NO EXPLANATION NECESSARY, just the final answer for 5 MC questions, it would help me tremendously! (thumbs up)

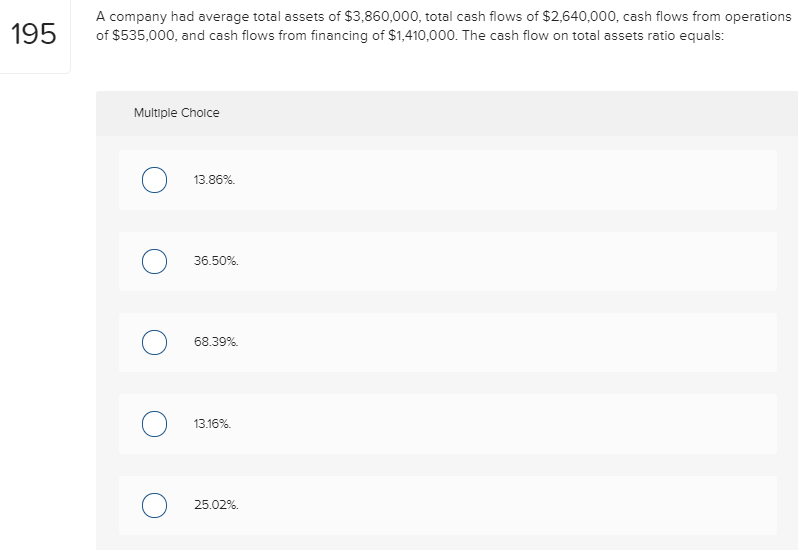

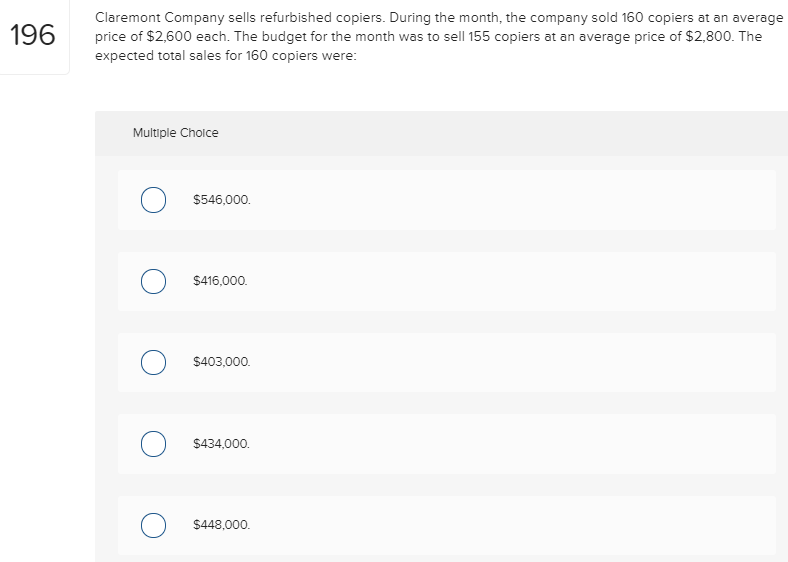

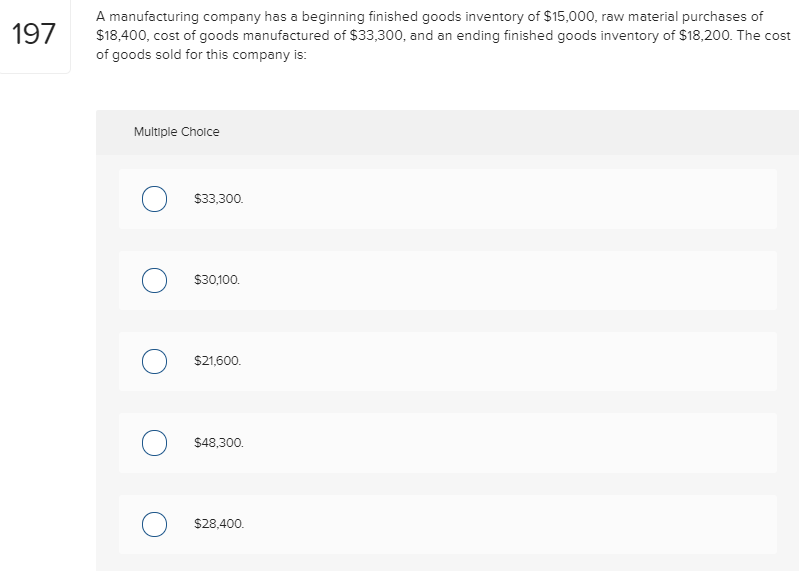

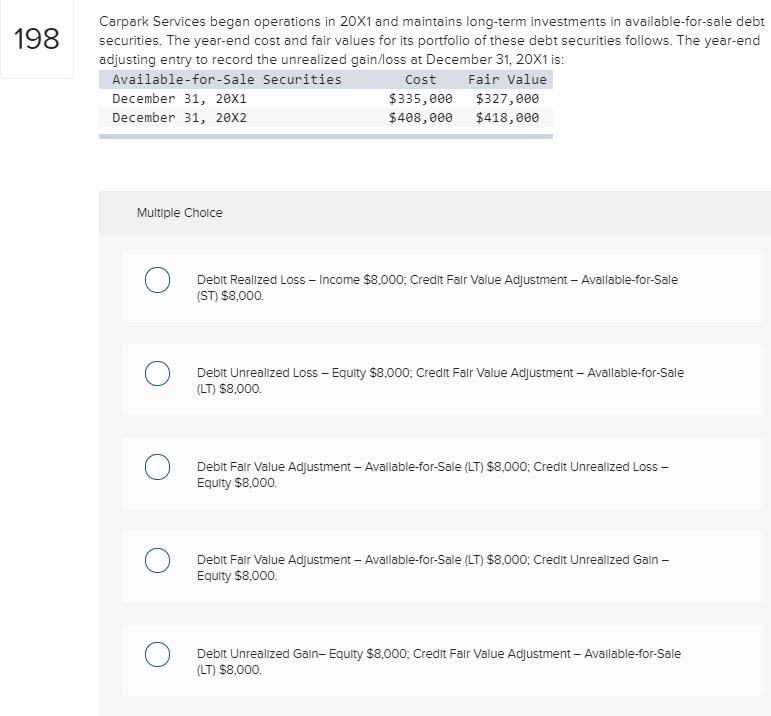

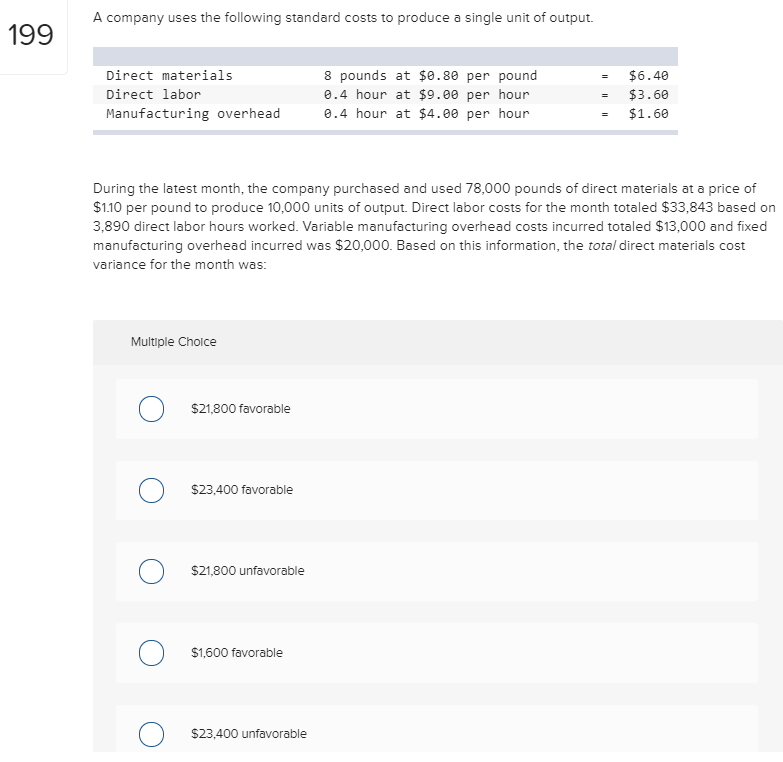

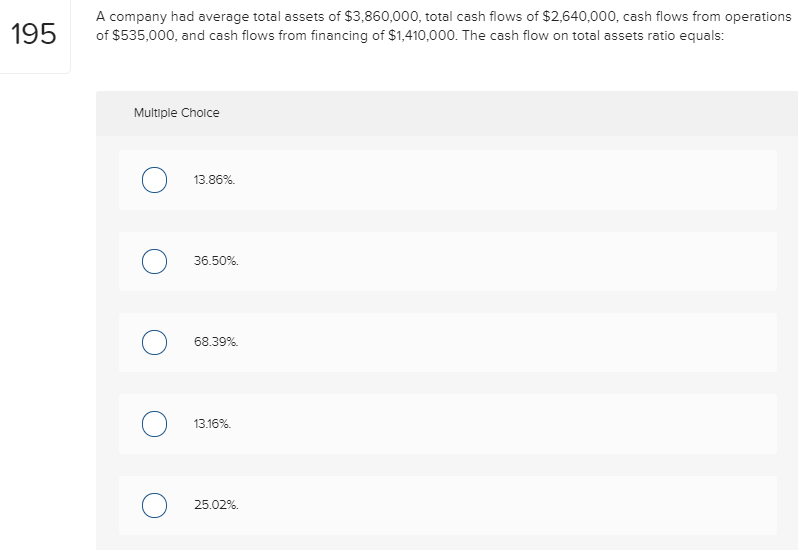

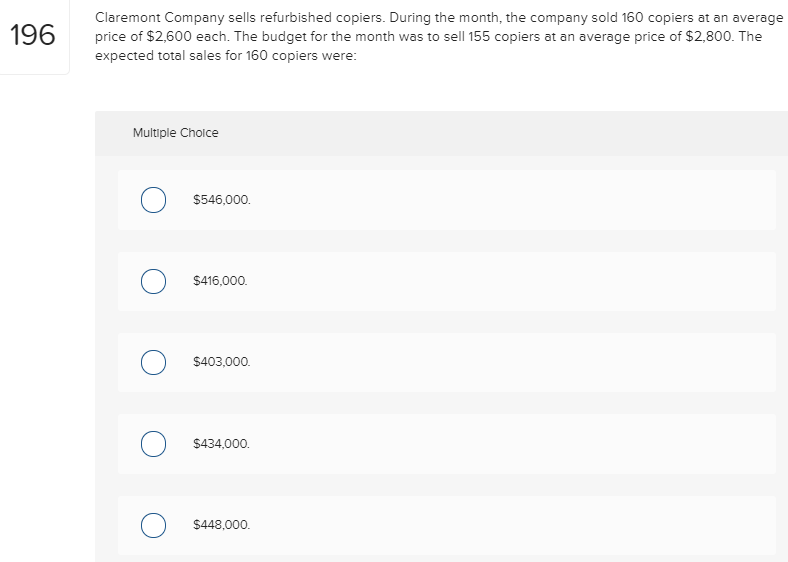

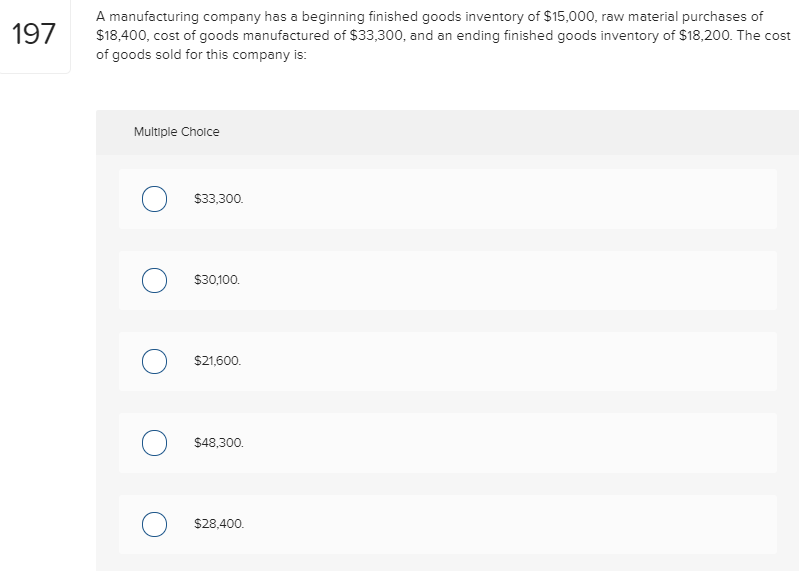

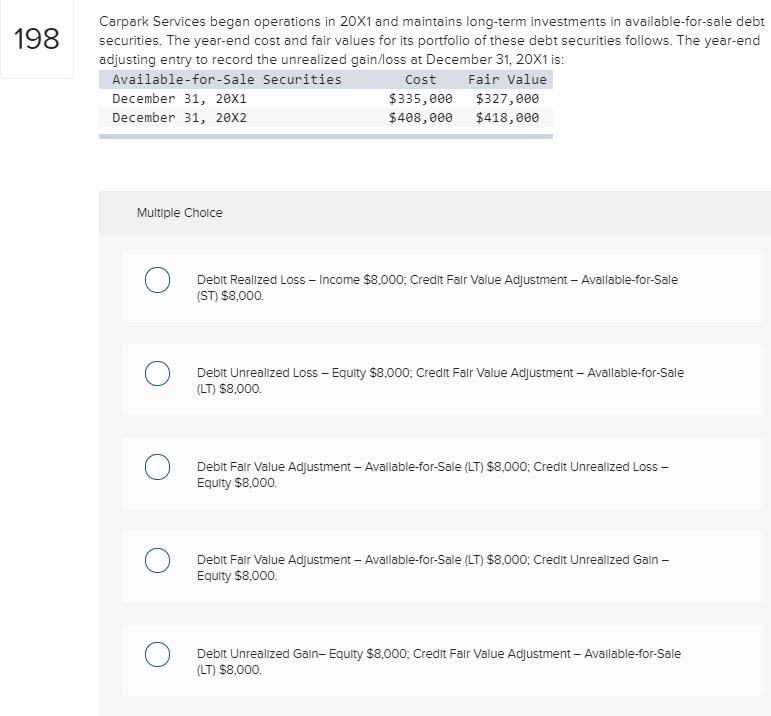

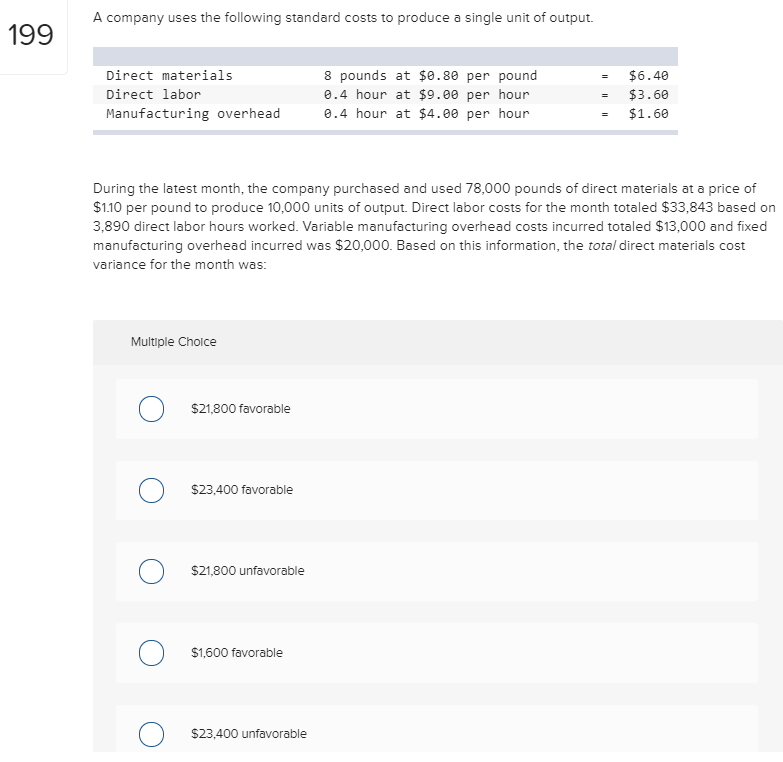

195 A company had average total assets of $3,860,000, total cash flows of $2,640,000, cash flows from operations of $535,000, and cash flows from financing of $1,410,000. The cash flow on total assets ratio equals: Multiple Choice O 13.86%. 0 36.50% 36.50% 0 68.39% 68.39% O O 13.16% 13:16 O 0 25.02% 25.02% 196 Claremont Company sells refurbished copiers. During the month, the company sold 160 copiers at an average price of $2,600 each. The budget for the month was to sell 155 copiers at an average price of $2,800. The expected total sales for 160 copiers were: Multiple Choice S546,000. S416,000. O S403,000. S434,000. S448,000. 197 A manufacturing company has a beginning finished goods inventory of $15,000, raw material purchases of $18,400, cost of goods manufactured of $33,300, and an ending finished goods inventory of $18,200. The cost of goods sold for this company is: Multiple Choice $33,300. S30100. $21,600. S48,300. S28,400. 198 Carpark Services began operations in 20X1 and maintains long-term investments in available-for-sale debt securities. The year-end cost and fair values for its portfolio of these debt securities follows. The year-end adjusting entry to record the unrealized gain/loss at December 31, 20X1 is: Available-for-Sale Securities Cost Fair Value December 31, 20X1 $335,000 $327,000 December 31, 20x2 $408,000 $418,000 Multiple Choice o Debit Realized Loss -Income $8,000; Credit Fair Value Adjustment - Available-for-Sale (ST) $8,000 o Debit Unrealized Loss - Equity $8,000; Credit Fair Value Adjustment - Available for Sale (LT) $8,000 o Debit Fair Value Adjustment - Available-for-Sale (LT) $8,000; Credit Unrealized Loss - Equity $8,000. O Debit Fair Value Adjustment - Available-for-Sale (LT) $8,000; Credit Unrealized Gain - Equity $8,000. Debit Unrealized Gain-Equity $8,000: Credit Fair Value Adjustment - Available-for-Sale (LT) $8,000. A company uses the following standard costs to produce a single unit of output. 199 Direct materials Direct labor Manufacturing overhead 8 pounds at $0.80 per pound 0.4 hour at $9.00 per hour 0.4 hour at $4.00 per hour = = = $6.40 $3.60 $1.60 During the latest month, the company purchased and used 78,000 pounds of direct materials at a price of $1.10 per pound to produce 10,000 units of output. Direct labor costs for the month totaled $33,843 based on 3,890 direct labor hours worked. Variable manufacturing overhead costs incurred totaled $13,000 and fixed manufacturing overhead incurred was $20,000. Based on this information, the total direct materials cost variance for the month was: Multiple Choice $21,800 favorable o $23,400 favorable 0 $21,800 unfavorable $1,600 favorable o $23,400 unfavorable