Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NMH is evaluating the financing of a new project. The amount of investment capital required is RM 15 million. The expected Earnings before Interest

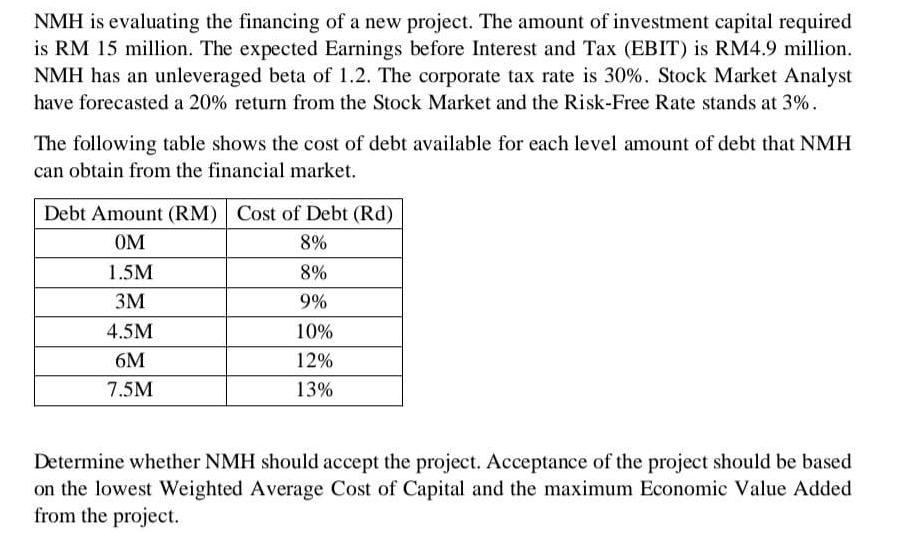

NMH is evaluating the financing of a new project. The amount of investment capital required is RM 15 million. The expected Earnings before Interest and Tax (EBIT) is RM4.9 million. NMH has an unleveraged beta of 1.2. The corporate tax rate is 30%. Stock Market Analyst have forecasted a 20% return from the Stock Market and the Risk-Free Rate stands at 3%. The following table shows the cost of debt available for each level amount of debt that NMH can obtain from the financial market. Debt Amount (RM) Cost of Debt (Rd) OM 8% 8% 9% 1.5M 3M 4.5M 6M 7.5M 10% 12% 13% Determine whether NMH should accept the project. Acceptance of the project should be based on the lowest Weighted Average Cost of Capital and the maximum Economic Value Added from the project.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Given the information provided NMH should not accept the project The cost of debt for the amount of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started