Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ning Time 2 hours, 09 minutes, 03 completion Status: Scenario You are an audit manager at Hogan & Associates and have been assigned to the

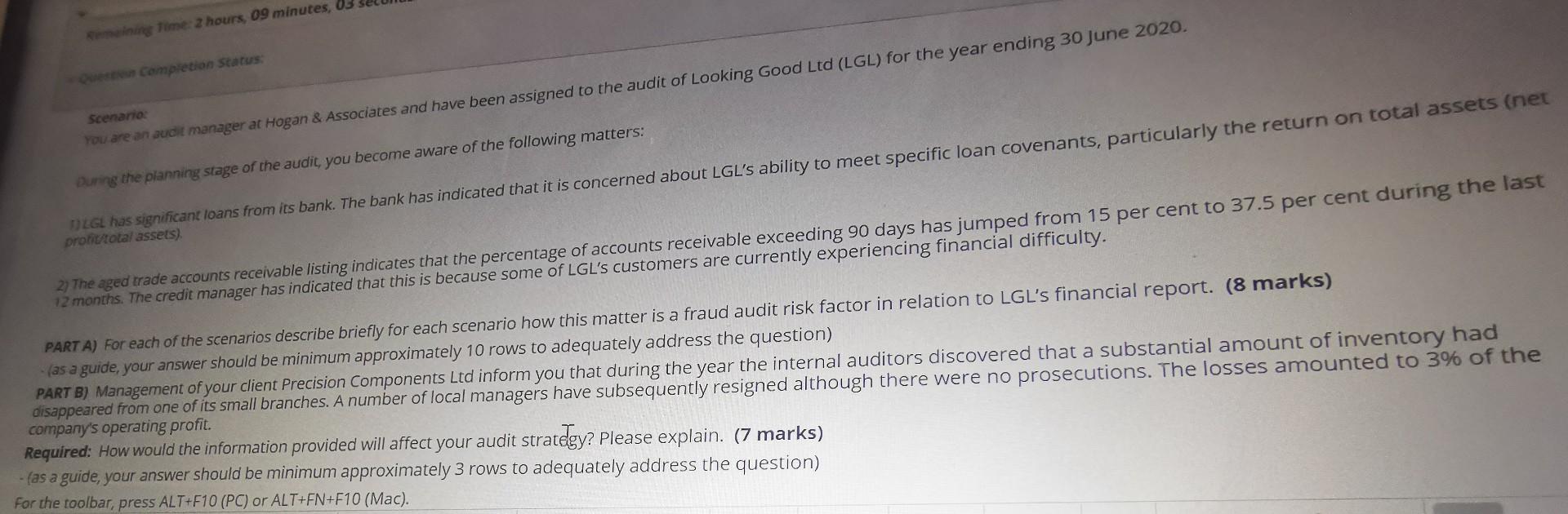

ning Time 2 hours, 09 minutes, 03 completion Status: Scenario You are an audit manager at Hogan & Associates and have been assigned to the audit of Looking Good Ltd (LGL) for the year ending 30 June 2020. Durng the planning stage of the audit, you become aware of the following matters: DLGL has significant loans from its bank. The bank has indicated that it is concerned about LGL's ability to meet specific loan covenants, particularly the return on total assets (net protitotal assets) 2) The aged trade accounts receivable listing indicates that the percentage of accounts receivable exceeding 90 days has jumped from 15 per cent to 37.5 per cent during the last 12 months. The credit manager has indicated that this is because some of LGL's customers are currently experiencing financial difficulty. PART A) For each of the scenarios describe briefly for each scenario how this matter is a fraud audit risk factor in relation to LGL's financial report. (8 marks) (as a guide, your answer should be minimum approximately 10 rows to adequately address the question) PART B) Management of your client Precision Components Ltd inform you that during the year the internal auditors discovered that a substantial amount of inventory had disappeared from one of its small branches. A number of local managers have subsequently resigned although there were no prosecutions. The losses amounted to 3% of the company's operating profit. Required: How would the information provided will affect your audit strategy? Please explain. (7 marks) - fas a guide, your answer should be minimum approximately 3 rows to adequately address the question) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). ning Time 2 hours, 09 minutes, 03 completion Status: Scenario You are an audit manager at Hogan & Associates and have been assigned to the audit of Looking Good Ltd (LGL) for the year ending 30 June 2020. Durng the planning stage of the audit, you become aware of the following matters: DLGL has significant loans from its bank. The bank has indicated that it is concerned about LGL's ability to meet specific loan covenants, particularly the return on total assets (net protitotal assets) 2) The aged trade accounts receivable listing indicates that the percentage of accounts receivable exceeding 90 days has jumped from 15 per cent to 37.5 per cent during the last 12 months. The credit manager has indicated that this is because some of LGL's customers are currently experiencing financial difficulty. PART A) For each of the scenarios describe briefly for each scenario how this matter is a fraud audit risk factor in relation to LGL's financial report. (8 marks) (as a guide, your answer should be minimum approximately 10 rows to adequately address the question) PART B) Management of your client Precision Components Ltd inform you that during the year the internal auditors discovered that a substantial amount of inventory had disappeared from one of its small branches. A number of local managers have subsequently resigned although there were no prosecutions. The losses amounted to 3% of the company's operating profit. Required: How would the information provided will affect your audit strategy? Please explain. (7 marks) - fas a guide, your answer should be minimum approximately 3 rows to adequately address the question) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started