Answered step by step

Verified Expert Solution

Question

1 Approved Answer

No need to do part d. Thank you! 3. When Linda Jones turns 7, her parents decide that she will become a doctor. They want

No need to do part d. Thank you!

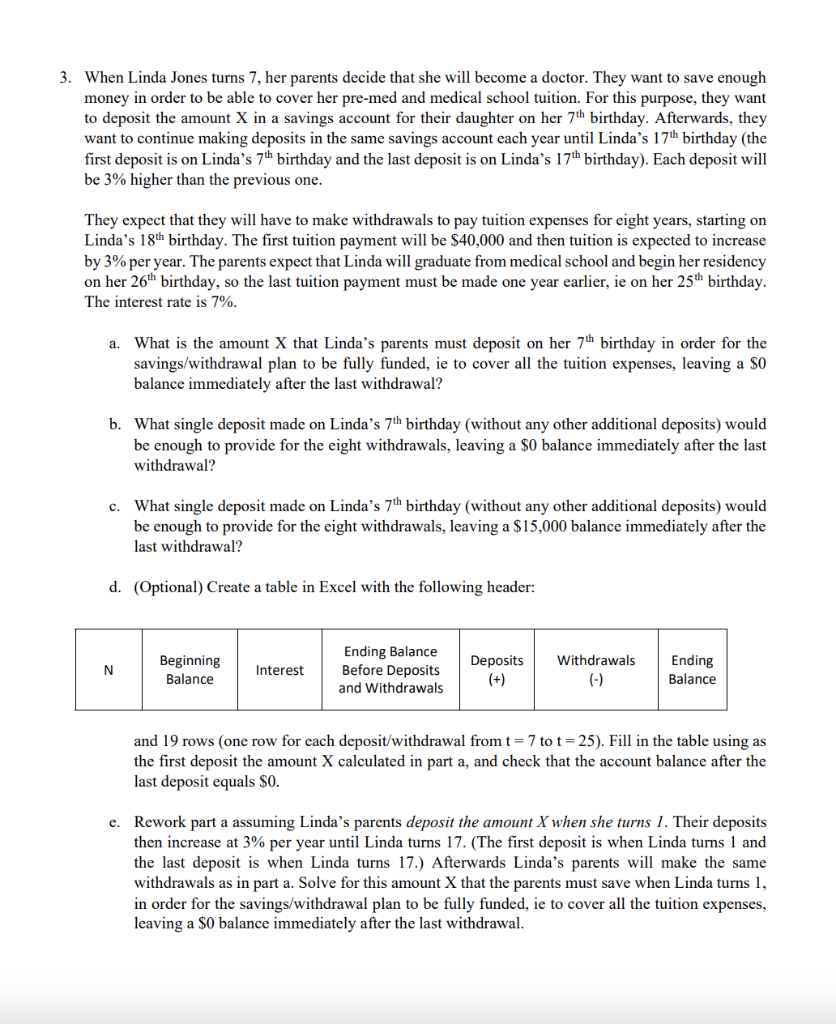

3. When Linda Jones turns 7, her parents decide that she will become a doctor. They want to save enough money in order to be able to cover her pre-med and medical school tuition. For this purpose, they want to deposit the amount X in a savings account for their daughter on her 7th birthday. Afterwards, they want to continue making deposits in the same savings account each year until Linda's 17th birthday (the first deposit is on Linda's 7th birthday and the last deposit is on Linda's 17th birthday). Each deposit will be 3% higher than the previous one. They expect that they will have to make withdrawals to pay tuition expenses for eight years, starting on Linda's 18th birthday. The first tuition payment will be $40,000 and then tuition is expected to increase by 3% per year. The parents expect that Linda will graduate from medical school and begin her residency on her 26th birthday, so the last tuition payment must be made one year earlier, ie on her 25th birthday. The interest rate is 7%. a. What is the amount X that Linda's parents must deposit on her 7th birthday in order for the savings/withdrawal plan to be fully funded, ie to cover all the tuition expenses, leaving a $0 balance immediately after the last withdrawal? b. What single deposit made on Linda's 7th birthday (without any other additional deposits) would be enough to provide for the eight withdrawals, leaving a $0 balance immediately after the last withdrawal? c. What single deposit made on Linda's 7th birthday (without any other additional deposits) would be enough to provide for the eight withdrawals, leaving a $15,000 balance immediately after the last withdrawal? d. (Optional) Create a table in Excel with the following header: N Beginning Balance Interest Ending Balance Before Deposits and Withdrawals Deposits (+) Withdrawals (-) Ending Balance and 19 rows (one row for each deposit/withdrawal from t= 7 to t= 25). Fill in the table using as the first deposit the amount X calculated in part a, and check that the account balance after the last deposit equals $0. e. Rework part a assuming Linda's parents deposit the amount X when she turns 1. Their deposits then increase at 3% per year until Linda turns 17. (The first deposit is when Linda turns 1 and the last deposit is when Linda turns 17.) Afterwards Linda's parents will make the same withdrawals as in part a. Solve for this amount X that the parents must save when Linda turns 1, in order for the savings/withdrawal plan to be fully funded, ie to cover all the tuition expenses, leaving a $0 balance immediately after the last withdrawal. 3. When Linda Jones turns 7, her parents decide that she will become a doctor. They want to save enough money in order to be able to cover her pre-med and medical school tuition. For this purpose, they want to deposit the amount X in a savings account for their daughter on her 7th birthday. Afterwards, they want to continue making deposits in the same savings account each year until Linda's 17th birthday (the first deposit is on Linda's 7th birthday and the last deposit is on Linda's 17th birthday). Each deposit will be 3% higher than the previous one. They expect that they will have to make withdrawals to pay tuition expenses for eight years, starting on Linda's 18th birthday. The first tuition payment will be $40,000 and then tuition is expected to increase by 3% per year. The parents expect that Linda will graduate from medical school and begin her residency on her 26th birthday, so the last tuition payment must be made one year earlier, ie on her 25th birthday. The interest rate is 7%. a. What is the amount X that Linda's parents must deposit on her 7th birthday in order for the savings/withdrawal plan to be fully funded, ie to cover all the tuition expenses, leaving a $0 balance immediately after the last withdrawal? b. What single deposit made on Linda's 7th birthday (without any other additional deposits) would be enough to provide for the eight withdrawals, leaving a $0 balance immediately after the last withdrawal? c. What single deposit made on Linda's 7th birthday (without any other additional deposits) would be enough to provide for the eight withdrawals, leaving a $15,000 balance immediately after the last withdrawal? d. (Optional) Create a table in Excel with the following header: N Beginning Balance Interest Ending Balance Before Deposits and Withdrawals Deposits (+) Withdrawals (-) Ending Balance and 19 rows (one row for each deposit/withdrawal from t= 7 to t= 25). Fill in the table using as the first deposit the amount X calculated in part a, and check that the account balance after the last deposit equals $0. e. Rework part a assuming Linda's parents deposit the amount X when she turns 1. Their deposits then increase at 3% per year until Linda turns 17. (The first deposit is when Linda turns 1 and the last deposit is when Linda turns 17.) Afterwards Linda's parents will make the same withdrawals as in part a. Solve for this amount X that the parents must save when Linda turns 1, in order for the savings/withdrawal plan to be fully funded, ie to cover all the tuition expenses, leaving a $0 balance immediately after the last withdrawalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started