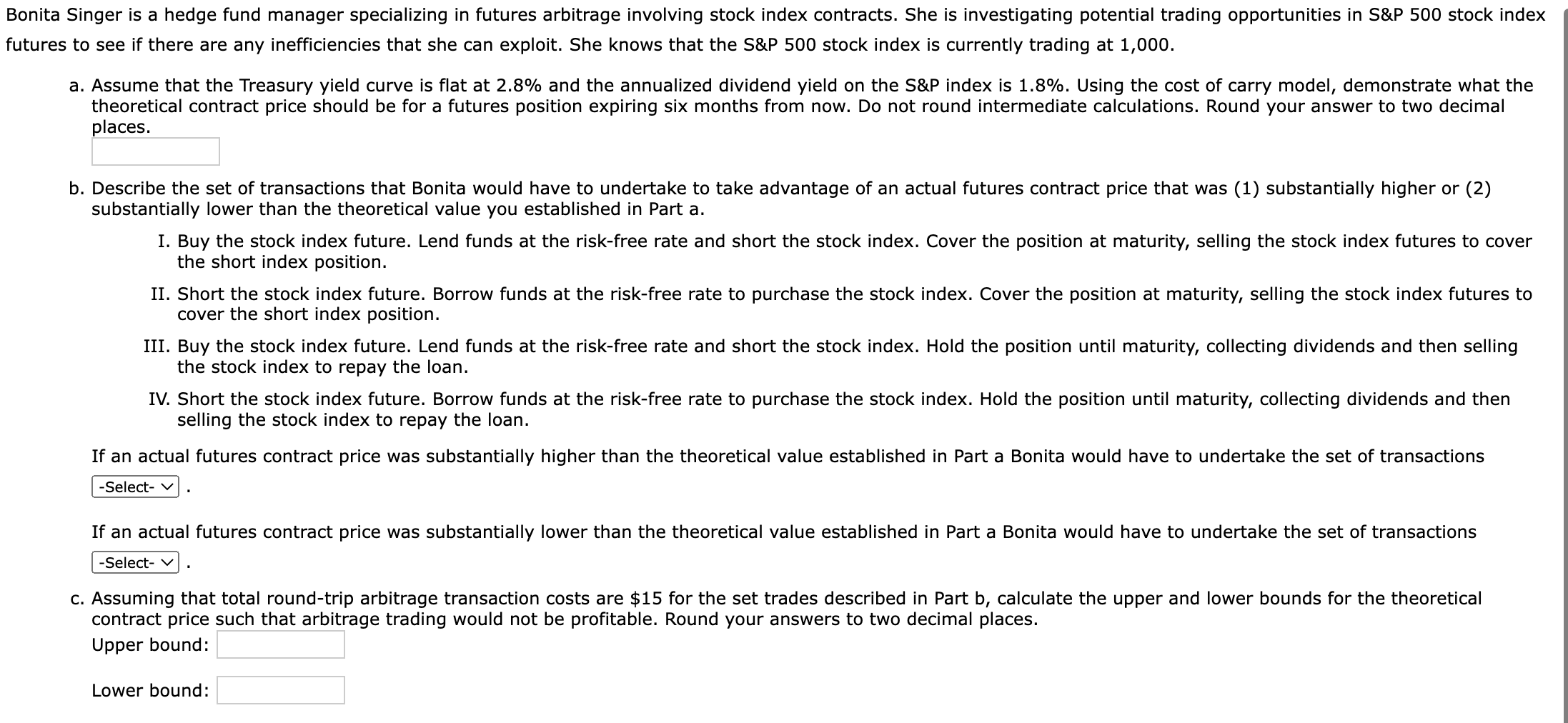

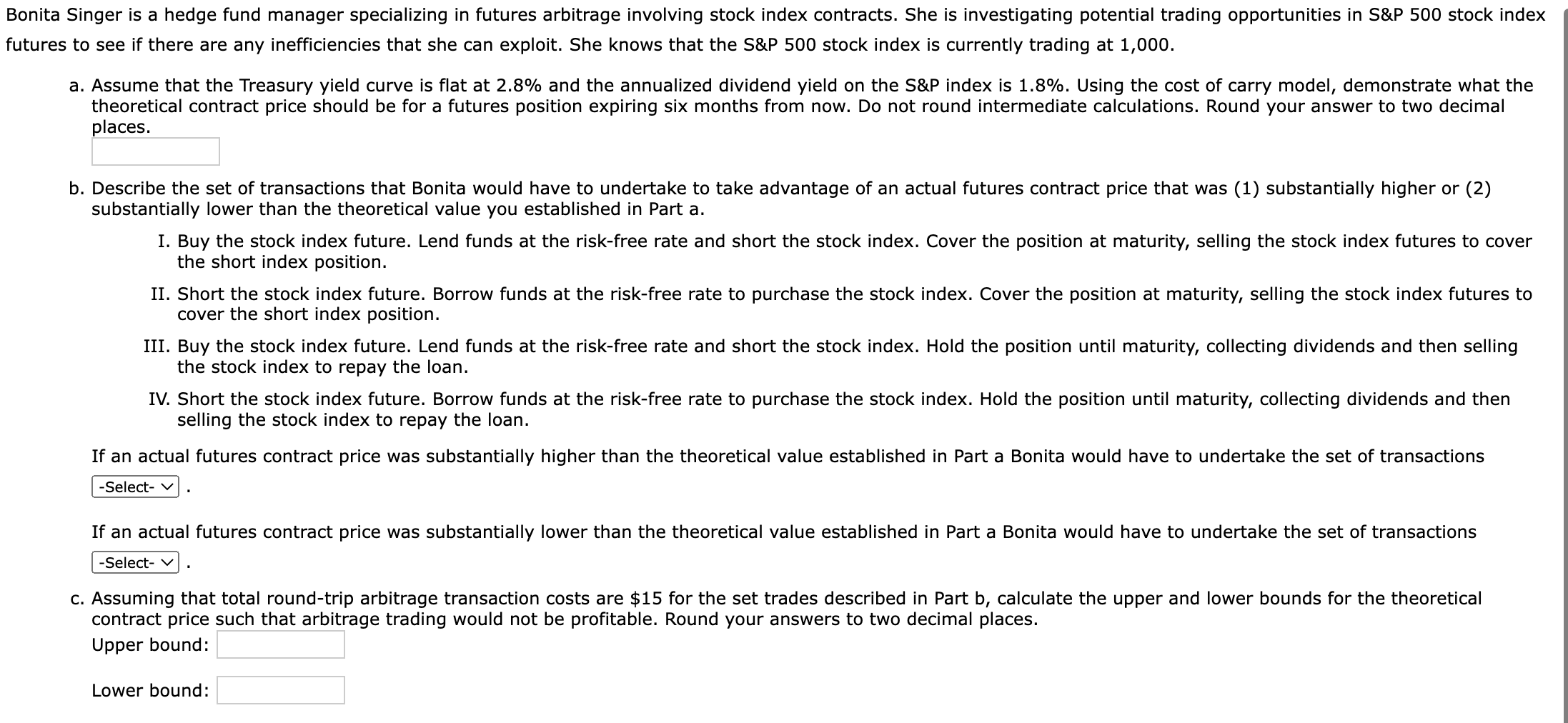

nita Singer is a hedge fund manager specializing in futures arbitrage involving stock index contracts. She is investigating potential trading opportunities in S\&P 500 stock index ures to see if there are any inefficiencies that she can exploit. She knows that the S\&P 500 stock index is currently trading at 1,000. a. Assume that the Treasury yield curve is flat at 2.8% and the annualized dividend yield on the S\&P index is 1.8%. Using the cost of carry model, demonstrate what the theoretical contract price should be for a futures position expiring six months from now. Do not round intermediate calculations. Round your answer to two decimal blaces. b. Describe the set of transactions that Bonita would have to undertake to take advantage of an actual futures contract price that was (1) substantially higher or (2) substantially lower than the theoretical value you established in Part a. I. Buy the stock index future. Lend funds at the risk-free rate and short the stock index. Cover the position at maturity, selling the stock index futures to cover the short index position. II. Short the stock index future. Borrow funds at the risk-free rate to purchase the stock index. Cover the position at maturity, selling the stock index futures to cover the short index position. III. Buy the stock index future. Lend funds at the risk-free rate and short the stock index. Hold the position until maturity, collecting dividends and then selling the stock index to repay the loan. IV. Short the stock index future. Borrow funds at the risk-free rate to purchase the stock index. Hold the position until maturity, collecting dividends and then selling the stock index to repay the loan. If an actual futures contract price was substantially higher than the theoretical value established in Part a Bonita would have to undertake the set of transactions If an actual futures contract price was substantially lower than the theoretical value established in Part a Bonita would have to undertake the set of transactions c. Assuming that total round-trip arbitrage transaction costs are $15 for the set trades described in Part b, calculate the upper and lower bounds for the theoretical contract price such that arbitrage trading would not be profitable. Round your answers to two decimal places. Upper bound