no need to explain

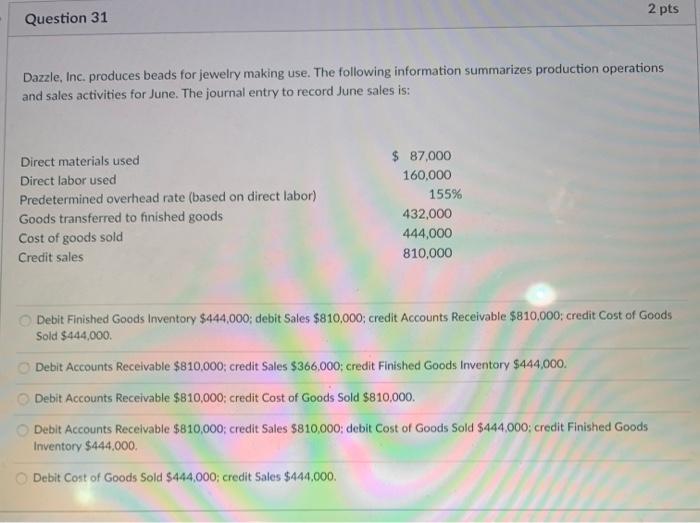

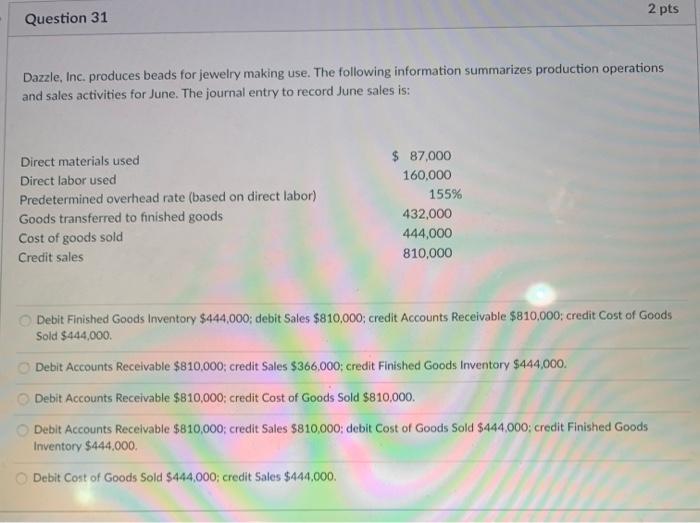

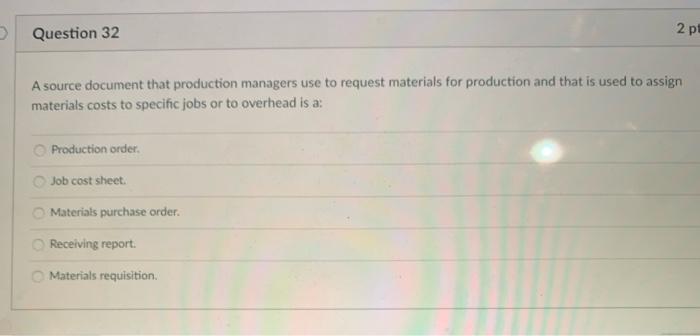

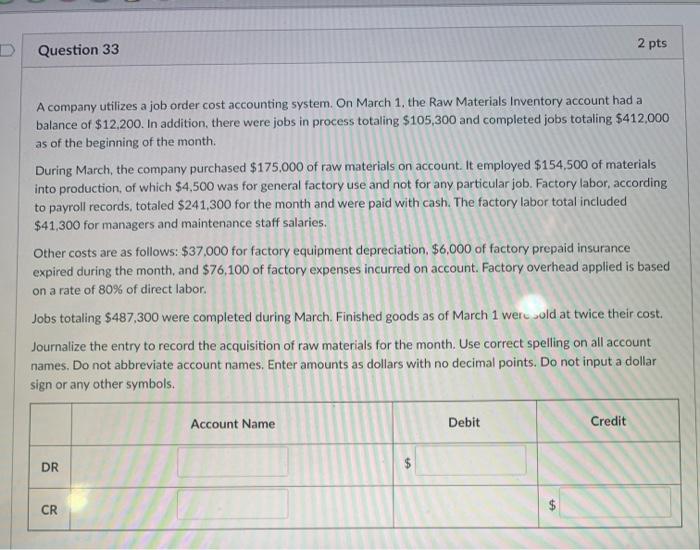

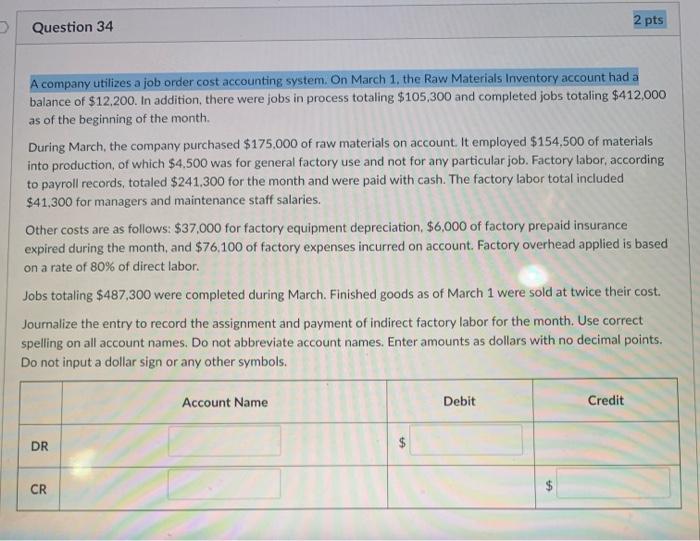

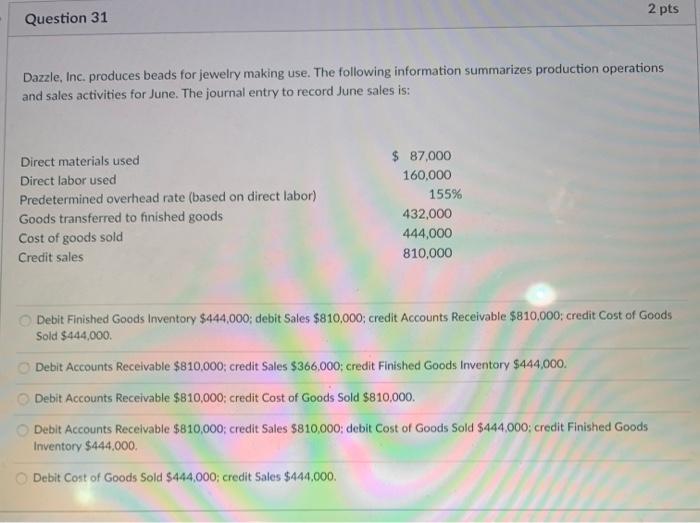

2 pts Question 31 Dazzle Inc. produces beads for jewelry making use. The following information summarizes production operations and sales activities for June. The journal entry to record June sales is: Direct materials used Direct labor used Predetermined overhead rate (based on direct labor) Goods transferred to finished goods Cost of goods sold Credit sales $ 87,000 160,000 155% 432,000 444,000 810,000 Debit Finished Goods Inventory $444,000 debit Sales $810,000; credit Accounts Receivable $810,000; credit Cost of Goods Sold $444,000 Debit Accounts Receivable $810,000; credit Sales $366,000 credit Finished Goods Inventory $444,000. Debit Accounts Receivable $810,000 credit Cost of Goods Sold $810,000 Debit Accounts Receivable $810,000; credit Sales $810,000; debit Cost of Goods Sold 5444.000; credit Finished Goods Inventory $444,000 Debit Cost of Goods Sold $444,000; credit Sales $444,000 Question 32 2 pt A source document that production managers use to request materials for production and that is used to assign materials costs to specific jobs or to overhead is a: Production order Job cost sheet Materials purchase order. Receiving report Materials requisition Question 33 2 pts A company utilizes a job order cost accounting system. On March 1, the Raw Materials Inventory account had a balance of $12,200. In addition, there were jobs in process totaling $105,300 and completed jobs totaling $412,000 as of the beginning of the month. During March, the company purchased $175,000 of raw materials on account. It employed $154,500 of materials into production, of which $4,500 was for general factory use and not for any particular job. Factory labor, according to payroll records, totaled $241,300 for the month and were paid with cash. The factory labor total included $41,300 for managers and maintenance staff salaries. Other costs are as follows: $37,000 for factory equipment depreciation, $6,000 of factory prepaid insurance expired during the month, and $76,100 of factory expenses incurred on account. Factory overhead applied is based on a rate of 80% of direct labor. Jobs totaling $487,300 were completed during March. Finished goods as of March 1 were sold at twice their cost. Journalize the entry to record the acquisition of raw materials for the month. Use correct spelling on all account names. Do not abbreviate account names. Enter amounts as dollars with no decimal points. Do not input a dollar sign or any other symbols. Account Name Debit Credit DR CR 2 pts Question 34 A company utilizes a job order cost accounting system. On March 1, the Raw Materials Inventory account had a balance of $12.200. In addition, there were jobs in process totaling $105,300 and completed jobs totaling $412,000 as of the beginning of the month. During March, the company purchased $175,000 of raw materials on account. It employed $154,500 of materials into production, of which $4,500 was for general factory use and not for any particular job. Factory labor, according to payroll records, totaled $241.300 for the month and were paid with cash. The factory labor total included $41,300 for managers and maintenance staff salaries. Other costs are as follows: $37,000 for factory equipment depreciation, $6,000 of factory prepaid insurance expired during the month, and $76,100 of factory expenses incurred on account. Factory overhead applied is based on a rate of 80% of direct labor. Jobs totaling $487,300 were completed during March. Finished goods as of March 1 were sold at twice their cost. Journalize the entry to record the assignment and payment of indirect factory labor for the month. Use correct spelling on all account names. Do not abbreviate account names. Enter amounts as dollars with no decimal points. Do not input a dollar sign or any other symbols. Account Name Debit Credit DR $ CR $