Question

Marijona meets with her insurance agent, Herkus, to open a Tax-Free Savings Account (TFSA). Marijona recently retired and, in addition to her employer pension

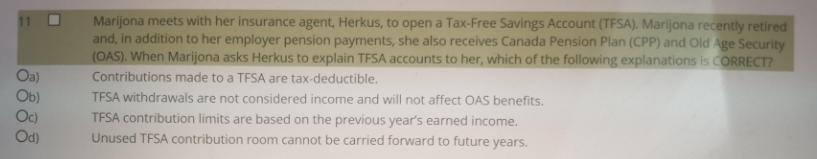

Marijona meets with her insurance agent, Herkus, to open a Tax-Free Savings Account (TFSA). Marijona recently retired and, in addition to her employer pension payments, she also receives Canada Pension Plan (CPP) and Old Age Security (OAS). When Marijona asks Herkus to explain TFSA accounts to her, which of the following explanations is CORRECT? Contributions made to a TFSA are tax-deductible. TFSA withdrawals are not considered income and will not affect OAS benefits. TFSA contribution limits are based on the previous year's earned income. Unused TFSA contribution room cannot be carried forward to future years. Oa) Ob) Oc) Od) 5888

Step by Step Solution

3.61 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Option B is correct TFSA withdrawa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxes And Business Strategy A Planning Approach

Authors: Myron Scholes, Mark Wolfson, Merle Erickson, Michelle Hanlon

5th Edition

132752670, 978-0132752671

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App