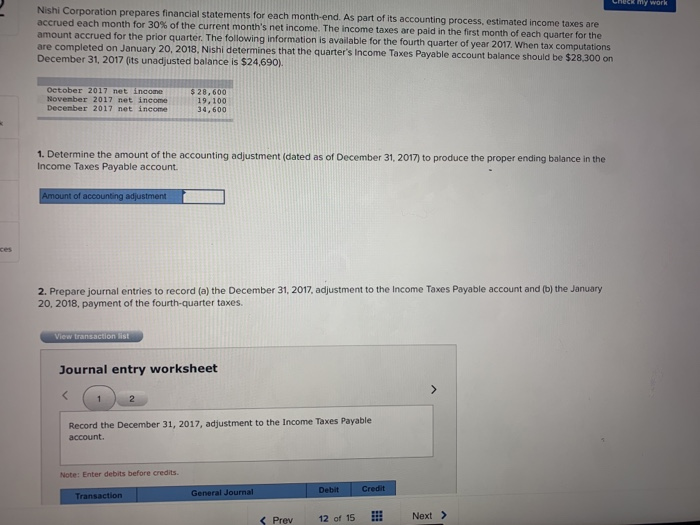

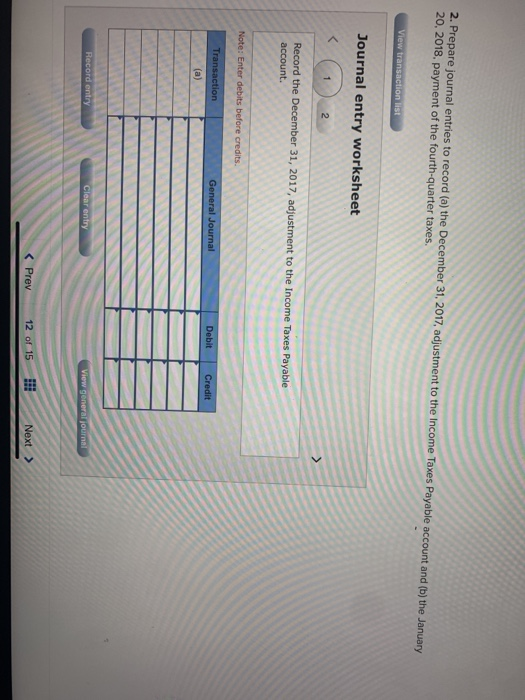

Nishi Corporation prepares financial statements for each month-end. As part of its accounting process, estimated income taxes are accrued each month for 30% amount accrued for the prior quarter. The following information is available for the fourth qua of the current month's net income. The income taxes are paid in the first month of each quarter for the rter of year 2017. When tax computations uarter's Income Taxes Payable account balance should be $28,300 on December 31, 2017 (its unadjusted balance is $24690) October 2017 net incone November 2017 net income Decenber 2017 net income $ 28,600 19,100 34,600 1. Determine the amount of the accounting adjustment (dated as of December 31, 2017) to produce the proper ending balance in the Income Taxes Payable account 2. Prepare journal entries to record (a) the December 31, 2017, adjustment to the Income Taxes Payable account and (b) the January 20, 2018, payment of the fourth-quarter taxes. Journal entry worksheet Record the December 31, 2017, adjustment to the Income Taxes Payable account. Note: Enter debits before credits General Journal Prev12 of 15 Next> 2. 20, 2018, payment of the fourth-quarter taxes e journal entries to record (a) the December 31, 2017, adju Journal entry worksheet Nishi Corporation prepares financial statements for each month-end. As part of its accounting process, estimated income taxes are accrued each month for 30% amount accrued for the prior quarter. The following information is available for the fourth qua of the current month's net income. The income taxes are paid in the first month of each quarter for the rter of year 2017. When tax computations uarter's Income Taxes Payable account balance should be $28,300 on December 31, 2017 (its unadjusted balance is $24690) October 2017 net incone November 2017 net income Decenber 2017 net income $ 28,600 19,100 34,600 1. Determine the amount of the accounting adjustment (dated as of December 31, 2017) to produce the proper ending balance in the Income Taxes Payable account 2. Prepare journal entries to record (a) the December 31, 2017, adjustment to the Income Taxes Payable account and (b) the January 20, 2018, payment of the fourth-quarter taxes. Journal entry worksheet Record the December 31, 2017, adjustment to the Income Taxes Payable account. Note: Enter debits before credits General Journal Prev12 of 15 Next> 2. 20, 2018, payment of the fourth-quarter taxes e journal entries to record (a) the December 31, 2017, adju Journal entry worksheet