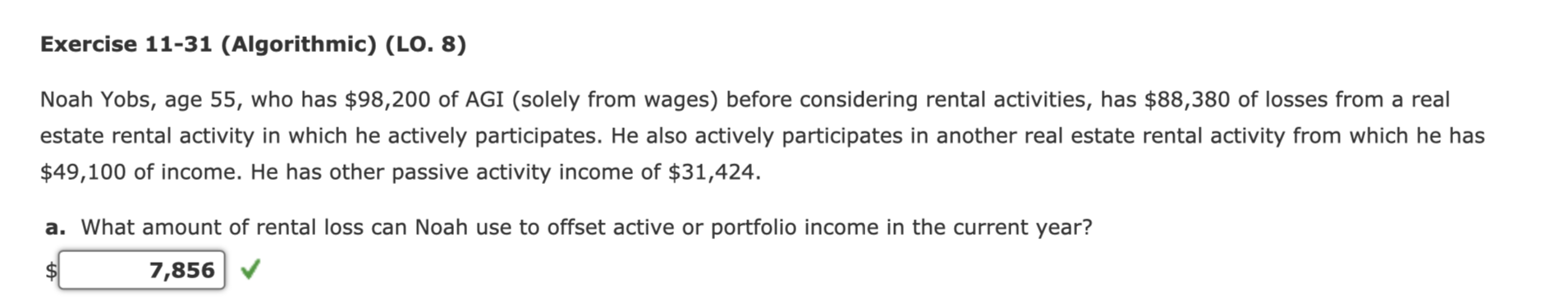

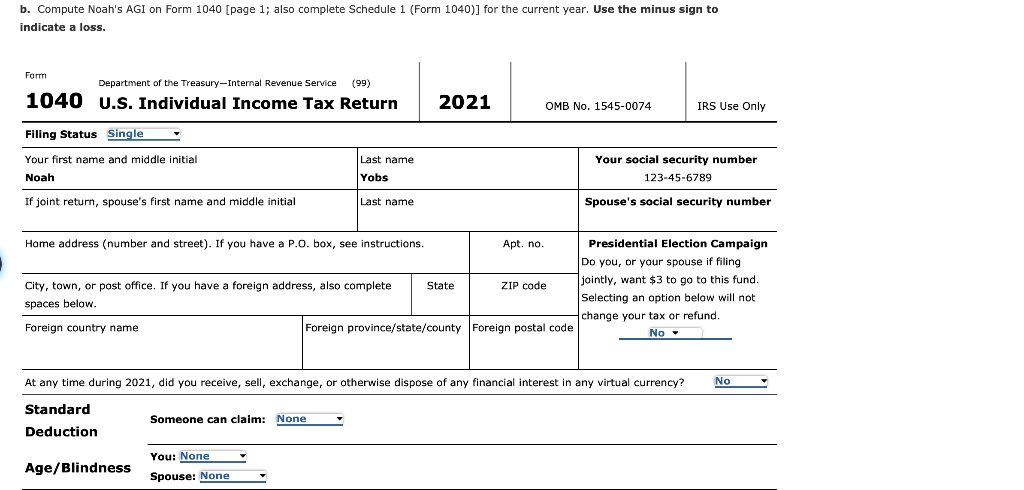

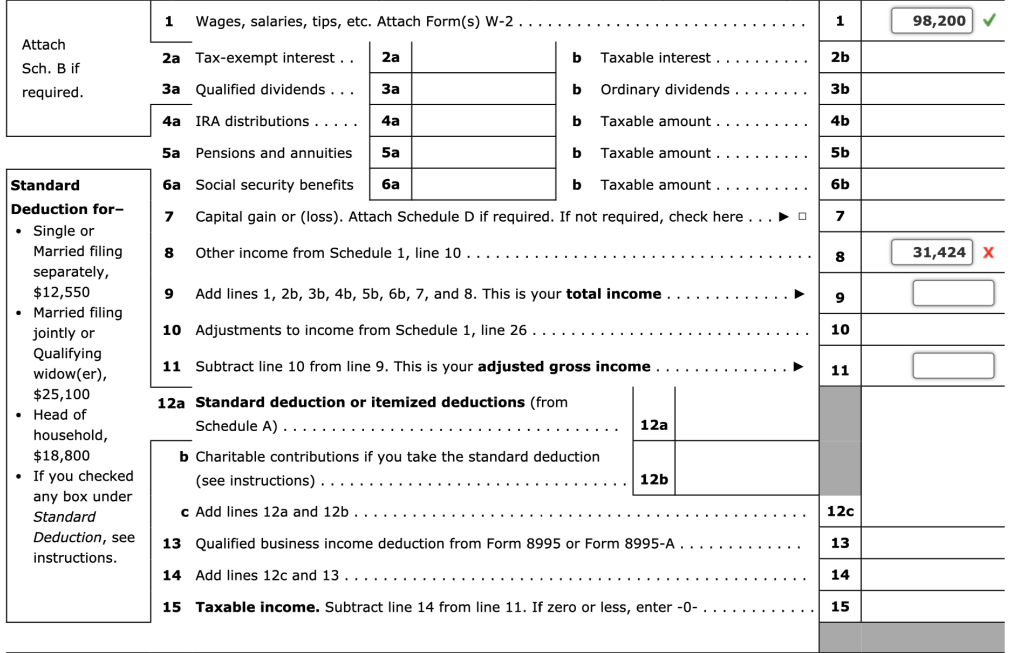

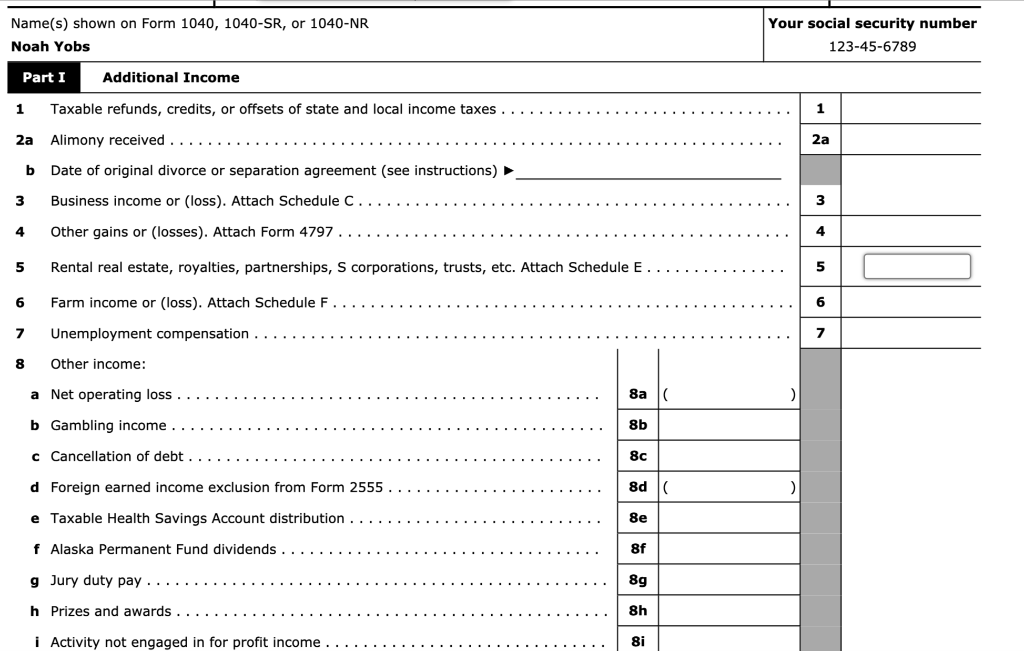

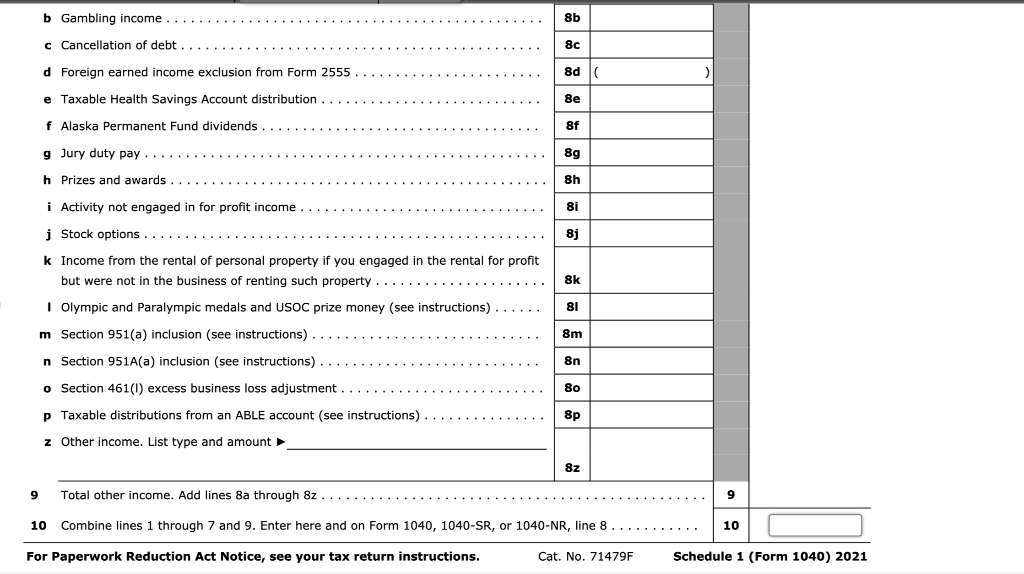

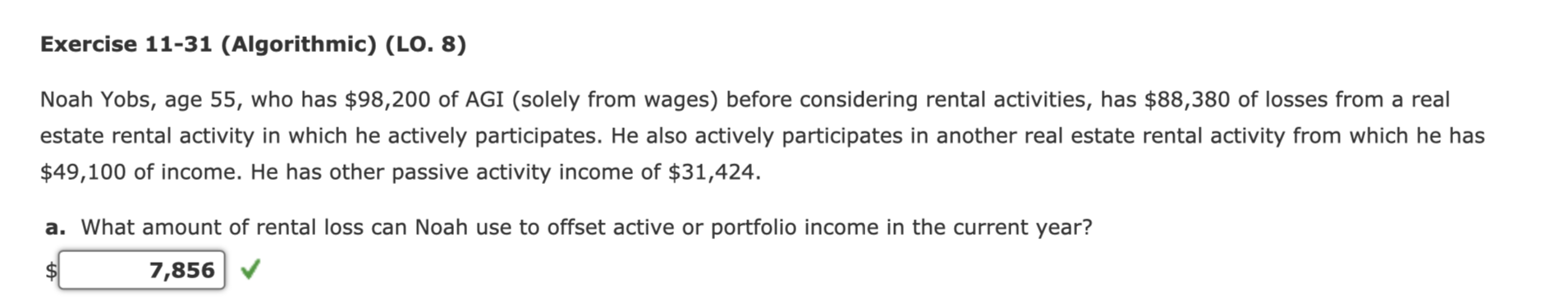

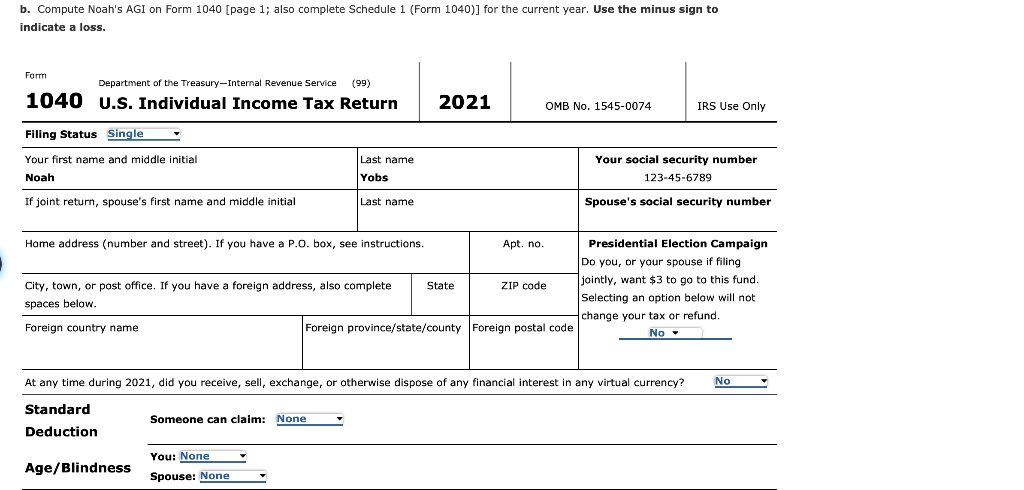

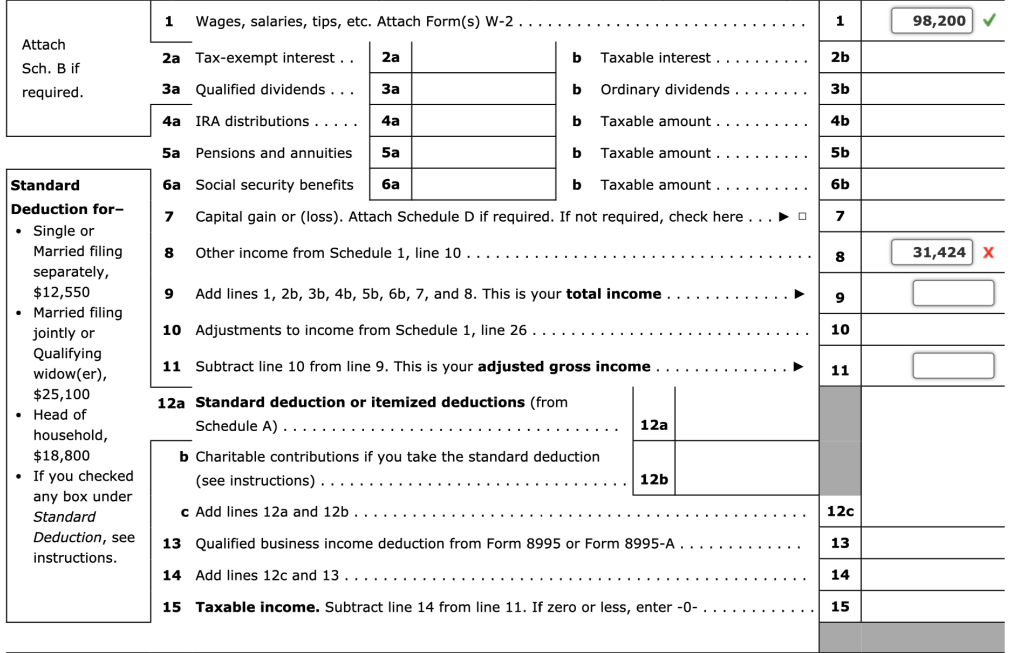

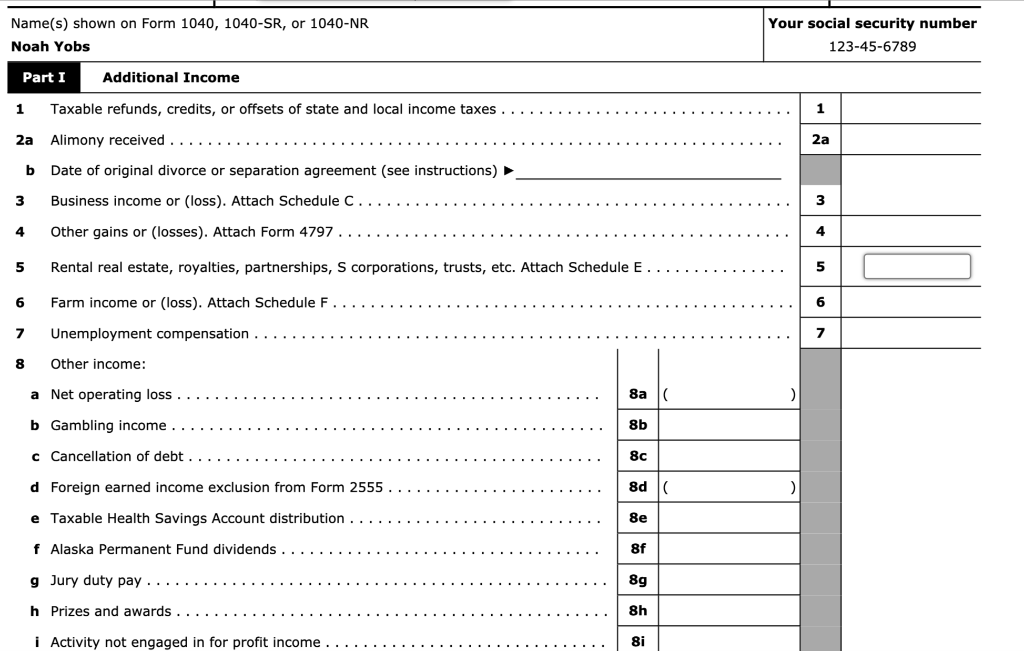

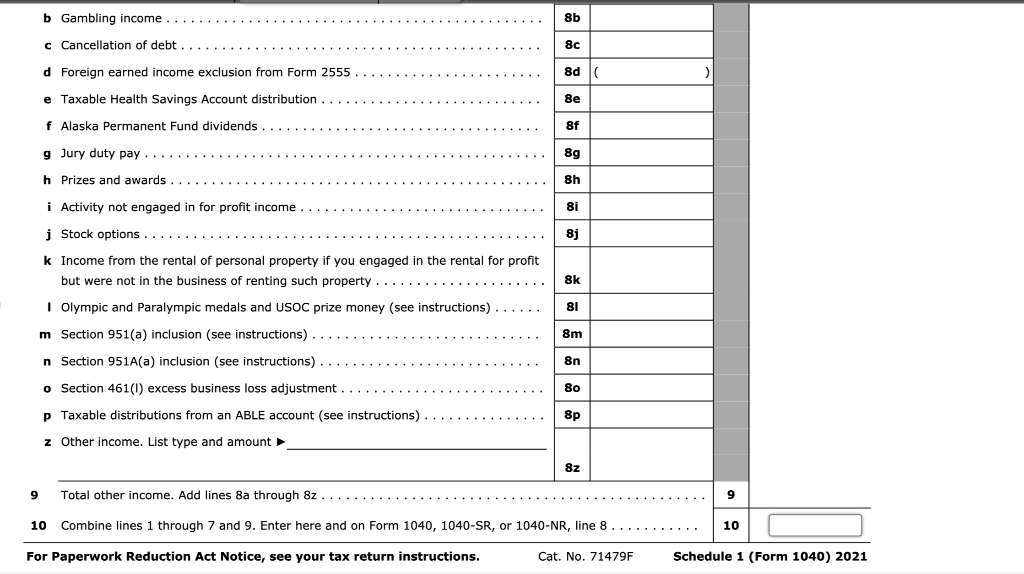

Noah Yobs, age 55, who has $98,200 of AGI (solely from wages) before considering rental activities, has $88,380 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity from which he has $49,100 of income. He has other passive activity income of $31,424. a. What amount of rental loss can Noah use to offset active or portfolio income in the current year? b. Compute Noah's AGI on Form 1040 [page 1 ; also complete Schedule 1 (Form 1040)] for the current year. Use the minus sign to indicate a loss. 1 Wages, salaries, tips, etc. Attach Form(s) w2 1 Attach Sch. B if 2a Tax-exempt interest.. required. 3a Qualified dividends... 6a Social security benefits \begin{tabular}{|c|c|} \hline 2a & \\ \hline 3a & \\ \hline 4a & \\ \hline 5a & \\ \hline 6a & \\ \hline \end{tabular} b Taxable interest b Ordinary dividends.... 4a IRA distributions ..... b Taxable amount. 5 P Pensions and annuities b Taxable amount b Taxable amount 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here ... - Single or Married filing 8 Other income from Schedule 1 , line 10 separately, $12,550 9 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income - Married filing jointly or 10 Adjustments to income from Schedule 1 , line 26 Qualifying widow(er), 11 Subtract line 10 from line 9. This is your adjusted gross income 11 $25,100 12a Standard deduction or itemized deductions (from - Head of household, $18,800 b Charitable contributions if you take the standard deduction - If you checked any box under Standard c Add lines 12a and 12b. Deduction, see 13 Qualified business income deduction from Form 8995 or Form 8995-A . . . . . . . . . 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter 015 \begin{tabular}{l|l} \hline Name(s) shown on Form 1040,1040SR, or 1040NR \\ Noah Yobs & Your social security number \\ \hline \end{tabular} Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes . 2a Alimony received b Date of original divorce or separation agreement (see instructions) 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E . . . . . . ..... 6 Farm income or (loss). Attach Schedule F 7 Unemployment compensation 8 Other income: c Cancellation of debt d Foreign earned income exclusion from Form 2555 . . . . . . . . . . . . . . . e Taxable Health Savings Account distribution . . .................. i Activity not engaged in for profit income . . ..................... b Gambling income c Cancellation of debt d Foreign earned income exclusion from Form 2555 . e Taxable Health Savings Account distribution f Alaska Permanent Fund dividends g Jury duty pay h Prizes and awards. i Activity not engaged in for profit income. j Stock options. k Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property I Olympic and Paralympic medals and USOC prize money (see instructions) m Section 951(a) inclusion (see instructions) n Section 951A(a) inclusion (see instructions) - Section 461(I) excess business loss adjustment. p Taxable distributions from an ABLE account (see instructions) z Other income. List type and amount - 9 Total other income. Add lines 8 a through 8z Combine lines 1 through 7 and 9. Enter here and on Form 1040,1040SR, or 1040NR, line 8 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040) 2021 Noah Yobs, age 55, who has $98,200 of AGI (solely from wages) before considering rental activities, has $88,380 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity from which he has $49,100 of income. He has other passive activity income of $31,424. a. What amount of rental loss can Noah use to offset active or portfolio income in the current year? b. Compute Noah's AGI on Form 1040 [page 1 ; also complete Schedule 1 (Form 1040)] for the current year. Use the minus sign to indicate a loss. 1 Wages, salaries, tips, etc. Attach Form(s) w2 1 Attach Sch. B if 2a Tax-exempt interest.. required. 3a Qualified dividends... 6a Social security benefits \begin{tabular}{|c|c|} \hline 2a & \\ \hline 3a & \\ \hline 4a & \\ \hline 5a & \\ \hline 6a & \\ \hline \end{tabular} b Taxable interest b Ordinary dividends.... 4a IRA distributions ..... b Taxable amount. 5 P Pensions and annuities b Taxable amount b Taxable amount 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here ... - Single or Married filing 8 Other income from Schedule 1 , line 10 separately, $12,550 9 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income - Married filing jointly or 10 Adjustments to income from Schedule 1 , line 26 Qualifying widow(er), 11 Subtract line 10 from line 9. This is your adjusted gross income 11 $25,100 12a Standard deduction or itemized deductions (from - Head of household, $18,800 b Charitable contributions if you take the standard deduction - If you checked any box under Standard c Add lines 12a and 12b. Deduction, see 13 Qualified business income deduction from Form 8995 or Form 8995-A . . . . . . . . . 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter 015 \begin{tabular}{l|l} \hline Name(s) shown on Form 1040,1040SR, or 1040NR \\ Noah Yobs & Your social security number \\ \hline \end{tabular} Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes . 2a Alimony received b Date of original divorce or separation agreement (see instructions) 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E . . . . . . ..... 6 Farm income or (loss). Attach Schedule F 7 Unemployment compensation 8 Other income: c Cancellation of debt d Foreign earned income exclusion from Form 2555 . . . . . . . . . . . . . . . e Taxable Health Savings Account distribution . . .................. i Activity not engaged in for profit income . . ..................... b Gambling income c Cancellation of debt d Foreign earned income exclusion from Form 2555 . e Taxable Health Savings Account distribution f Alaska Permanent Fund dividends g Jury duty pay h Prizes and awards. i Activity not engaged in for profit income. j Stock options. k Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property I Olympic and Paralympic medals and USOC prize money (see instructions) m Section 951(a) inclusion (see instructions) n Section 951A(a) inclusion (see instructions) - Section 461(I) excess business loss adjustment. p Taxable distributions from an ABLE account (see instructions) z Other income. List type and amount - 9 Total other income. Add lines 8 a through 8z Combine lines 1 through 7 and 9. Enter here and on Form 1040,1040SR, or 1040NR, line 8 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040) 2021