Answered step by step

Verified Expert Solution

Question

1 Approved Answer

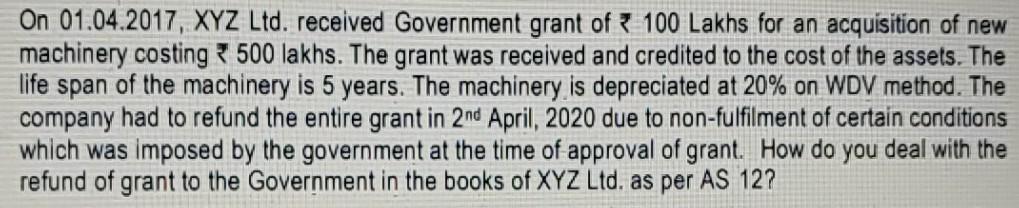

No missing data On 01.04.2017, XYZ Ltd. received Government grant of 100 Lakhs for an acquisition of new machinery costing 500 lakhs. The grant was

No missing data

On 01.04.2017, XYZ Ltd. received Government grant of 100 Lakhs for an acquisition of new machinery costing 500 lakhs. The grant was received and credited to the cost of the assets. The life span of the machinery is 5 years. The machinery is depreciated at 20% on WDV method. The company had to refund the entire grant in 2nd April, 2020 due to non-fulfilment of certain conditions which was imposed by the government at the time of approval of grant. How do you deal with the refund of grant to the Government in the books of XYZ Ltd. as per AS 12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started