Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Connie opens a tax-free savings account (TFSA) and invests $10,000 in the Skymark Balanced Segregated Fund. The fund has a 75% maturity guarantee, a

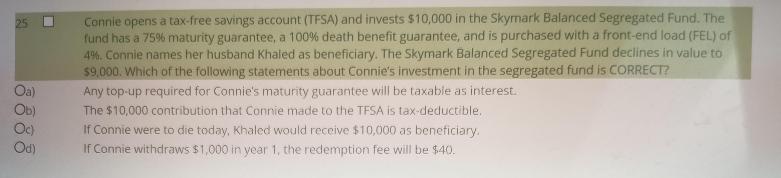

Connie opens a tax-free savings account (TFSA) and invests $10,000 in the Skymark Balanced Segregated Fund. The fund has a 75% maturity guarantee, a 100% death benefit guarantee, and is purchased with a front-end load (FEL) of 4%. Connie names her husband Khaled as beneficiary. The Skymark Balanced Segregated Fund declines in value to $9,000. Which of the following statements about Connie's investment in the segregated fund is CORRECT? Any top-up required for Connie's maturity guarantee will be taxable as interest. The $10,000 contribution that Connie made to the TFSA is tax-deductible, If Connie were to die today, Khaled would receive $10,000 as beneficiary. If Connie withdraws $1,000 in year 1, the redemption fee will be $40. 25 O Oa) Ob) Oc) Od) 18888

Step by Step Solution

★★★★★

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Option C is correct If connie wer...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started