no financial calculators please

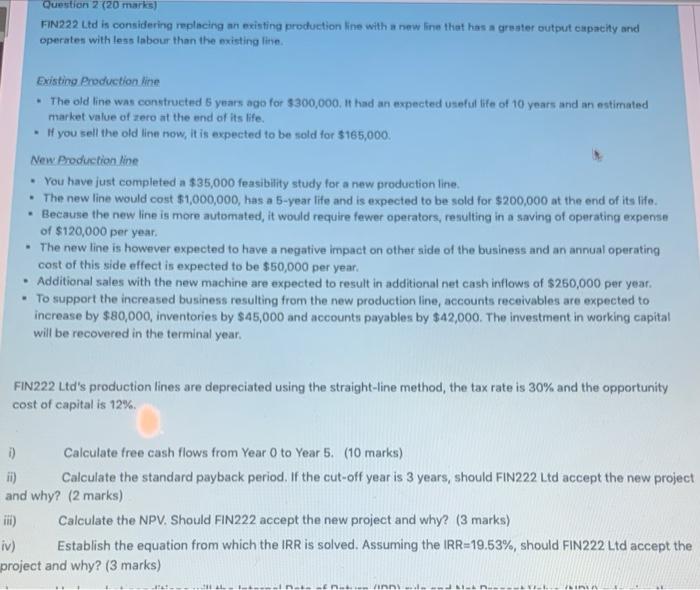

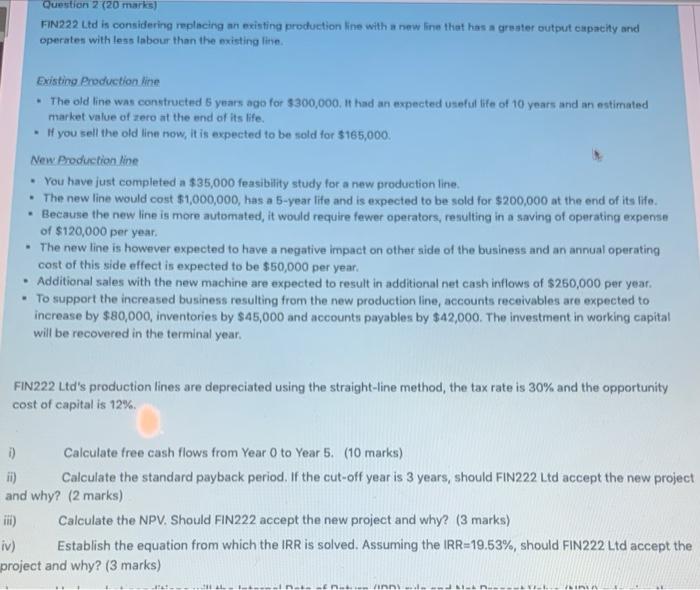

FiN222 Ltd is considering rmplacing an existing production line with a new frine that has a greater output eapacity arvd operates with leas labour than the existing tithe. Existing Production line - The old line was constructed 5 years ago for 3300,000 . 1 had an expected useful life of 10 years and an estimated market value of zero at the end of its life. - If you sell the ofd line now, it is expected to be sold for $165,000. New Production line - You have just completed a $35,000 feasibility study for a new production line. - The new line would cost $1,000,000, has a 5 -year life and is expected to be sold for $200,000 at the end of its life. - Because the new line is more automated, it would require fewer operators, resulting in a saving of operating expense of $120,000 per year. - The new line is however expected to have a negative impact on other side of the business and an annual operating cost of this side effect is expected to be $50,000 per year. - Additional sales with the new machine are expected to result in additional net cash inflows of $260,000 par year. - To support the increased business resulting from the new production line, accounts receivables are expected to increase by $80,000, inventories by $45,000 and accounts payables by $42,000. The investment in working capital will be recovered in the terminal year. IN222 Ltd's production lines are depreciated using the straight-line method, the tax rate is 30% and the opportunity ost of capital is 12%. Calculate free cash flows from Year 0 to Year 5. (10 marks) Calculate the standard payback period. If the cut-off year is 3 years, should FIN222 Ltd accept the new projec d why? (2 marks) Calculate the NPV. Should FIN222 accept the new project and why? (3 marks) Establish the equation from which the IRR is solved. Assuming the IRR=19.53\%, should FIN222 Ltd accept thi ject and why? (3 marks) FiN222 Ltd is considering rmplacing an existing production line with a new frine that has a greater output eapacity arvd operates with leas labour than the existing tithe. Existing Production line - The old line was constructed 5 years ago for 3300,000 . 1 had an expected useful life of 10 years and an estimated market value of zero at the end of its life. - If you sell the ofd line now, it is expected to be sold for $165,000. New Production line - You have just completed a $35,000 feasibility study for a new production line. - The new line would cost $1,000,000, has a 5 -year life and is expected to be sold for $200,000 at the end of its life. - Because the new line is more automated, it would require fewer operators, resulting in a saving of operating expense of $120,000 per year. - The new line is however expected to have a negative impact on other side of the business and an annual operating cost of this side effect is expected to be $50,000 per year. - Additional sales with the new machine are expected to result in additional net cash inflows of $260,000 par year. - To support the increased business resulting from the new production line, accounts receivables are expected to increase by $80,000, inventories by $45,000 and accounts payables by $42,000. The investment in working capital will be recovered in the terminal year. IN222 Ltd's production lines are depreciated using the straight-line method, the tax rate is 30% and the opportunity ost of capital is 12%. Calculate free cash flows from Year 0 to Year 5. (10 marks) Calculate the standard payback period. If the cut-off year is 3 years, should FIN222 Ltd accept the new projec d why? (2 marks) Calculate the NPV. Should FIN222 accept the new project and why? (3 marks) Establish the equation from which the IRR is solved. Assuming the IRR=19.53\%, should FIN222 Ltd accept thi ject and why