Answered step by step

Verified Expert Solution

Question

1 Approved Answer

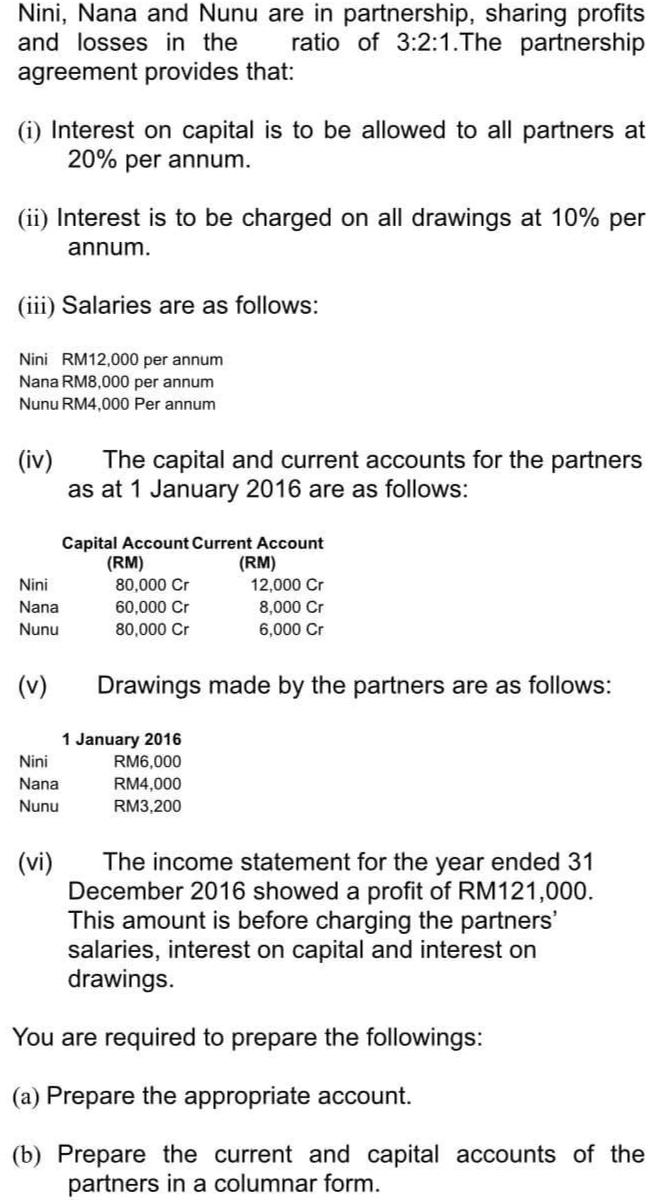

Nini, Nana and Nunu are in partnership, sharing profits and losses in the ratio of 3:2:1.The partnership agreement provides that: (i) Interest on capital

Nini, Nana and Nunu are in partnership, sharing profits and losses in the ratio of 3:2:1.The partnership agreement provides that: (i) Interest on capital is to be allowed to all partners at 20% per annum. (ii) Interest is to be charged on all drawings at 10% per annum. (iii) Salaries are as follows: Nini RM12,000 per annum Nana RM8,000 per annum Nunu RM4,000 Per annum (iv) The capital and current accounts for the partners as at 1 January 2016 are as follows: Nini Nana Nunu (v) Nini Nana Nunu Capital Account Current Account (RM) 80,000 Cr 60,000 Cr 80,000 Cr (RM) 1 January 2016 RM6,000 RM4,000 RM3,200 12,000 Cr 8,000 Cr 6,000 Cr Drawings made by the partners are as follows: (vi) The income statement for the year ended 31 December 2016 showed a profit of RM121,000. This amount is before charging the partners' salaries, interest on capital and interest on drawings. You are required to prepare the followings: (a) Prepare the appropriate account. (b) Prepare the current and capital accounts of the partners in a columnar form.

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Preparation of appropriate accounts Interest on Capital Account Partner Opening Balance Int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started