no time plz help me with tihs

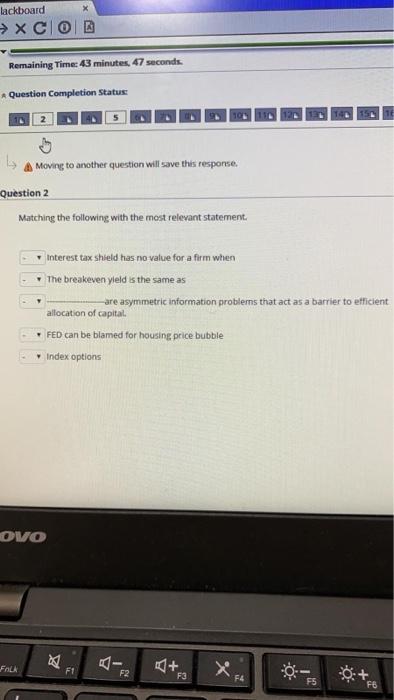

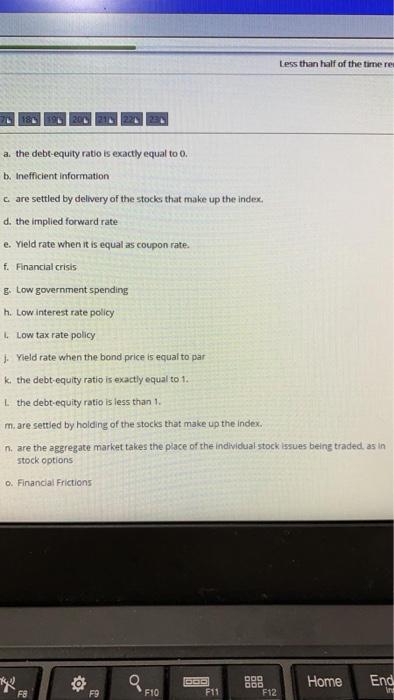

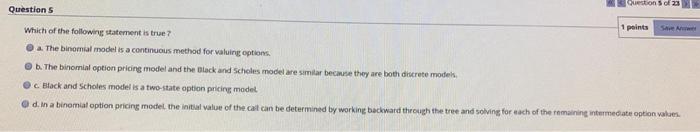

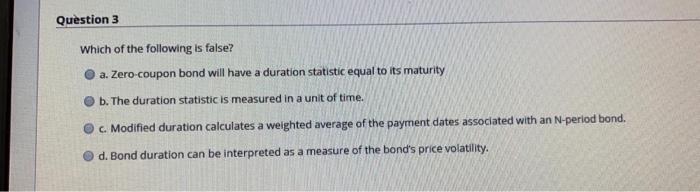

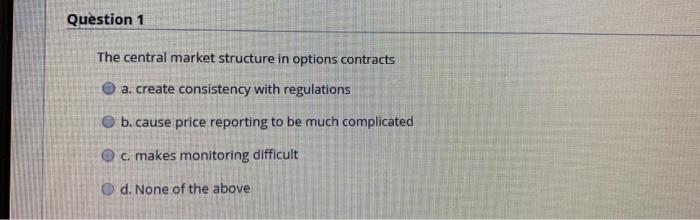

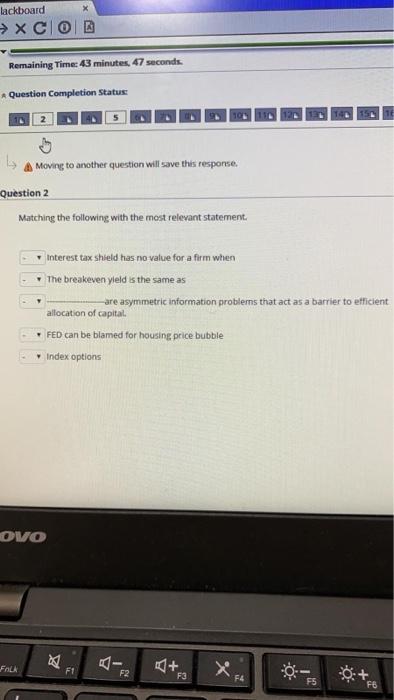

lackboard XCIO Remaining Time: 43 minutes, 47 seconds Question Completion Status: A Moving to another question will save this response. Question 2 Matching the following with the most relevant statement Interest tax shteld has no value for a firm when The breakeven ylelds the same as are asymmetric information problems that act as a barrier to efficient allocation of capital. FED can be blamed for housing price bubble Index options OVO FOLK F1 F2 F3 F5 FB Less than half of the timere a. the debt-equity ratio is exactly equal to 0. b. Inefficient information care settled by delivery of the stocks that make up the index d. the implied forward rate e Yield rate when it is equal as coupon rate. f. Financial crisis 3. Low government spending h. Low interest rate policy Low tax rate policy | Yield rate when the bond price is equal to par k the debt-equity ratio is exactly equal to 1. 1 the debt-equity ratio is less than 1. m. are settled by holding of the stocks that make up the index. n. are the aggregate market takes the place of the individual stock issues being traded as in stock options c. Financial Frictions ** 0 DOD DOD F12 Home End FB F9 F10 F11 Question of 23 Questions 1 points SA Which of the following statement is true? a The binomial model is a continuous method for valuing options. b. The binomial option pricing model and the Black and Scholes model are similar because they are both discrete models c Black and Scholes model is a two-state option pricing model d. In a binomial option pricing model the initial value of the cat can be determined by working backward through the tree and solving for each of the remaining intermediate option values Question 3 Which of the following is false? a. Zero-coupon bond will have a duration statistic equal to its maturity b. The duration statistic is measured in a unit of time. c. Modified duration calculates a weighted average of the payment dates associated with an N-perlod bond. d. Bond duration can be interpreted as a measure of the bond's price volatility. Question 1 The central market structure in options contracts a. create consistency with regulations b. cause price reporting to be much complicated c. makes monitoring difficult d. None of the above