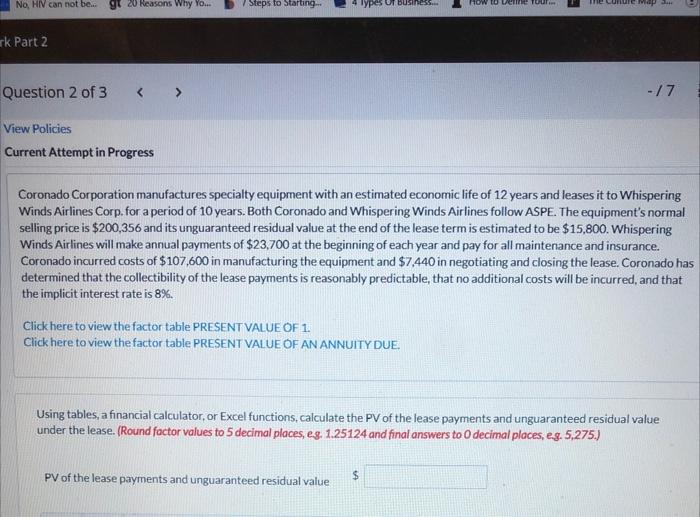

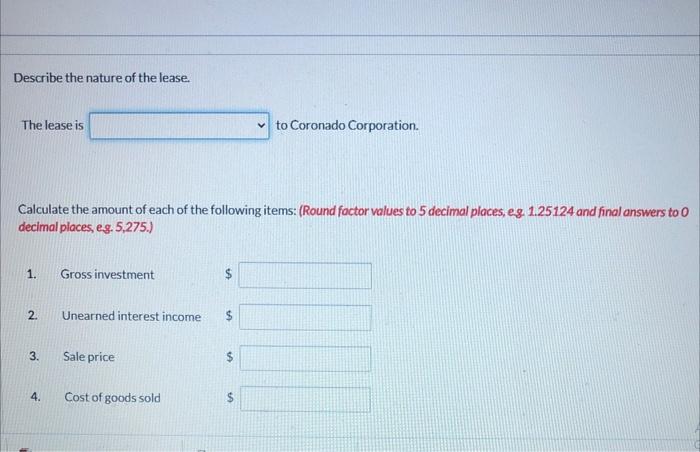

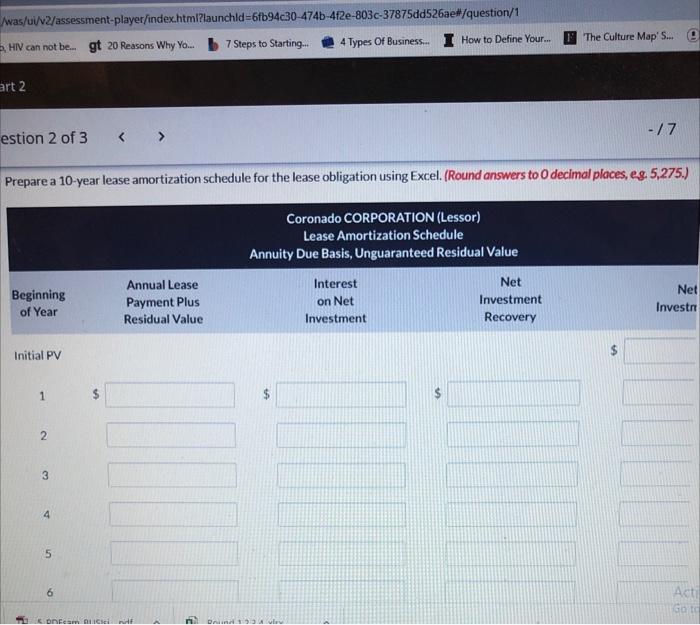

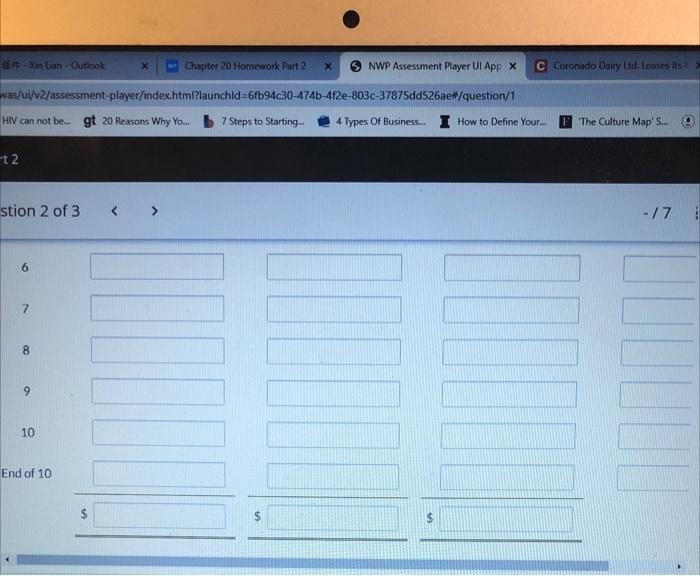

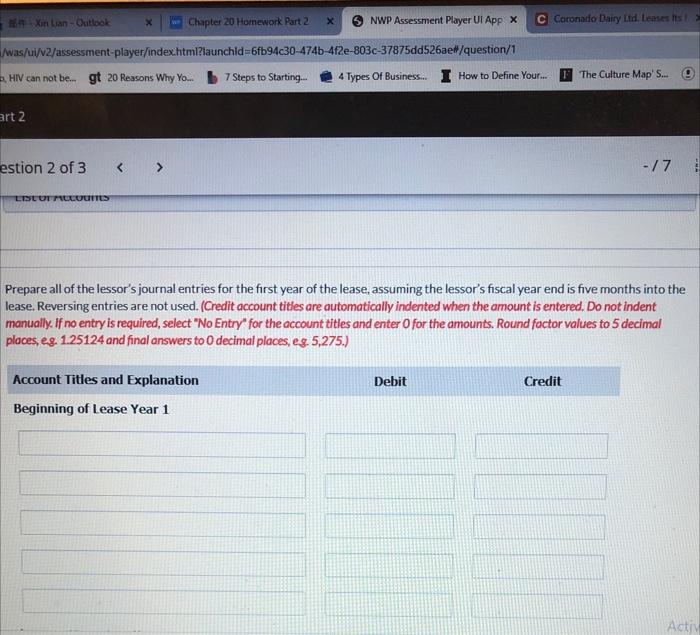

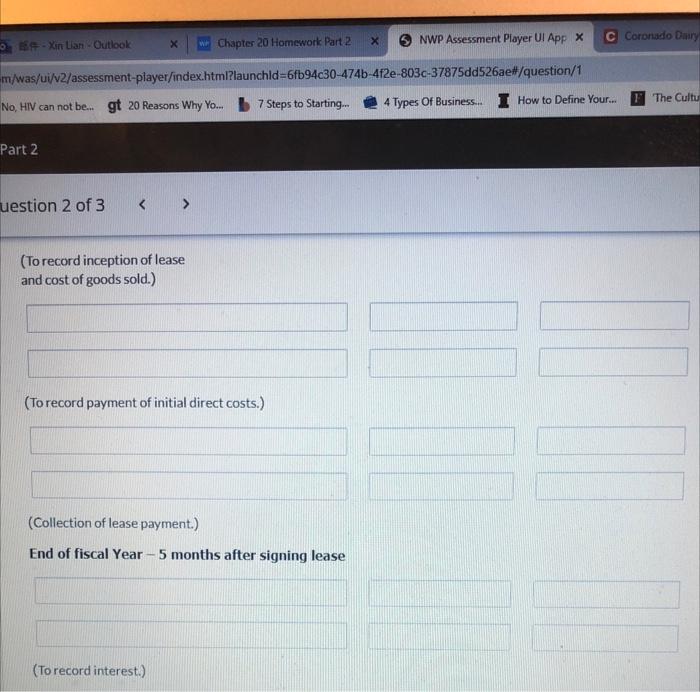

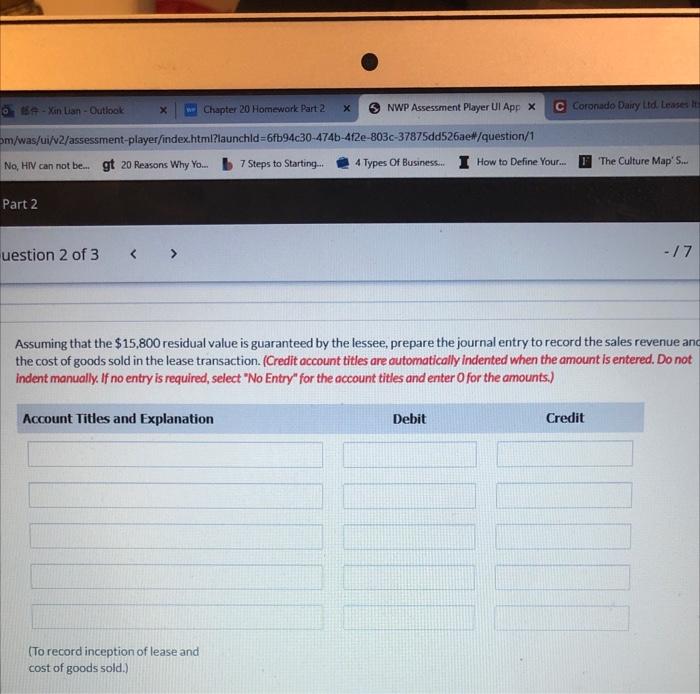

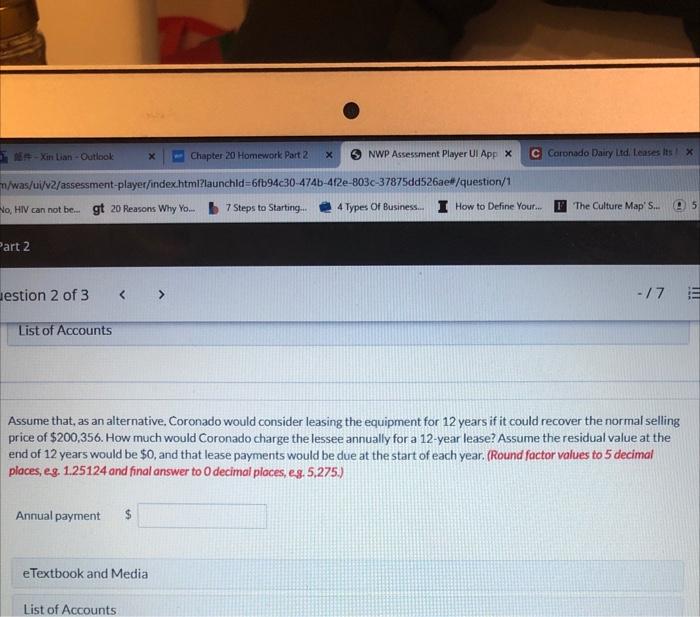

No, HIV can not be..g 20 Reasons Why Yo... Steps to Starting Ur business HOW TO U U map ck Part 2 Question 2 of 3 -17 View Policies Current Attempt in Progress Coronado Corporation manufactures specialty equipment with an estimated economic life of 12 years and leases it to Whispering Winds Airlines Corp. for a period of 10 years. Both Coronado and Whispering Winds Airlines follow ASPE. The equipment's normal selling price is $200,356 and its unguaranteed residual value at the end of the lease term is estimated to be $15,800. Whispering Winds Airlines will make annual payments of $23,700 at the beginning of each year and pay for all maintenance and insurance. Coronado incurred costs of $107,600 in manufacturing the equipment and $7,440 in negotiating and closing the lease. Coronado has determined that the collectibility of the lease payments is reasonably predictable, that no additional costs will be incurred, and that the implicit interest rate is 8%. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Using tables, a financial calculator, or Excel functions, calculate the PV of the lease payments and unguaranteed residual value under the lease. (Round factor values to 5 decimal places, eg, 1.25124 and final answers to decimal places, e.g. 5,275.) PV of the lease payments and unguaranteed residual value $ Describe the nature of the lease. The lease is to Coronado Corporation. Calculate the amount of each of the following items: (Round factor values to 5 decimal places, eg. 1.25124 and final answers to o decimal places, eg. 5,275.) 1. Gross investment $ 2 Unearned interest income $ 3. Sale price $ 4. Cost of goods sold $ was/ui/v2/assessment-player/index.html?launchid=6fb94c30-474b-4f2e-803c-37875dd526ae/question/1 HIV can not be gt 20 Reasons Why Yo... 7 Steps to Starting. 4 Types Of Business... I How to Define Your... The Culture Map' S... art 2 -17 estion 2 of 3 Prepare a 10-year lease amortization schedule for the lease obligation using Excel. (Round answers to 0 decimal places, eg. 5,275.) Coronado CORPORATION (Lessor) Lease Amortization Schedule Annuity Due Basis, Unguaranteed Residual Value Beginning of Year Annual Lease Payment Plus Residual Value Interest on Net Investment Net Investment Recovery Net Investr $ Initial PV 1 2 3 4 5 ON 6 Acti Go to Onesmiem Oni - on Lan - Outlook w Chapter 20 Homework Part 2 X 3 NWP Assessment Player Ul App X C Coronado Dairy Ltd Lenses its was/ui/v2/assessment-player/index.html?launchid=6fb94c30-474b-4f2e-803c-37875dd526ae#/question/1 HIV can not be... gt 20 Reasons Why Yo... 7 Steps to Starting... 4 Types Of Business... I How to Define Your... F The Culture Map's... t2 stion 2 of 3 -17 6 7 OD 9 ON 10 End of 10 $ $ Xin Lian - Outlook X Chapter 20 Homework Part 2 X NWP Assessment Player UI App X C Coronado Dairy Ltd. Lees > was/ui/v2/assessment-player/index.html?launchid=6fb94c30-474b-4f2e-803c-37875dd526ae/question/1 HIV can not be gt 20 Reasons Why Yo... 7 Steps to Starting.. 4 Types Of Business... I How to Define Your... The Culture Map' S. art 2 estion 2 of 3 -17 LISLUT MULUTUS Prepare all of the lessor's journal entries for the first year of the lease, assuming the lessor's fiscal year end is five months into the lease. Reversing entries are not used. (Credit account titles are automatically indented when the amount is entered. Do not indent manually . If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round factor values to 5 decimal places, eg. 1.25124 and final answers to decimal places, eg. 5,275.) Account Titles and Explanation Debit Credit Beginning of Lease Year 1 Activ X - Xin Lian Outlook C Coronado Dairy X w Chapter 20 Homework Part 2 NWP Assessment Player Ul App X m/was/ui/V2/assessment-player/index.html?launchid=6fb94c30-474b-4f2e-803c-37875dd526ae/question/1 No, HIV can not be... gt 20 Reasons Why Yo... 7 Steps to Starting. 4 Types Of Business... I How to Define Your... F The Cultu Part 2 uestion 2 of 3 (To record inception of lease and cost of goods sold.) (To record payment of initial direct costs.) (Collection of lease payment.) End of fiscal Year - 5 months after signing lease (To record interest.) 189 - Xin Lian - Outlook X Chapter 20 Homework Part 2 NWP Assessment Player Ul App X C Coronado Dairy Ltd. Leases it Om/was/ui/v2/assessment-player/index.html?launchid=6fb94c30-474b-412e-803c-37875dd526ae/question/1 No, HIV can not be gt 20 Reasons Why Yo... 7 Steps to Starting... 4 Types Of Business... I How to Define Your. The Culture Map's.. Part 2 uestion 2 of 3 -17 Assuming that the $15,800 residual value is guaranteed by the lessee, prepare the journal entry to record the sales revenue and the cost of goods sold in the lease transaction. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit (To record inception of lease and cost of goods sold.) - Xintian - Outlook X Chapter 20 Homework Part 2 X > NWP Assessment Player UI App X C Coronado Dairy Ltd. Leases its X mn/was/ui/v2/assessment-player/index.html?launchid=6fb94c30-474b-412e-803c-37875dd526ae#/question/1 No HIV can not be gt 20 Reasons Why Yo.. 7 Steps to Starting... 4 Types Of Business... I How to Define Your... T The Culture Map' S... Part 2 estion 2 of 3 -17 TI List of Accounts Assume that, as an alternative. Coronado would consider leasing the equipment for 12 years if it could recover the normal selling price of $200,356. How much would Coronado charge the lessee annually for a 12-year lease? Assume the residual value at the end of 12 years would be $0, and that lease payments would be due at the start of each year. (Round factor values to 5 decimal places, eg. 1.25124 and final answer to decimal places, eg, 5.275.) Annual payment $ e Textbook and Media List of Accounts No, HIV can not be..g 20 Reasons Why Yo... Steps to Starting Ur business HOW TO U U map ck Part 2 Question 2 of 3 -17 View Policies Current Attempt in Progress Coronado Corporation manufactures specialty equipment with an estimated economic life of 12 years and leases it to Whispering Winds Airlines Corp. for a period of 10 years. Both Coronado and Whispering Winds Airlines follow ASPE. The equipment's normal selling price is $200,356 and its unguaranteed residual value at the end of the lease term is estimated to be $15,800. Whispering Winds Airlines will make annual payments of $23,700 at the beginning of each year and pay for all maintenance and insurance. Coronado incurred costs of $107,600 in manufacturing the equipment and $7,440 in negotiating and closing the lease. Coronado has determined that the collectibility of the lease payments is reasonably predictable, that no additional costs will be incurred, and that the implicit interest rate is 8%. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Using tables, a financial calculator, or Excel functions, calculate the PV of the lease payments and unguaranteed residual value under the lease. (Round factor values to 5 decimal places, eg, 1.25124 and final answers to decimal places, e.g. 5,275.) PV of the lease payments and unguaranteed residual value $ Describe the nature of the lease. The lease is to Coronado Corporation. Calculate the amount of each of the following items: (Round factor values to 5 decimal places, eg. 1.25124 and final answers to o decimal places, eg. 5,275.) 1. Gross investment $ 2 Unearned interest income $ 3. Sale price $ 4. Cost of goods sold $ was/ui/v2/assessment-player/index.html?launchid=6fb94c30-474b-4f2e-803c-37875dd526ae/question/1 HIV can not be gt 20 Reasons Why Yo... 7 Steps to Starting. 4 Types Of Business... I How to Define Your... The Culture Map' S... art 2 -17 estion 2 of 3 Prepare a 10-year lease amortization schedule for the lease obligation using Excel. (Round answers to 0 decimal places, eg. 5,275.) Coronado CORPORATION (Lessor) Lease Amortization Schedule Annuity Due Basis, Unguaranteed Residual Value Beginning of Year Annual Lease Payment Plus Residual Value Interest on Net Investment Net Investment Recovery Net Investr $ Initial PV 1 2 3 4 5 ON 6 Acti Go to Onesmiem Oni - on Lan - Outlook w Chapter 20 Homework Part 2 X 3 NWP Assessment Player Ul App X C Coronado Dairy Ltd Lenses its was/ui/v2/assessment-player/index.html?launchid=6fb94c30-474b-4f2e-803c-37875dd526ae#/question/1 HIV can not be... gt 20 Reasons Why Yo... 7 Steps to Starting... 4 Types Of Business... I How to Define Your... F The Culture Map's... t2 stion 2 of 3 -17 6 7 OD 9 ON 10 End of 10 $ $ Xin Lian - Outlook X Chapter 20 Homework Part 2 X NWP Assessment Player UI App X C Coronado Dairy Ltd. Lees > was/ui/v2/assessment-player/index.html?launchid=6fb94c30-474b-4f2e-803c-37875dd526ae/question/1 HIV can not be gt 20 Reasons Why Yo... 7 Steps to Starting.. 4 Types Of Business... I How to Define Your... The Culture Map' S. art 2 estion 2 of 3 -17 LISLUT MULUTUS Prepare all of the lessor's journal entries for the first year of the lease, assuming the lessor's fiscal year end is five months into the lease. Reversing entries are not used. (Credit account titles are automatically indented when the amount is entered. Do not indent manually . If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round factor values to 5 decimal places, eg. 1.25124 and final answers to decimal places, eg. 5,275.) Account Titles and Explanation Debit Credit Beginning of Lease Year 1 Activ X - Xin Lian Outlook C Coronado Dairy X w Chapter 20 Homework Part 2 NWP Assessment Player Ul App X m/was/ui/V2/assessment-player/index.html?launchid=6fb94c30-474b-4f2e-803c-37875dd526ae/question/1 No, HIV can not be... gt 20 Reasons Why Yo... 7 Steps to Starting. 4 Types Of Business... I How to Define Your... F The Cultu Part 2 uestion 2 of 3 (To record inception of lease and cost of goods sold.) (To record payment of initial direct costs.) (Collection of lease payment.) End of fiscal Year - 5 months after signing lease (To record interest.) 189 - Xin Lian - Outlook X Chapter 20 Homework Part 2 NWP Assessment Player Ul App X C Coronado Dairy Ltd. Leases it Om/was/ui/v2/assessment-player/index.html?launchid=6fb94c30-474b-412e-803c-37875dd526ae/question/1 No, HIV can not be gt 20 Reasons Why Yo... 7 Steps to Starting... 4 Types Of Business... I How to Define Your. The Culture Map's.. Part 2 uestion 2 of 3 -17 Assuming that the $15,800 residual value is guaranteed by the lessee, prepare the journal entry to record the sales revenue and the cost of goods sold in the lease transaction. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit (To record inception of lease and cost of goods sold.) - Xintian - Outlook X Chapter 20 Homework Part 2 X > NWP Assessment Player UI App X C Coronado Dairy Ltd. Leases its X mn/was/ui/v2/assessment-player/index.html?launchid=6fb94c30-474b-412e-803c-37875dd526ae#/question/1 No HIV can not be gt 20 Reasons Why Yo.. 7 Steps to Starting... 4 Types Of Business... I How to Define Your... T The Culture Map' S... Part 2 estion 2 of 3 -17 TI List of Accounts Assume that, as an alternative. Coronado would consider leasing the equipment for 12 years if it could recover the normal selling price of $200,356. How much would Coronado charge the lessee annually for a 12-year lease? Assume the residual value at the end of 12 years would be $0, and that lease payments would be due at the start of each year. (Round factor values to 5 decimal places, eg. 1.25124 and final answer to decimal places, eg, 5.275.) Annual payment $ e Textbook and Media List of Accounts