Question

No one is giving me the right answers and this is due tonight... No explanation is required. I have worked this from every angle. I

No one is giving me the right answers and this is due tonight...

No explanation is required. I have worked this from every angle. I just need the following 6 answers please:

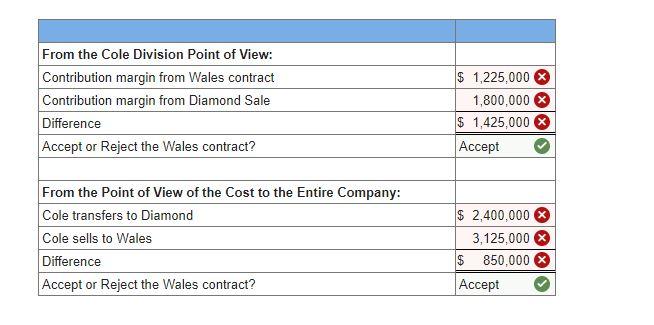

From Cole Division point of view:

1. Contribution margin from Wales Contract __________

2. Contribution margin from Diamon Sale __________

3. Difference ___________

From the Point of View of the Cost to the Entire Company:

1. Cole transfers to Diamond __________

2. Cole sales to Wales __________

3. Difference ___________

Required information Skip to question Robert Products Incorporated consists of three decentralized divisions: Bayside Division, Cole Division, and Diamond Division. The president of Robert Products has given the managers of the three divisions authority to decide whether to sell outside the company or among themselves at an internal price determined by the division managers. Market conditions are such that sales made internally or externally will not affect market or transfer prices. Intermediate markets will always be available for Bayside, Cole, and Diamond to purchase their manufacturing needs or sell their product. The manager of the Cole Division is currently considering the two alternative orders presented below: The Diamond Division is in need of 3,000 units of a motor that can be supplied by the Cole Division. To manufacture these motors, Cole would purchase components from the Bayside Division at a price of $600 per unit; Bayside's variable cost for these components is $300 per unit. Cole Division will further process these components at a variable cost of $500 per unit. If the Diamond Division cannot obtain the motors from Cole Division, it will purchase the motors from London Company which has offered to supply them to Diamond at a price of $1,500 per unit. London Company would also purchase 3,000 components from Bayside Division at a price of $400 for each of these motors; Bayside's variable cost for these components is $200 per unit. The Wales Company wants to place an order with the Cole Division for 3,500 similar motors at a price of $1,250 per unit. Cole would again purchase components from the Bayside Division at a price of $500 per unit; Bayside's variable cost for these components is $250 per unit. Cole Division will further process these components at a variable cost of $400 per unit. The Cole Division's plant capacity is limited, and the division can accept either the Wales contract or the Diamond order, but not both. The president of Robert Products and the manager of the Cole Division agree that it would not be beneficial in the short or long run to increase capacity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started