no explanation req

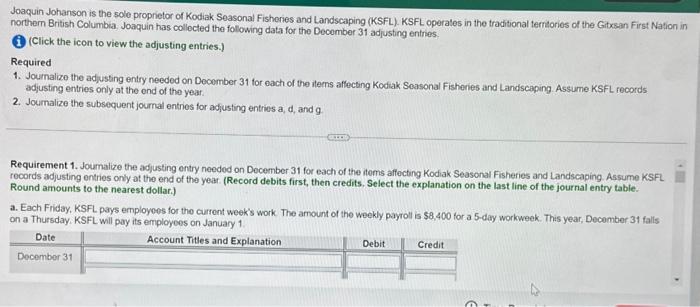

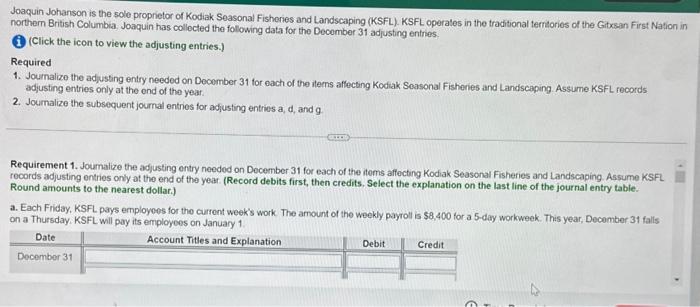

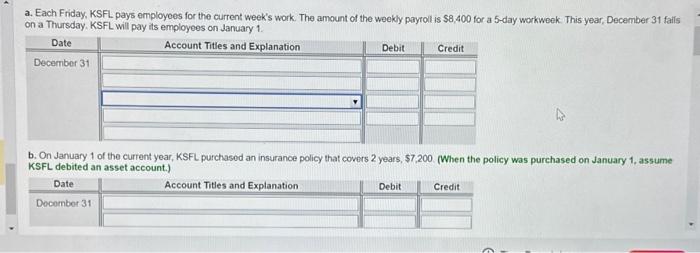

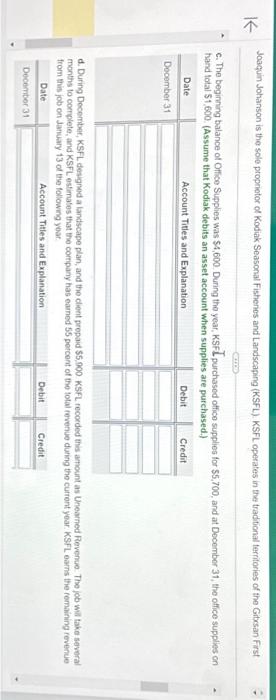

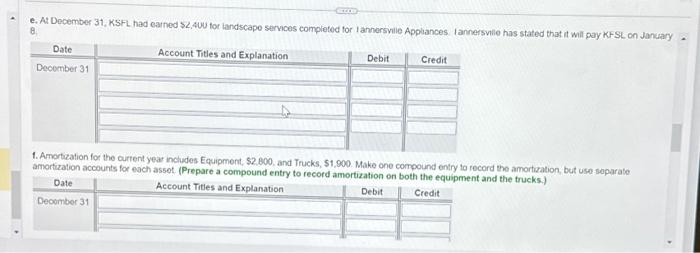

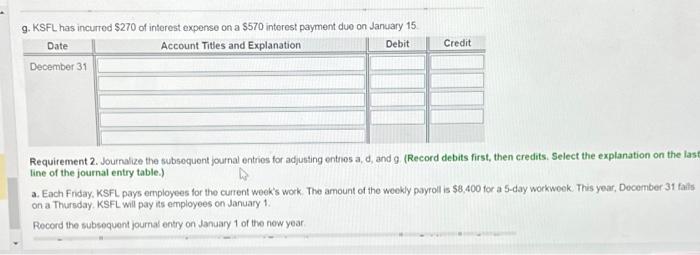

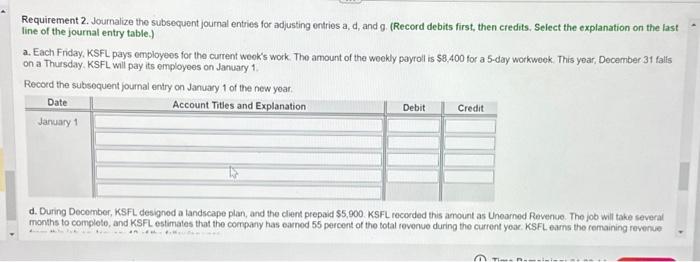

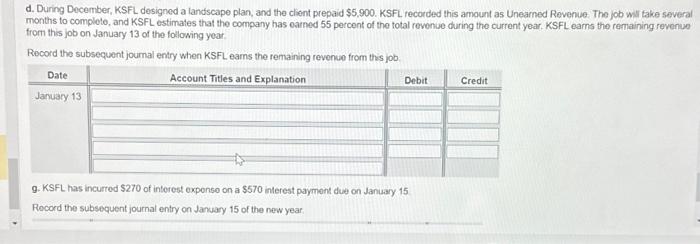

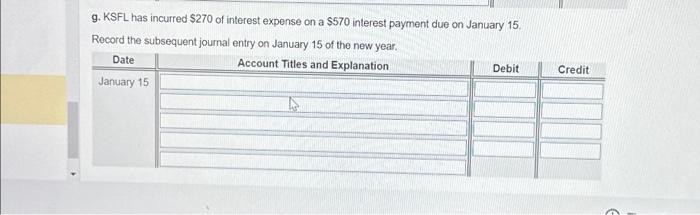

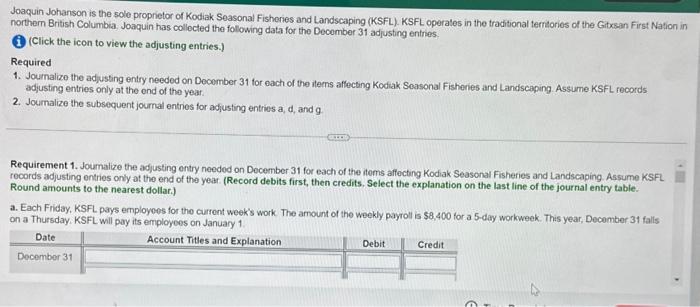

Joacuin Johanson is the sole proprietor of Kodiak Seasonal Fisheries and Landscaping (KSFL). KSFL operales in the traditional terr Lories of the Gitxsan First Nation northem British Columbia, Joaquin has collected the following data for the Decomber 31 adjusting entries. (Click the icon to view the adjusting entries.) Required 1. Journalize the adjusting entry needed on December 31 for each of the iterns affecting Kodiak Seasonal Fisheries and Landscaping Assume KSFL fecords adjusting entries only at the end of the year. 2. Joumalize the subsequent joumal entries for adjusting entries a, d, and g Requirement 1. Joumalize the adjusting entry needod on Docember 31 for each of the items affecting Kodiak Seasonal Fisheries and Landscaping. Assume KSFL records adjusting entries only at the end of the year. (Record debits first, then credits, Select the explanation on the last line of the journal entry table. Round amounts to the nearest dollar.) a. Each Friday, KSFL pays employees for the current week's work. The amount of the weekly payroll is $8,400 for a 5 -day workweek. This year, Decemter 31 falls on a Thursday. KSFL will pay its employees on January 1 a. Each Friday, KSFL pays employoes for the current week's work. The amount of the weekly payroll is $8,400 for a 5 -day workweek. This year, December 31 fails on a Thursday. KSFL will pay its employees on January 1. b. On January 1 of the current year, KSFL purchased an insurance policy that covers 2 years, $7,200. When the policy was purchased on January 1 , assume KSFL debited an asset account.) c. The beginning balance of Office Supplies was $4,600. During the year, KSFL purchased office supplies for $5,700, and at Docember 31 , the office supplies on hand lodal 51,600 . (Assume that Kodiak debits an asset account when supplies are purchased.) d. During December, KSFL designed a landscape plan, and the clent propaid $5.900 KSFL recoeded this amount as Unearned Revenue. The job will take sevvral months to cornplete, and KSFL estimates that the company has eamed 55 porcont of the lotal revenue during the current yoar. KSFL earns the remaining revenue from this job on January 13 of the followng yoar. e. At December 31, KSFL had earned \$L,4UU tor iandscape services completed for 1 annersvile Applances lannersvile has stated that it will pay KFSL on Januar 8. 1. Amortization for the curtent year includes Equipment, $2.800. and Trucks, $1,900. Make one compound entry to tecord the amortization, but use soparate amortization accounts for eoch asset. (Prepare a compound entry to record amortization on both the eauinment and the trucks.) 9. KSFL has incurred $270 of inferest expense on a $570 interest payment due on January 15 Requirement 2. Journalize the subsoquent journal entries for adjusting enthos a,d, and g. (Record debits first, then credits. Select the explanation on the las line of the journal entry table.) a. Each Friday, KSFL pays employees for the curtent week's work. The amount of the weokly payroll is $8,400 for a 5 -day workweek This year, December 31 fails on a Thursday. KSFL wil pay iss employees on January 1. Record the subsoquent journak entry on January 1 of the now year. Requirement 2. Journalize the subsequent joumal entries for adjusting entries a, d, and g. (Record debits first, then credits, Select the explanation on the last line of the journal entry table.) a. Each Friday, KSFL pays employees for the current wook's work. The amount of the woekly payroll is $8,400 for a 5 -day workweek. This year, December 31 falls on a Thursiday. KSFL will pay its employees on January 1. Recoed the subsequent joumal entry on January 1 of the new yoar. d. During Docomber, KSFL designed a landscape plan, and the client prepaid $5,900. KSFL recorded this amount as Unoarned Reverue. The job will take several months to complete, and KSFL estimates that the cornpany has earnod 55 percent of the total revorse during the current yoar. KSFL earns the remaining revenue d. During December, KSFL designed a landscape plan, and the client prepaid $5.900. KSFL recorded this amount as Unearned Revenue. The job w\$ take several months to complete, and KSFL estimates that the company has earned 55 percent of the total revenue during the current year. KSFL earns the remaining revenue from this job on January 13 of the following yoar Record the subsequent journal entry when KSFL earns the remaining revenuo from this job 9. KSFL has incurred $270 of interest expenso on a $570 interest payment due on January 15 Rocord the subsequent journal entry on January 15 of the new year: 9. KSFL has incurred $270 of interest expense on a $570 interest payment due on January 15 . Record the subsequent joumal entry on January 15 of the new year