No dividends were declared or paid during the year 2020 due to poor economic conditions. Consider the following events in preparing a Statement of Stockholders Equity and earnings per share for the year 2021.

No dividends were declared or paid during the year 2020 due to poor economic conditions. Consider the following events in preparing a Statement of Stockholders Equity and earnings per share for the year 2021.

The companys net income for 2021 is $1,988,000 -- BEFORE any of the above transactions, adjustments or interest and dividend calculations. The income tax rate is 25%.

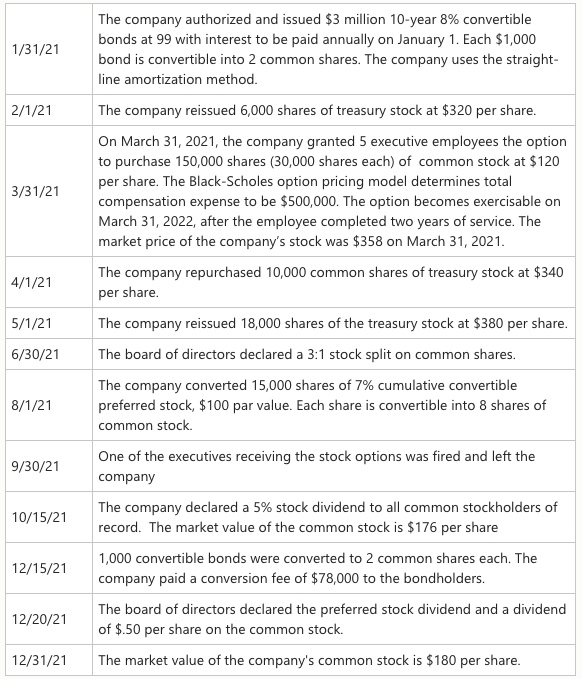

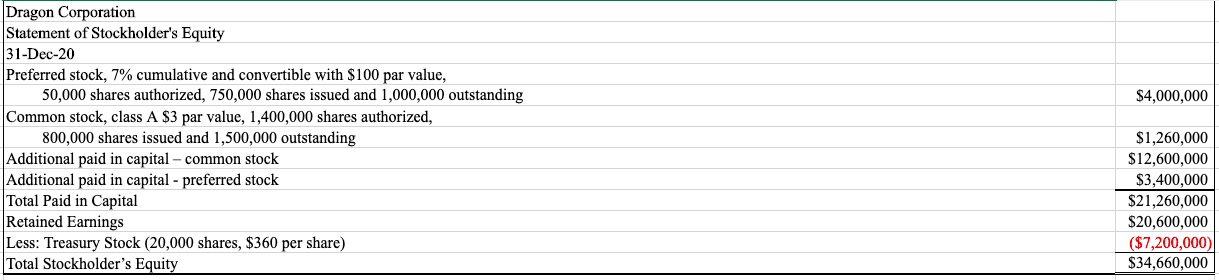

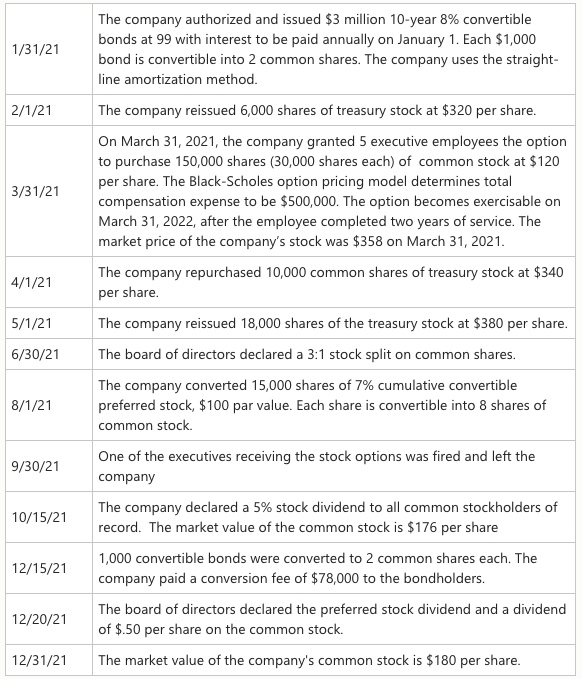

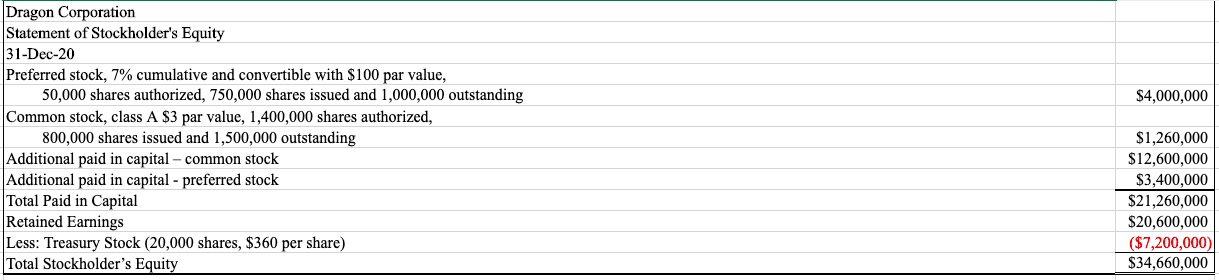

$4,000,000 Dragon Corporation Statement of Stockholder's Equity 31-Dec-20 Preferred stock, 7% cumulative and convertible with $100 par value, 50,000 shares authorized, 750,000 shares issued and 1,000,000 outstanding Common stock, class A $3 par value, 1,400,000 shares authorized, 800,000 shares issued and 1,500,000 outstanding Additional paid in capital common stock Additional paid in capital - preferred stock Total Paid in Capital Retained Earnings Less: Treasury Stock (20,000 shares, $360 per share) Total Stockholder's Equity $1,260,000 $12,600,000 $3,400,000 $21,260,000 $20,600,000 ($7,200,000) $34,660,000 1/31/21 2/1/21 3/31/21 4/1/21 5/1/21 The company authorized and issued $3 million 10-year 8% convertible bonds at 99 with interest to be paid annually on January 1. Each $1,000 bond is convertible into 2 common shares. The company uses the straight- line amortization method. The company reissued 6,000 shares of treasury stock at $320 per share. On March 31, 2021, the company granted 5 executive employees the option to purchase 150,000 shares (30,000 shares each) of common stock at $120 per share. The Black-Scholes option pricing model determines total compensation expense to be $500,000. The option becomes exercisable on March 31, 2022, after the employee completed two years of service. The market price of the company's stock was $358 on March 31, 2021. The company repurchased 10,000 common shares of treasury stock at $340 per share. The company reissued 18,000 shares of the treasury stock at $380 per share. The board of directors declared a 3:1 stock split on common shares. The company converted 15,000 shares of 7% cumulative convertible preferred stock, $100 par value. Each share is convertible into 8 shares of common stock. One of the executives receiving the stock options was fired and left the company The company declared a 5% stock dividend to all common stockholders of record. The market value of the common stock is $176 per share 1,000 convertible bonds were converted to 2 common shares each. The company paid a conversion fee of $78,000 to the bondholders. The board of directors declared the preferred stock dividend and a dividend of $.50 per share on the common stock. The market value of the company's common stock is $180 per share. 6/30/21 8/1/21 9/30/21 10/15/21 12/15/21 12/20/21 12/31/21 $4,000,000 Dragon Corporation Statement of Stockholder's Equity 31-Dec-20 Preferred stock, 7% cumulative and convertible with $100 par value, 50,000 shares authorized, 750,000 shares issued and 1,000,000 outstanding Common stock, class A $3 par value, 1,400,000 shares authorized, 800,000 shares issued and 1,500,000 outstanding Additional paid in capital common stock Additional paid in capital - preferred stock Total Paid in Capital Retained Earnings Less: Treasury Stock (20,000 shares, $360 per share) Total Stockholder's Equity $1,260,000 $12,600,000 $3,400,000 $21,260,000 $20,600,000 ($7,200,000) $34,660,000 1/31/21 2/1/21 3/31/21 4/1/21 5/1/21 The company authorized and issued $3 million 10-year 8% convertible bonds at 99 with interest to be paid annually on January 1. Each $1,000 bond is convertible into 2 common shares. The company uses the straight- line amortization method. The company reissued 6,000 shares of treasury stock at $320 per share. On March 31, 2021, the company granted 5 executive employees the option to purchase 150,000 shares (30,000 shares each) of common stock at $120 per share. The Black-Scholes option pricing model determines total compensation expense to be $500,000. The option becomes exercisable on March 31, 2022, after the employee completed two years of service. The market price of the company's stock was $358 on March 31, 2021. The company repurchased 10,000 common shares of treasury stock at $340 per share. The company reissued 18,000 shares of the treasury stock at $380 per share. The board of directors declared a 3:1 stock split on common shares. The company converted 15,000 shares of 7% cumulative convertible preferred stock, $100 par value. Each share is convertible into 8 shares of common stock. One of the executives receiving the stock options was fired and left the company The company declared a 5% stock dividend to all common stockholders of record. The market value of the common stock is $176 per share 1,000 convertible bonds were converted to 2 common shares each. The company paid a conversion fee of $78,000 to the bondholders. The board of directors declared the preferred stock dividend and a dividend of $.50 per share on the common stock. The market value of the company's common stock is $180 per share. 6/30/21 8/1/21 9/30/21 10/15/21 12/15/21 12/20/21 12/31/21

No dividends were declared or paid during the year 2020 due to poor economic conditions. Consider the following events in preparing a Statement of Stockholders Equity and earnings per share for the year 2021.

No dividends were declared or paid during the year 2020 due to poor economic conditions. Consider the following events in preparing a Statement of Stockholders Equity and earnings per share for the year 2021.