Question

Nolan Corp. uses no debt. The weighted average cost of capital is 10.4 percent. The current market value of the equity is $18 million

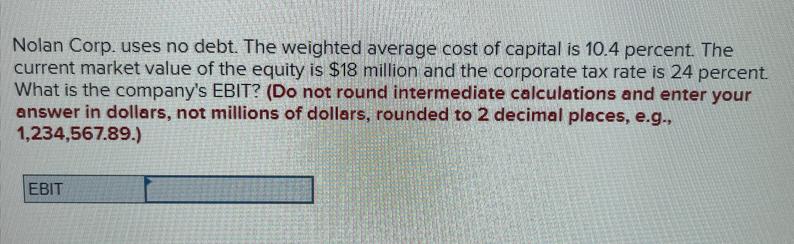

Nolan Corp. uses no debt. The weighted average cost of capital is 10.4 percent. The current market value of the equity is $18 million and the corporate tax rate is 24 percent. What is the company's EBIT? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) EBIT

Step by Step Solution

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the companys EBIT Earnings Before Interest and Taxes we can use the formula for calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management Measuring Monitoring And Motivating Performance

Authors: Leslie G. Eldenburg, Susan Wolcott, Liang Hsuan Chen, Gail Cook

2nd Canadian Edition

1118168879, 9781118168875

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App