475 0.331 0.232 0.164 0.116 0.083 0.060 0.043 0.031 0.023 0.017 0.012 0.007 0.005 0.002 20 0.673 0.660 0.456 0.439 0.312 0.294 0.215 0.199 0.149 0.135 0.104 0.093 0.083 0.073 0.064 0.051 0.044 0.037 0.031 0.026 0.019 0015 0.014 0.011 0.010 0.007 0.006 0.005 0.004 0.003 0.002 0.002 0.004 0,003 0.001 0,001 20 0.022 21 22 0.008 21 0.647 0.422 0.278 0.184 0.056 0.038 0,026 0.018 0013 0.009 0.002 0,001 22 0.123 0.006 0,004 0.406 0.262 0247 0.170 0.158 0.049 0.033 0,022 0.019 0.015 0.013 0010 0.008 0.007 0.006 23 23 0.634 0.112 0.074 0.005 0.003 0.002 0,000 0.028 0.066 0.001 0.000 24 0.622 0.390 0.102 0.043 0.004 0.003 24 25 0.610 0.024 0.010 0.007 0.005 25 0.375 0.233 0.146 0.092 0.059 0.038 0.016 0.003 0.002 0.001 0.001 0.000 26 26 0.135 0.009 0.007 0.598 0.361 0.220 0.084 0.053 0.033 0.021 0.014 0.006 0.004 0.002 0.002 0.001 0.001 0,000 27 0.586 0.207 0.076 0.029 0.018 0.005 0.003 0.347 0.125 0.047 0.011 0.002 0.001 0.001 0.001 0.000 27 28 0.574 0.002 0333 0.196 0.116 0.069 0.042 0.026 0.016 0.010 0.006 0.004 0.002 0.001 0.001 0.000 0.000 28 29 30 29 30 0.563 0.321 0.185 0.107 0.063 0.037 0.022 0.014 0.008 0.005 0.003 0.002 0.001 0.001 0.000 0.000 0.000 0.552 0.308 0.174 0.099 0.057 0.033 0.020 0.012 0.007 0.004 0.003 0.002 0.001 0.001 0.000 0.000 0.000 35 0.500 0.253 0.130 0.068 0.036 0.019 0.010 0.006 0.003 0.002 0.001 0.001 0.000 0.000 0.000 0.000 0.000 35 40 0.453 0.208 0,097 0.046 0.022 0.011 0.005 0.003 0.001 0.001 0,000 0.000 0.000 0.000 0.000 0.000 0.000 Present value annuity of $1 factors 28% 30% 2% 14% 20% 22% Periods % 10% 12% 16% 18% 24% 26% 40% Poriods 0.943 0.926 0.909 0.893 0.862 0.806 0.769 0.758 0.980 0.877 0.847 0.833 0.781 0.714 1 0.962 0.820 0794 1 942 1605 1.528 1.457 1.886 1.833 1.783 1.736 1690 1647 1.566 1.492 1424 1392 1.361 1331 1224 3 2.884 2775 2673 3465 2.577 3312 2.487 3170 2.402 2.322 2.914 2.246 2.174 2.106 2.042 2.494 1981 1923 2320 1868 1816 1.766 1.589 2.096 1.849 3.808 3.630 3.037 2.798 2.690 2.589 2.404 2241 2.166 4 5 4.713 3993 3791 3.605 3274 3.127 2.745 2.635 2.532 2.005 5 4.452 4.212 3.433 2.991 2.864 2.436 2.345 5,601 5242 4.917 4.623 4355 4.111 3.889 3685 3.498 3326 3.167 3.020 2.885 2759 2643 2.534 2.168 6.472 6.002 6.733 5.582 6.210 5.206 5.747 4868 5.335 4.564 4.288 4.639 4.039 3812 4.078 3605 3416 3.619 3.242 3.421 3.083 3241 2937 3076 2802 2925 2.677 2.786 2.263 2.331 7.325 4.968 4.344 3837 8 2.868 7.435 5.328 4.946 4607 3.366 2379 8.162 6.802 6.247 5.759 4.303 4031 3.786 3.566 3.184 3.019 10 8.983 8.111 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.192 3.923 3682 3.465 3.269 3.092 2.930 2.414 10 11 9.787 8.760 7.887 7.139 6.495 5.938 6.194 5.453 5.029 5.197 4.656 4,793 4.327 4.035 3.776 3.543 3335 3.147 2.978 3013 2438 11 12 10.575 9.385 8.384 7.536 6814 5.660 4.439 4.127 3.851 3606 3.387 3.190 2.456 12 13 11348 9.986 8853 7.904 7.103 6.424 5.842 5342 4.910 4533 4.203 3912 3656 3427 3.223 3040 2.469 13 6.628 14 12.106 10.563 9.295 8.244 7.367 6.002 5468 5.008 4.611 4.265 3962 3.695 3459 3249 3.061 2478 14 15 12.849 11.118 11652 9.712 8.559 8.851 7.606 7.824 6.811 6.142 6.265 5575 5668 5.092 5.162 4.675 4.315 4.357 4.001 4.033 3.726 3.751 3.483 3.268 3.076 2.484 15 3.088 16 16 13.578 10.106 6.974 4.730 3503 3.283 2.489 17 14.292 12.166 10477 9.122 8022 7.120 6.373 5.749 5.222 4.775 4391 4.059 3771 3518 3.295 3.097 2.492 17 8.201 18 14.992 15.678 12.659 13.134 10.828 11.158 9.372 9.604 7.250 7.366 6.467 5.818 5.273 4.812 4.419 4.080 4.097 3.786 3.799 3.529 3539 3304 3.104 2.494 18 19 8.365 6.550 5.877 5.316 4.843 4.442 3311 3.109 2.496 19 20 20 16.351 13.590 11470 9.818 8.514 7.469 6623 5.929 5.353 4.870 4.460 4.110 3.808 3.546 3316 3113 2.497 21 17.011 14.029 11.764 10.017 8649 7.562 6687 5.973 5.384 4.891 4.476 4.121 3816 3.551 3.320 3116 2.498 21 22 22 17.658 18.292 14.451 14.857 12.042 12303 10.201 10.371 10.529 8.772 8.883 7.645 7.718 6.743 6.792 6.011 6.044 6.073 5.410 5.432 4.909 4.925 4.488 4.130 4.137 3.822 3827 3.556 3.559 3323 3.325 3.118 3120 2.498 2.499 23 4.499 23 24 8985 7.784 5,451 4.937 4.507 3327 18.914 15.247 12.550 6.835 4.143 3831 3.562 3121 2.499 24 25 19.523 15.622 12.783 10.675 9.077 7843 6.873 6.097 5,467 4.948 4.514 4.147 3834 3.564 3.329 3.122 2.499 25 4.956 4.520 26 26 20.121 15.983 16.330 13.003 10.810 10.935 9.161 7.896 7.943 6.906 6118 5,480 4.151 4,154 3837 3.566 3330 3.123 2.500 9237 6.935 5.492 4.964 27 27 20.707 13211 6,136 4.528 3839 3567 3.331 3.123 2500 11.05 4528 28 28 21.281 16.663 13.406 9.307 7.984 6.961 6.152 5.502 4.970 4.157 3840 3.568 3.331 3.124 2.500 29 29 30 21844 22.396 16.984 13.591 13.765 11.158 11.258 9.370 9.427 8.022 8.055 6.983 7.003 6.166 6.177 5.510 5.517 4.975 4.979 4.531 4.534 4.159 3841 3842 3.569 3569 3.332 3.332 3.124 3.124 2.500 2.500 30 17.292 4.160 Requirement 1a. Calculate the net present value. (Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for a negative net present value. Enter the net present value of the investment rounded to the nearest whole dollar.) The net present value is $ Requirement 1b. Calculate the payback period. (Round your answer to two decimal places.) The payback period is years Requirement 1c. Calculate the internal rate of return. (Round your answer to two decimal places.) % The internal rate of return is