Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no need for link, the additional information and financial information is both expanded and added onto the page Malachi Lambert graduated from the University of

no need for link, the additional information and financial information is both expanded and added onto the page

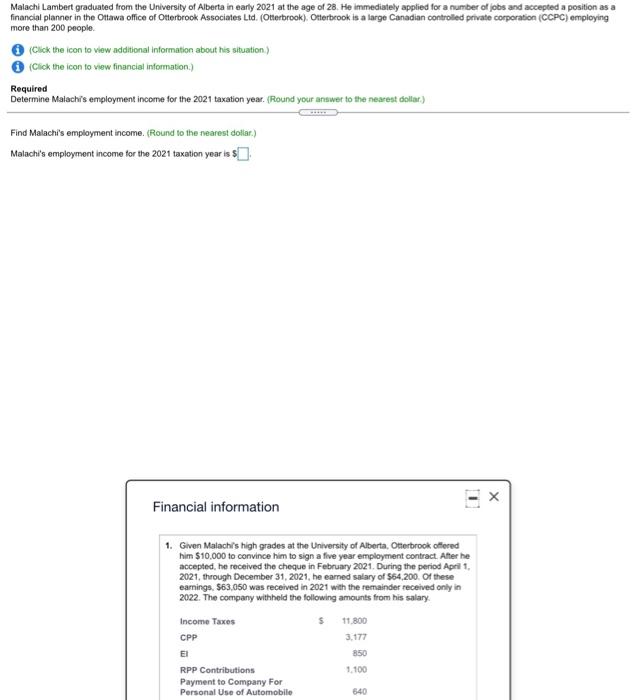

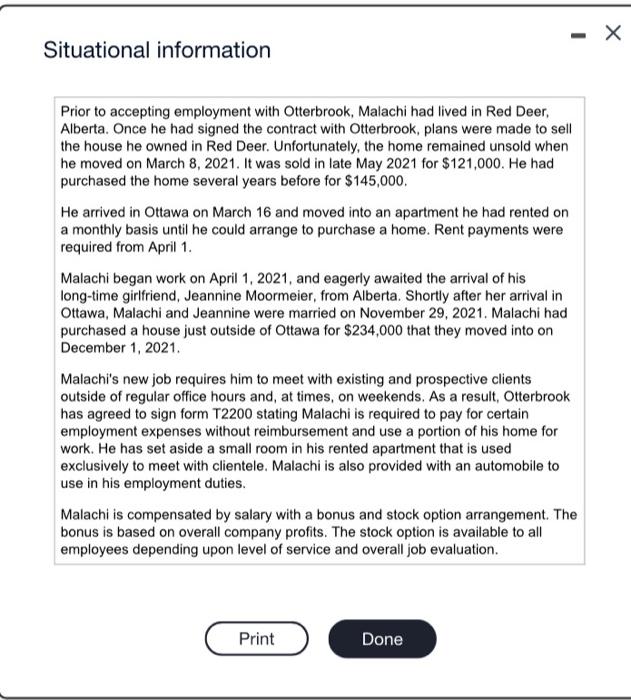

Malachi Lambert graduated from the University of Alberta in early 2021 at the age of 28. He immediately applied for a number of jobs and accepted a position as a financial planner in the Ottawa office of Otterbrook Associates Ltd. (Otterbrook). Otterbrook is a large Canadian controlled private corporation (CCPC) employing more than 200 people (Click the icon to view additional information about his situation) (Click the icon to view financial information) Required Determine Malachis employment income for the 2021 taxation year. (Round your answer to the nearest dollar) Find Malachi's employment income. (Round to the nearest doilar.) Malach's employment income for the 2021 taxation year is s] 1 Financial information 1. Given Malach's high grades at the University of Alberta, Otterbrook offered him $10,000 to convince him to sign a five year employment contract. After he accepted, he received the cheque in February 2021. During the period April 1. 2021, through December 31, 2021, he earned salary of $54,200. Of these earnings. $63.050 was received in 2021 with the remainder received only in 2022. The company withheld the following amounts from his salary Income Taxes CPP 11.800 3.177 850 1.100 RPP Contributions Payment to Company For Personal use of Automobile 640 Situational information Prior to accepting employment with Otterbrook, Malachi had lived in Red Deer, Alberta. Once he had signed the contract with Otterbrook, plans were made to sell the house he owned in Red Deer. Unfortunately, the home remained unsold when he moved on March 8, 2021. It was sold in late May 2021 for $121,000. He had purchased the home several years before for $145,000 He arrived in Ottawa on March 16 and moved into an apartment he had rented on a monthly basis until he could arrange to purchase a home. Rent payments were required from April 1. Malachi began work on April 1, 2021, and eagerly awaited the arrival of his long-time girlfriend, Jeannine Moormeier, from Alberta. Shortly after her arrival in Ottawa, Malachi and Jeannine were married on November 29, 2021. Malachi had purchased a house just outside of Ottawa for $234,000 that they moved into on December 1, 2021. Malachi's new job requires him to meet with existing and prospective clients outside of regular office hours and, at times, on weekends. As a result, Otterbrook has agreed to sign form T2200 stating Malachi is required to pay for certain employment expenses without reimbursement and use a portion of his home for work. He has set aside a small room in his rented apartment that is used exclusively to meet with clientele. Malachi is also provided with an automobile to use in his employment duties. Malachi is compensated by salary with a bonus and stock option arrangement. The bonus is based on overall company profits. The stock option is available to all employees depending upon level of service and overall job evaluation. Print Done Malachi Lambert graduated from the University of Alberta in early 2021 at the age of 28. He immediately applied for a number of jobs and accepted a position as a financial planner in the Ottawa office of Otterbrook Associates Ltd. (Otterbrook). Otterbrook is a large Canadian controlled private corporation (CCPC) employing more than 200 people (Click the icon to view additional information about his situation) (Click the icon to view financial information) Required Determine Malachis employment income for the 2021 taxation year. (Round your answer to the nearest dollar) Find Malachi's employment income. (Round to the nearest doilar.) Malach's employment income for the 2021 taxation year is s] 1 Financial information 1. Given Malach's high grades at the University of Alberta, Otterbrook offered him $10,000 to convince him to sign a five year employment contract. After he accepted, he received the cheque in February 2021. During the period April 1. 2021, through December 31, 2021, he earned salary of $54,200. Of these earnings. $63.050 was received in 2021 with the remainder received only in 2022. The company withheld the following amounts from his salary Income Taxes CPP 11.800 3.177 850 1.100 RPP Contributions Payment to Company For Personal use of Automobile 640 Situational information Prior to accepting employment with Otterbrook, Malachi had lived in Red Deer, Alberta. Once he had signed the contract with Otterbrook, plans were made to sell the house he owned in Red Deer. Unfortunately, the home remained unsold when he moved on March 8, 2021. It was sold in late May 2021 for $121,000. He had purchased the home several years before for $145,000 He arrived in Ottawa on March 16 and moved into an apartment he had rented on a monthly basis until he could arrange to purchase a home. Rent payments were required from April 1. Malachi began work on April 1, 2021, and eagerly awaited the arrival of his long-time girlfriend, Jeannine Moormeier, from Alberta. Shortly after her arrival in Ottawa, Malachi and Jeannine were married on November 29, 2021. Malachi had purchased a house just outside of Ottawa for $234,000 that they moved into on December 1, 2021. Malachi's new job requires him to meet with existing and prospective clients outside of regular office hours and, at times, on weekends. As a result, Otterbrook has agreed to sign form T2200 stating Malachi is required to pay for certain employment expenses without reimbursement and use a portion of his home for work. He has set aside a small room in his rented apartment that is used exclusively to meet with clientele. Malachi is also provided with an automobile to use in his employment duties. Malachi is compensated by salary with a bonus and stock option arrangement. The bonus is based on overall company profits. The stock option is available to all employees depending upon level of service and overall job evaluation. Print Done Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started