Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no information missing Client: Lisa, Age 34 Client's Yearly Gross Income: $170,000.00 Household Yearly Gross Income: $170,000.00 Employment Start Date: August 2022 Lisa was recently

no information missing

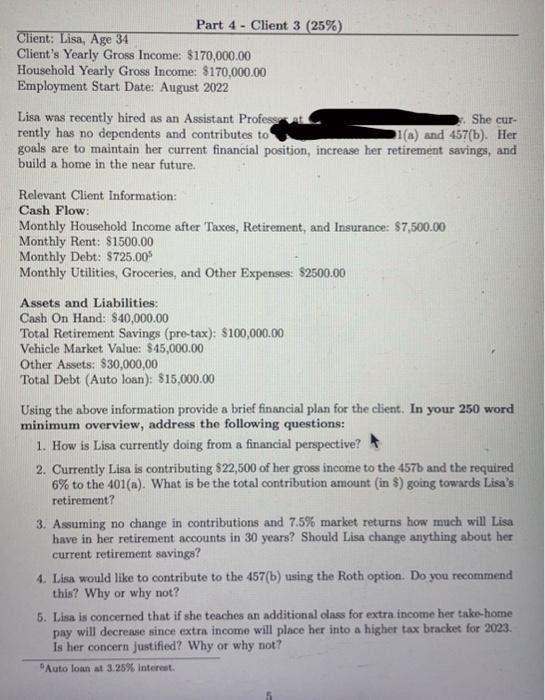

Client: Lisa, Age 34 Client's Yearly Gross Income: $170,000.00 Household Yearly Gross Income: $170,000.00 Employment Start Date: August 2022 Lisa was recently hired as an Assistant Profesgert. She currently has no dependents and contributes to goals are to maintain her current financial position, increase her retirement savings, and build a home in the near future. Relevant Client Information: Cash Flow: Monthly Household Income after Taxes, Retirement, and Insurance: $7,500.00 Monthly Rent: $1500.00 Monthly Debt: $725.005 Monthly Utilities, Groceries, and Other Expenses: $2500.00 Assets and Liabilities: Cash On Hand: $40,000.00 Total Retirement Savings (pre-tax): $100,000.00 Vehicle Market Value: $45,000.00 Other Assets: $30,000,00 Total Debt (Auto loan): $15,000.00 Using the above information provide a brief financial plan for the client. In your 250 word minimum overview, address the following questions: 1. How is Lisa currently doing from a financial perspective? 2. Currently Lisa is contributing $22,500 of her gross income to the 457b and the required 6% to the 401(a). What is be the total contribution amount (in \$) going towards Lisa's retirement? 3. Assuming no change in contributions and 7.5% market returns how much will Lisa have in her retirement accounts in 30 years? Should Lisa change anything about her current retirement savings? 4. Lisa would like to contribute to the 457 (b) using the Roth option. Do you recommend this? Why or why not? 5. Lisa is concerned that if she teaches an additional class for extra income ber take-home pay will decrease since extra income will place her into a higher tax bracket for 2023 . is her concern justified? Why or why not? 5 Auto loan at 3.25% interest Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started