No need for Explanation

and you can skip Q 21

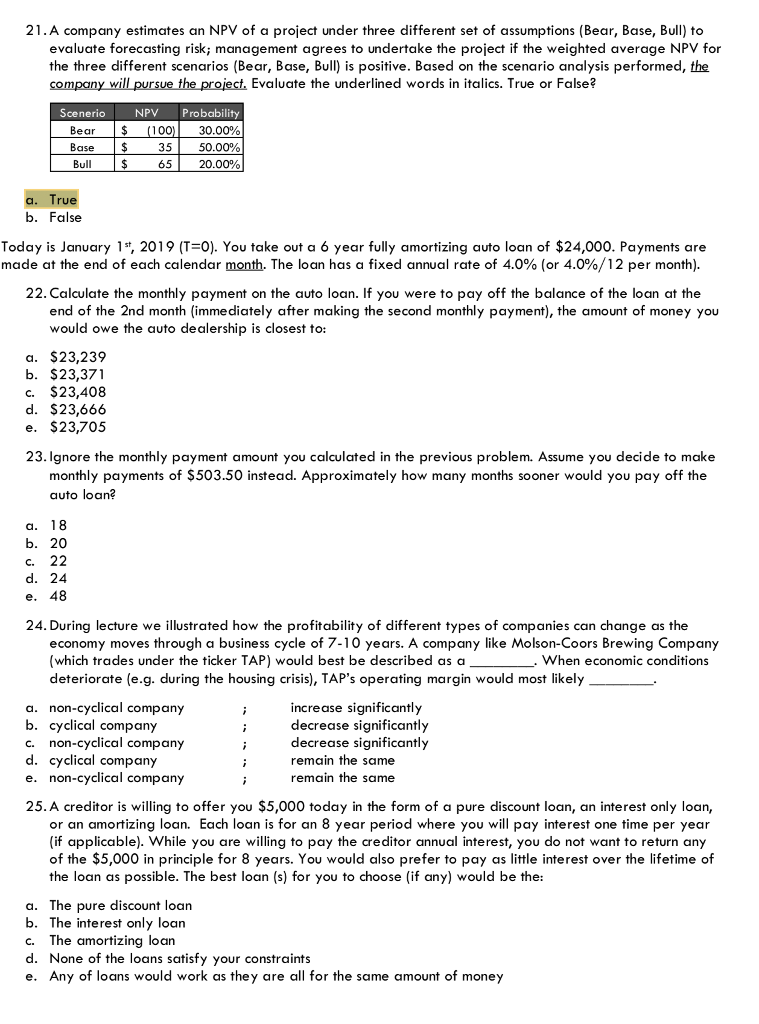

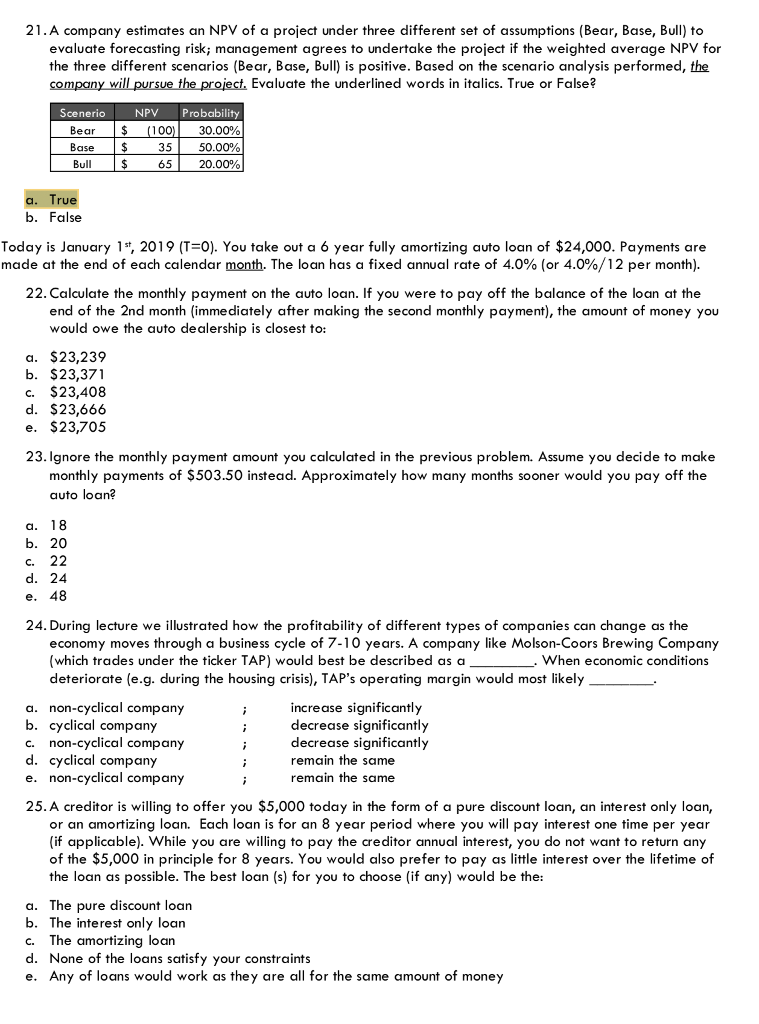

21.A company estimates an NPV of a project under three different set of assumptions (Bear, Base, Bull) to evaluate forecasting risk; management agrees to undertake the project if the weighted average NPV for the three different scenarios (Bear, Base, Bull) is positive. Based on the scenario analysis performed, the company will pursue the proiect. Evaluate the underlined words in italics. True or False? Scenerio Bear Base Bull NPV Probability 30.00% 35| 50.00% 65 20.00% ru b. False Today is January 1t, 2019 (T-0). You take out a 6 year fully amortizing auto loan of $24,000. Payments are made at the end of each calendar month. The loan has a fixed annual rate of 4.0% (or 4.0%/12 per month). 22. Calculate the monthly payment on the auto loan. If you were to pay off the balance of the loan at the end of the 2nd month (immediately after making the second monthly payment), the amount of money you would owe the auto dealership is closest to: a. $23,239 b. $23,371 c. $23,408 d. $23,666 e. $23,705 23. Ignore the monthly payment amount you calculated in the previous problem. Assume you decide to make monthly payments of $503.50 instead. Approximately how many months sooner would you pay off the auto loan? b. 20 c. 22 e. 48 24. During lecture we illustrated how the profitability of different types of companies can change as the economy moves through a business cycle of 7-10 years. A company like Molson-Coors Brewing Company (which trades under the ticker TAP) would best be described asa When economic conditions deteriorate (e.g. during the housing crisis), TAP's operating margin would most likely a. non-cyclical company b. cyclical compan)y c. non-cyclical company d. cyclical company e. non-cyclical company increase significantly decrease significantly decrease significantly remain the samee remain the same 25. A creditor is willing to offer you $5,000 today in the form of a pure discount loan, an interest only loan, or an amortizing loan. Each loan is for an 8 year period where you will pay interest one time per year (if applicable). While you are willing to pay the creditor annual interest, you do not want to return any of the $5,000 in principle for 8 years. You would also prefer to pay as little interest over the lifetime of the loan as possible. The best loan (s) for you to choose (if any) would be the: a. The pure discount loan b. The interest only loan c. The amortizing loan d. None of the loans satisfy your constraints e. Any of loans would work as they are all for the same amount of money