Answered step by step

Verified Expert Solution

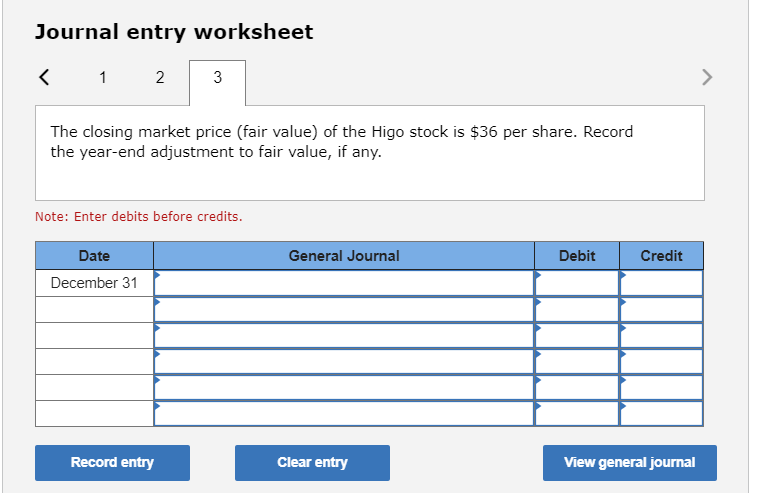

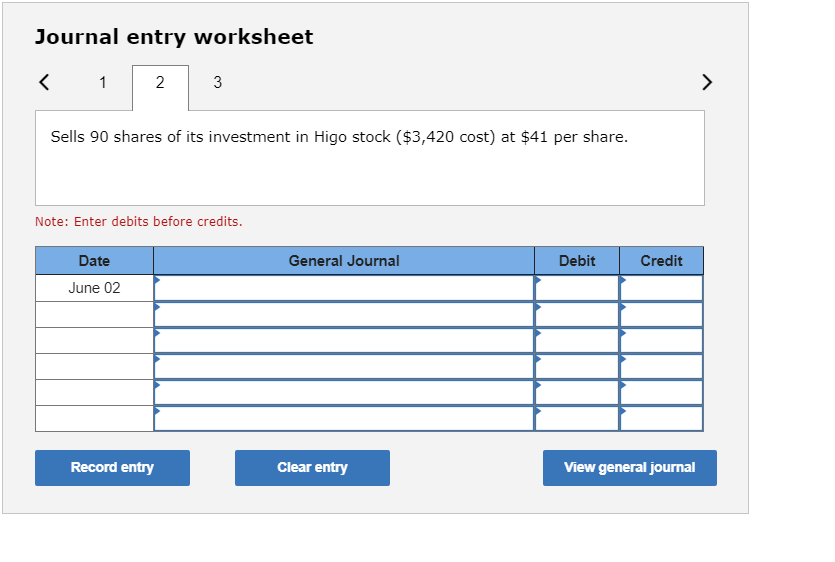

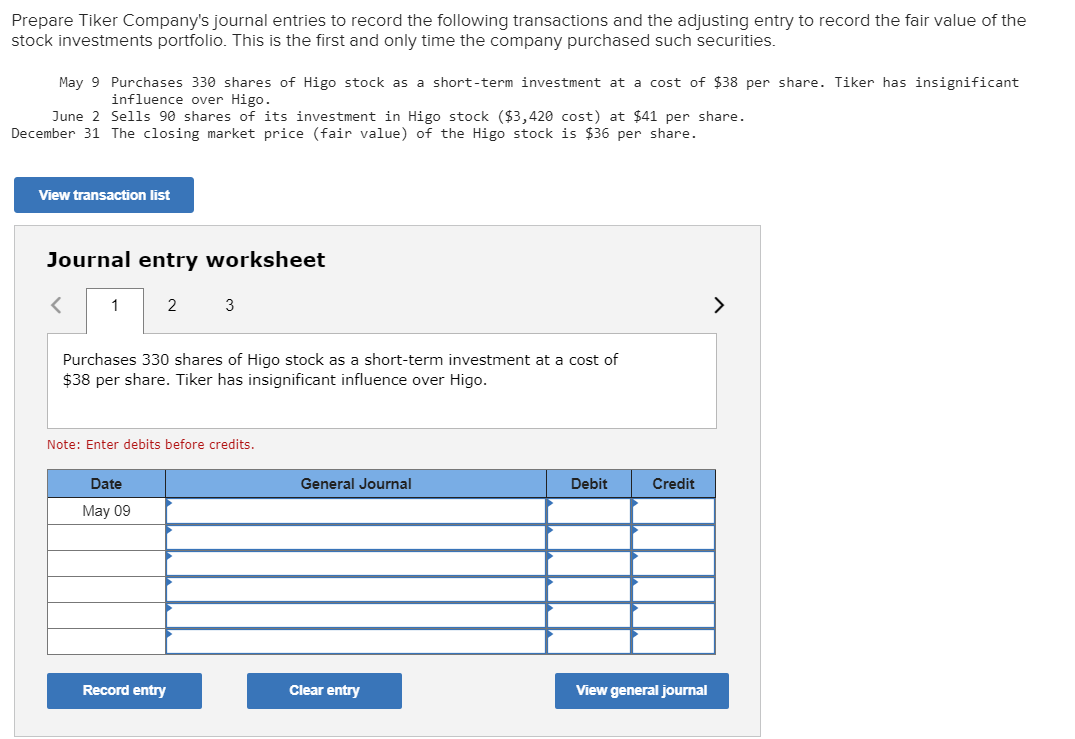

Question

1 Approved Answer

No journal entry required Accounts payable Accounts receivable Accumulated depreciationBuilding Accumulated depreciationEquipment Amortization expense Bonds payable Brokerage fee expense Building Cash Common stock, $10 par

- No journal entry required

- Accounts payable

- Accounts receivable

- Accumulated depreciationBuilding

- Accumulated depreciationEquipment

- Amortization expense

- Bonds payable

- Brokerage fee expense

- Building

- Cash

- Common stock, $10 par value

- Cost of goods sold

- Debt investments - Available-for-sale

- Debt investments - Held-to-maturity

- Debt investments - Trading

- Depreciation expenseBuilding

- Depreciation expenseEquipment

- Discount on bonds payable

- Dividend revenue

- Earnings from equity method investments

- Equipment

- Equity method investments

- Fair value adjustment - Available-for-sale

- Fair value adjustment - Stock

- Fair value adjustment - Trading

- Gain on retirement of bonds payable

- Gain on sale of debt investments

- Gain on sale of stock investments

- Income summary

- Interest expense

- Interest payable

- Interest receivable

- Interest revenue

- Inventory

- Land

- Loss on retirement of bonds payable

- Loss on sale of debt investments

- Loss on sale of stock investments

- Notes payable

- Paid-in capital in excess of par value, common stock

- Paid-in capital in excess of par value, preferred stock

- Paid-in capital, treasury stock

- Preferred stock, $100 par value

- Premium on bonds payable

- Rental expense

- Rental revenue

- Retained earnings

- Salaries expense

- Sales

- Sales discounts

- Sales returns and allowances

- Stock investments

- Supplies

- Supplies expense

- Treasury stock

- Unrealized gain - Equity

- Unrealized gain - Income

- Unrealized loss - Equity

- Unrealized loss - Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started