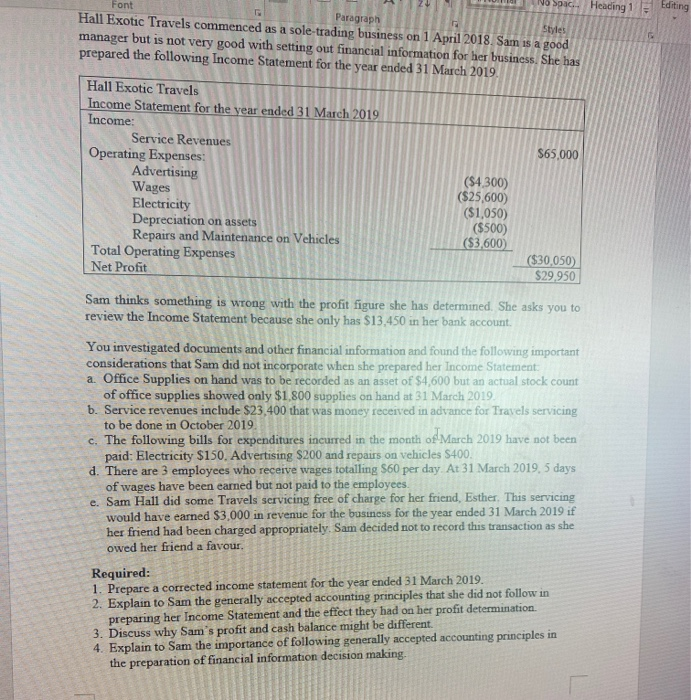

No Space Heading 1 Editing Font Paragraph Styles Hall Exotic Travels commenced as a sole-trading business on 1 April 2018 Sam is a good manager but is not very good with setting out financial information for her business. She has prepared the following Income Statement for the year ended 31 March 2019. Wages Hall Exotic Travels Income Statement for the year ended 31 March 2019 Income: Service Revenues Operating Expenses: $65.000 Advertising (S4300) ($25,600) Electricity ($1,050) Depreciation on assets ($500) Repairs and Maintenance on Vehicles ($3,600) Total Operating Expenses ($30,050) Net Profit $29.950 Sam thinks something is wrong with the profit figure she has determined. She asks you to review the Income Statement because she only has $13,450 in her bank account You investigated documents and other financial information and found the following important considerations that Sam did not incorporate when she prepared her Income Statement a Office Supplies on hand was to be recorded as an asset of $4,600 but an actual stock count of office supplies showed only $1,800 supplies on hand at 31 March 2019 b. Service revenues include $23.400 that was money received in advance for Travels servicing to be done in October 2019. c. The following bills for expenditures incurred in the month of March 2019 have not been paid: Electricity $150. Advertising $200 and repairs on vehicles S400. d. There are 3 employees who receive wages totalling $60 per day At 31 March 2019, 5 days of wages have been earned but not paid to the employees. e. Sam Hall did some Travels servicing free of charge for her friend, Esther. This servicing would have earned $3,000 in revenue for the business for the year ended 31 March 2019 if her friend had been charged appropriately. Sam decided not to record this transaction as she owed her friend a favour. Required: 1. Prepare a corrected income statement for the year ended 31 March 2019. 2. Explain to Sam the generally accepted accounting principles that she did not follow in preparing her Income Statement and the effect they had on her profit determination 3. Discuss why Sam's profit and cash balance might be different. 4. Explain to Sam the importance of following generally accepted accounting principles in the preparation of financial information decision making