Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no excel working out just manual working out thank you The parts a) and b) below are independent questions w! do not relate to each

no excel working out just manual working out thank you

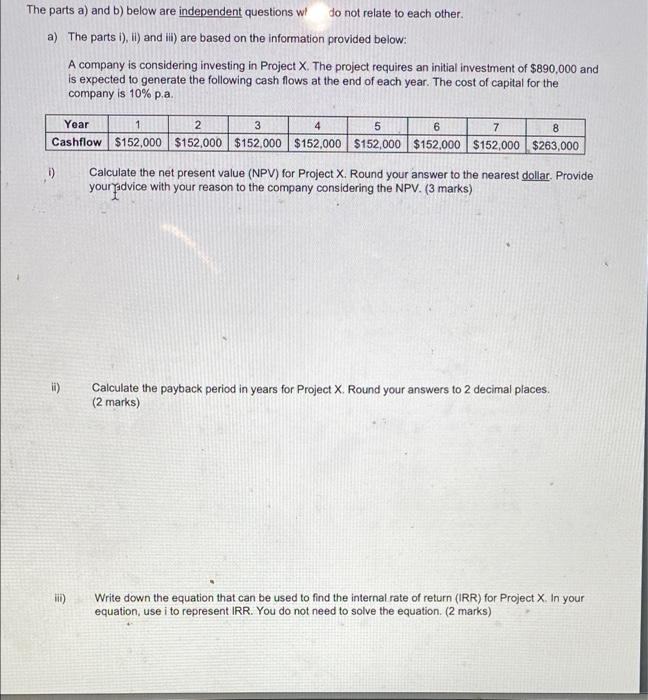

The parts a) and b) below are independent questions w! do not relate to each other. a) The parts 1), l) and ii) are based on the information provided below: A company is considering investing in Project X. The project requires an initial investment of $890,000 and is expected to generate the following cash flows at the end of each year. The cost of capital for the company is 10% p.a. 1 2 3 4 5 6 Year 7 8 Cashflow $152,000 $152,000 $152,000 $152,000 $152,000 $152,000 $152,000 $263,000 D) Calculate the net present value (NPV) for Project X. Round your answer to the nearest dollar. Provide your advice with your reason to the company considering the NPV. (3 marks) 10) Calculate the payback period in years for Project X. Round your answers to 2 decimal places. (2 marks) il) Write down the equation that can be used to find the internal rate of return (IRR) for Project X. In your equation, use i to represent IRR. You do not need to solve the equation. (2 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started