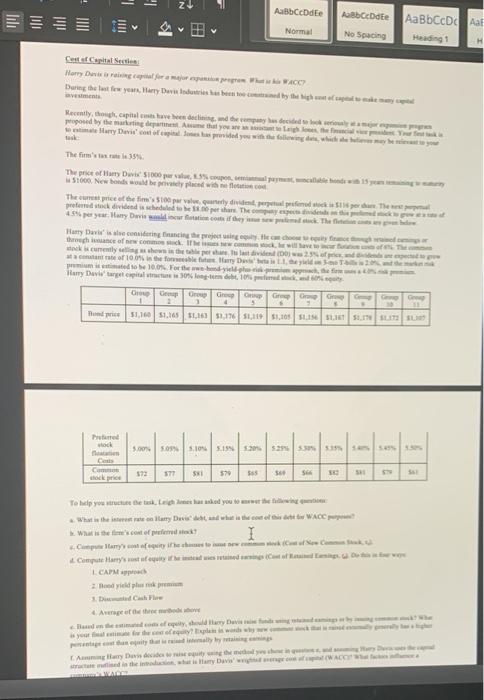

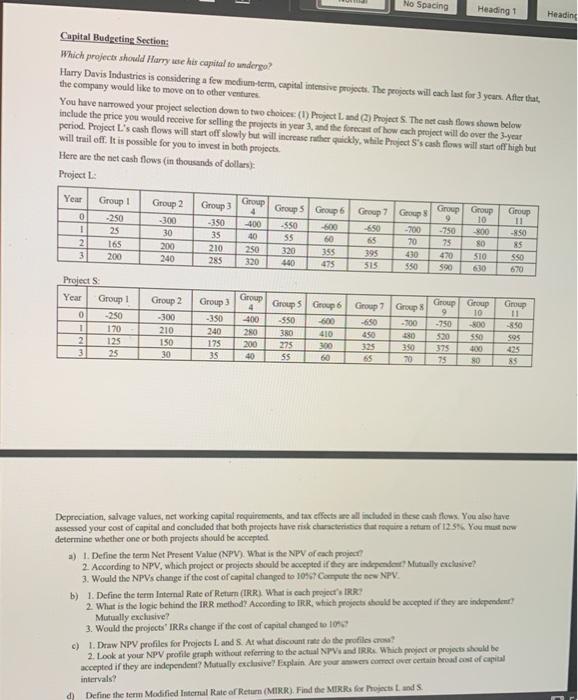

No Spacing Heading 1 Heading Capital Budgeting Section: Which projects should Harry use his capital to undergo? Harry Davis Industries is considering a few medium-term, capital intensive projects. The projects will cach last for 3 years. After that, the company would like to move on to other ventures You have narrowed your project selection down to two choice (1) Project Land (2) Project S. The net cash flows shown below include the price you would receive for selling the projects in your 3. and the forecast of how each project will do ever the 3-year period. Project L's cash flows will start off slowly but will increase the quickly, while Project's cash flows will start of high but will trail off. It is possible for you to invest in both projects. Here are the net cash flows (in thousands of dollars): Project L Year Group 1 Group 2 Group Groep Groups Group 6 Group Group Group Group Group 0 -250 -300 -350 -550 -800 -700 1 25 30 35 40 55 60 65 70 2 165 200 210 250 320 355 395 430 3 200 240 285 320 440 475 515 550 4 9 -750 75 420 590 10 800 80 510 11 850 85 550 670 Groep Group Projects Year Group 1 0 -250 1 120 2 125 3 25 Group 2 -300 210 150 30 Group -350 240 175 35 4 400 280 200 40 Group Group 6 -550 600 30 410 275 300 SS 60 Group Group -650 -700 450 230 350 65 20 Group Group 9 10 -750 -800 520 550 375 75 SO 325 -850 595 425 85 Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flow. You also have assessed your cost of capital and concluded that both projects have risk characteristics that require a return of 12.86. You must now determine whether one or both projects should be accepted a) 1. Define the term Net Present Value (NPV). What is the NPV of each project 2. According to NPV, which project of projects should be accepted ir day we independent Mutually exclusive? 3. Would the NPVs change if the cost of capital changed to 10527 Compute the new NPV. b) 1. Define the term Internal Rate of Return (IRR) What is cach project IRR 2. What is the logic behind the IRR method' According to IRR, which projects should be accepted if they are independent? Mutually exchasive? 3. Would the projects' IRRs change if the cost of capital changed to 10% c) 1. Draw NPV profiles for Projects and S. At what discount rate do the profiles cross? 2. Look at your NPV profile graph without referring to the actual NPVs and IRRE Which projector projects should be accepted if they are independent? Mutually exclusive Baplain. Are your we correct over certain becadost of capital intervals? Define the term Modified Internal Rate of Return (MIRR). Find the MIRRs for hojects and S. d) No Spacing Heading 1 Heading Capital Budgeting Section: Which projects should Harry use his capital to undergo? Harry Davis Industries is considering a few medium-term, capital intensive projects. The projects will cach last for 3 years. After that, the company would like to move on to other ventures You have narrowed your project selection down to two choice (1) Project Land (2) Project S. The net cash flows shown below include the price you would receive for selling the projects in your 3. and the forecast of how each project will do ever the 3-year period. Project L's cash flows will start off slowly but will increase the quickly, while Project's cash flows will start of high but will trail off. It is possible for you to invest in both projects. Here are the net cash flows (in thousands of dollars): Project L Year Group 1 Group 2 Group Groep Groups Group 6 Group Group Group Group Group 0 -250 -300 -350 -550 -800 -700 1 25 30 35 40 55 60 65 70 2 165 200 210 250 320 355 395 430 3 200 240 285 320 440 475 515 550 4 9 -750 75 420 590 10 800 80 510 11 850 85 550 670 Groep Group Projects Year Group 1 0 -250 1 120 2 125 3 25 Group 2 -300 210 150 30 Group -350 240 175 35 4 400 280 200 40 Group Group 6 -550 600 30 410 275 300 SS 60 Group Group -650 -700 450 230 350 65 20 Group Group 9 10 -750 -800 520 550 375 75 SO 325 -850 595 425 85 Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flow. You also have assessed your cost of capital and concluded that both projects have risk characteristics that require a return of 12.86. You must now determine whether one or both projects should be accepted a) 1. Define the term Net Present Value (NPV). What is the NPV of each project 2. According to NPV, which project of projects should be accepted ir day we independent Mutually exclusive? 3. Would the NPVs change if the cost of capital changed to 10527 Compute the new NPV. b) 1. Define the term Internal Rate of Return (IRR) What is cach project IRR 2. What is the logic behind the IRR method' According to IRR, which projects should be accepted if they are independent? Mutually exchasive? 3. Would the projects' IRRs change if the cost of capital changed to 10% c) 1. Draw NPV profiles for Projects and S. At what discount rate do the profiles cross? 2. Look at your NPV profile graph without referring to the actual NPVs and IRRE Which projector projects should be accepted if they are independent? Mutually exclusive Baplain. Are your we correct over certain becadost of capital intervals? Define the term Modified Internal Rate of Return (MIRR). Find the MIRRs for hojects and S. d)