Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NO ANONYMOUS ANSWERS PLEASE. THX You have been tasked with estimating the value of one share of Xcel Energy, an electric utility company. Xcel generated

NO ANONYMOUS ANSWERS PLEASE. THX

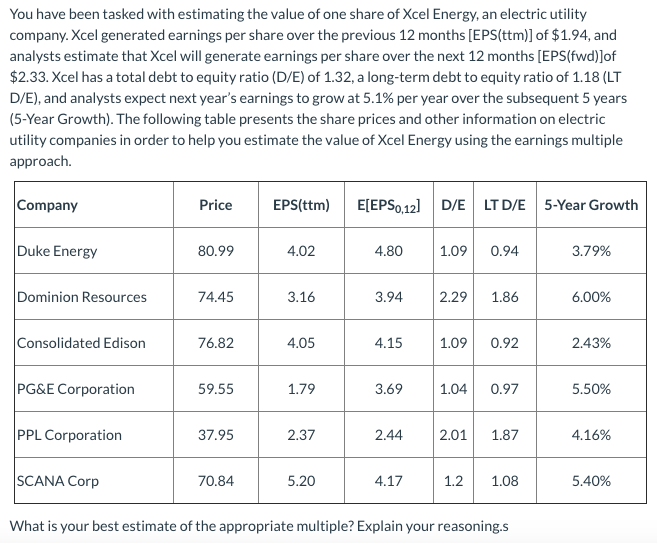

You have been tasked with estimating the value of one share of Xcel Energy, an electric utility company. Xcel generated earnings per share over the previous 12 months [EPS(ttm)] of $1.94, and analysts estimate that Xcel will generate earnings per share over the next 12 months [EPS(fwd)]of $2.33. Xcel has a total debt to equity ratio (D/E) of 1.32, a long-term debt to equity ratio of 1.18 (LT D/E), and analysts expect next year's earnings to grow at 5.1% per year over the subsequent 5 years (5-Year Growth). The following table presents the share prices and other information on electric utility companies in order to help you estimate the value of Xcel Energy using the earnings multiple approach. Company Price EPS(ttm) E[EPS0,121 D/E LTD/E 5-Year Growth Duke Energy 80.99 4.02 4.80 1.09 0.94 3.79% Dominion Resources 74.45 3.16 3.94 2.29 1.86 6.00% Consolidated Edison 76.82 4.05 4.15 1.09 0.92 2.43% PG&E Corporation 59.55 1.79 3.69 1.04 0.97 5.50% PPL Corporation 37.95 2.37 2.44 2.01 1.87 4.16% SCANA Corp 70.84 5.20 4.17 1.2 1.08 5.40% What is your best estimate of the appropriate multiple? Explain your reasonings You have been tasked with estimating the value of one share of Xcel Energy, an electric utility company. Xcel generated earnings per share over the previous 12 months [EPS(ttm)] of $1.94, and analysts estimate that Xcel will generate earnings per share over the next 12 months [EPS(fwd)]of $2.33. Xcel has a total debt to equity ratio (D/E) of 1.32, a long-term debt to equity ratio of 1.18 (LT D/E), and analysts expect next year's earnings to grow at 5.1% per year over the subsequent 5 years (5-Year Growth). The following table presents the share prices and other information on electric utility companies in order to help you estimate the value of Xcel Energy using the earnings multiple approach. Company Price EPS(ttm) E[EPS0,121 D/E LTD/E 5-Year Growth Duke Energy 80.99 4.02 4.80 1.09 0.94 3.79% Dominion Resources 74.45 3.16 3.94 2.29 1.86 6.00% Consolidated Edison 76.82 4.05 4.15 1.09 0.92 2.43% PG&E Corporation 59.55 1.79 3.69 1.04 0.97 5.50% PPL Corporation 37.95 2.37 2.44 2.01 1.87 4.16% SCANA Corp 70.84 5.20 4.17 1.2 1.08 5.40% What is your best estimate of the appropriate multiple? Explain your reasoningsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started