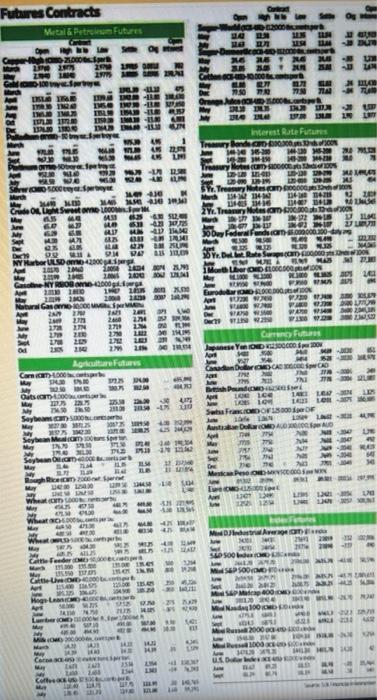

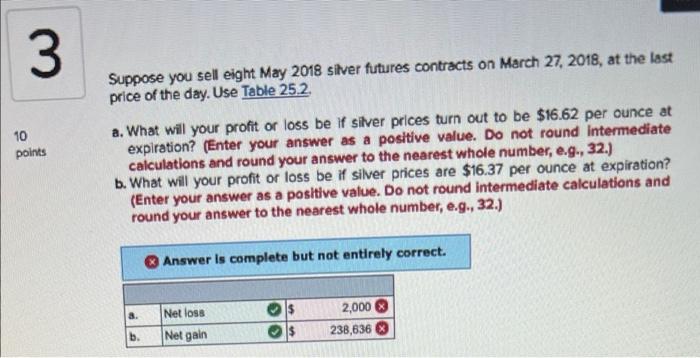

NO Futures Contracts Metal & Per Futures KO WD IT LESS S MOS ANNA D. Tat XL 200 CHORDS 8 W TON 30 1 BLO IN IN Interest Rate Futures . w LAPOR mo DON E ore KO 11 In to ME WEB KW H00 ORA BORAN INTRO wut ON COM Ott NEW W ANAS 1 WHEN? NITS AND 02 M N ON 10 MM Treasury DHE 309 UN BAS GROSS MO Treas.com M. 1140 TE GOLLO Some M DIE B UN 350 MM - 4 Treasury MODO 60 HUB 5143 IN INS LE HUS - Obey Federwandscam 00000000 UN M KUN WAS IN RU NYULSDM-42000 SOY.DLL Rate Som 20 SONU SMUL NAS 20 2000 TOULOID FLOORIOS OS 10 WMS TO 2018 MUN ED LCD Natural Gas 1000MM AM 2 IM 2017 EN P. 2016 w WARE 20 IN 22 N 2 TAHUN DUM Curreno Fun Japanese YODOCO DO Agricultores Com Das CAMO IN -30 My TRON IN Outs.com PDL 2017 ce AN SO IN 200 UN SLOW CIDOFF WS 2 S DODALOM Seyte Map IN INOL THUB IN Seyla N-340 M NE Rico Men Peso VICO 1 Whe 20 My 129 1 My EL What aut NUT ME MU on AR TOOSTAGROS - SEE SOM Ne - WL M IT OCT STORY RUS KU WWW MWA 2009 VA 00569 MHESEP SOOME US 11 LES MORIN CiteUOD . HD HBN23 PUSH IN CR SOT TOWWE M MOOG OROLINE wee PANOORD 21 M TIETET FITS R20000 1000 MO w Cars w EL 10 MHS 10 USD NE WIE RT Colt WIFT LE 3 Suppose you sell eight May 2018 silver futures contracts on March 27, 2018, at the last price of the day. Use Table 25.2 10 points a. What will your profit or loss be if silver prices turn out to be $16.62 per ounce at expiration? (Enter your answer as a positive value. Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What will your profit or loss be if silver prices are $16.37 per ounce at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Answer is complete but not entirely correct. Net loss Net gain 2,000 238,636 b. NO Futures Contracts Metal & Per Futures KO WD IT LESS S MOS ANNA D. Tat XL 200 CHORDS 8 W TON 30 1 BLO IN IN Interest Rate Futures . w LAPOR mo DON E ore KO 11 In to ME WEB KW H00 ORA BORAN INTRO wut ON COM Ott NEW W ANAS 1 WHEN? NITS AND 02 M N ON 10 MM Treasury DHE 309 UN BAS GROSS MO Treas.com M. 1140 TE GOLLO Some M DIE B UN 350 MM - 4 Treasury MODO 60 HUB 5143 IN INS LE HUS - Obey Federwandscam 00000000 UN M KUN WAS IN RU NYULSDM-42000 SOY.DLL Rate Som 20 SONU SMUL NAS 20 2000 TOULOID FLOORIOS OS 10 WMS TO 2018 MUN ED LCD Natural Gas 1000MM AM 2 IM 2017 EN P. 2016 w WARE 20 IN 22 N 2 TAHUN DUM Curreno Fun Japanese YODOCO DO Agricultores Com Das CAMO IN -30 My TRON IN Outs.com PDL 2017 ce AN SO IN 200 UN SLOW CIDOFF WS 2 S DODALOM Seyte Map IN INOL THUB IN Seyla N-340 M NE Rico Men Peso VICO 1 Whe 20 My 129 1 My EL What aut NUT ME MU on AR TOOSTAGROS - SEE SOM Ne - WL M IT OCT STORY RUS KU WWW MWA 2009 VA 00569 MHESEP SOOME US 11 LES MORIN CiteUOD . HD HBN23 PUSH IN CR SOT TOWWE M MOOG OROLINE wee PANOORD 21 M TIETET FITS R20000 1000 MO w Cars w EL 10 MHS 10 USD NE WIE RT Colt WIFT LE 3 Suppose you sell eight May 2018 silver futures contracts on March 27, 2018, at the last price of the day. Use Table 25.2 10 points a. What will your profit or loss be if silver prices turn out to be $16.62 per ounce at expiration? (Enter your answer as a positive value. Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What will your profit or loss be if silver prices are $16.37 per ounce at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Answer is complete but not entirely correct. Net loss Net gain 2,000 238,636 b