Answered step by step

Verified Expert Solution

Question

1 Approved Answer

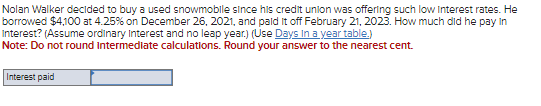

Nolan Walker decided to buy a used snowmobile since his credit union was offering such low Interest rates. He borrowed $4,100 at 4.25% on

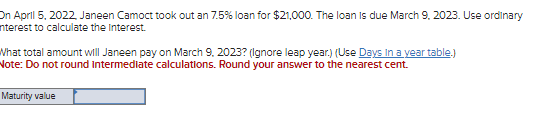

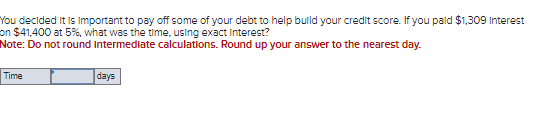

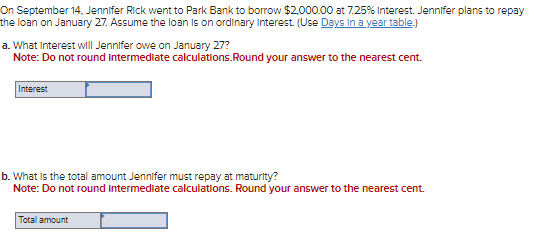

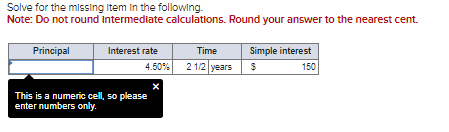

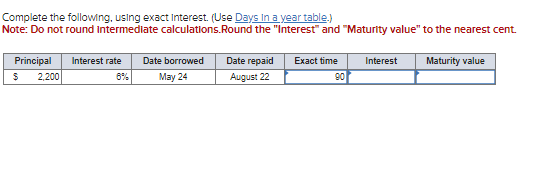

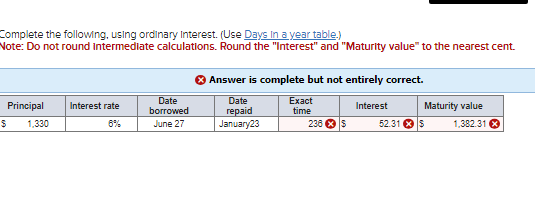

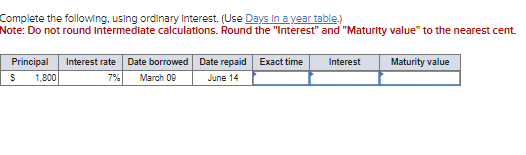

Nolan Walker decided to buy a used snowmobile since his credit union was offering such low Interest rates. He borrowed $4,100 at 4.25% on December 26, 2021, and paid it off February 21, 2023. How much did he pay in Interest? (Assume ordinary Interest and no leap year.) (Use Days In a year table.) Note: Do not round intermediate calculations. Round your answer to the nearest cent. Interest paid On April 5, 2022, Janeen Camoct took out an 7.5% loan for $21,000. The loan is due March 9, 2023. Use ordinary nterest to calculate the interest. What total amount will Janeen pay on March 9, 2023? (Ignore leap year.) (Use Days in a year table.) Note: Do not round intermediate calculations. Round your answer to the nearest cent. Maturity value You decided it is important to pay off some of your debt to help build your credit score. If you paid $1,309 Interest on $41,400 at 5%, what was the time, using exact Interest? Note: Do not round Intermediate calculations. Round up your answer to the nearest day. Time days On September 14, Jennifer Rick went to Park Bank to borrow $2,000.00 at 7.25% Interest. Jennifer plans to repay the loan on January 27. Assume the loan is on ordinary Interest. (Use Days in a year table.) a. What interest will Jennifer owe on January 27? Note: Do not round intermediate calculations.Round your answer to the nearest cent. Interest b. What is the total amount Jennifer must repay at maturity? Note: Do not round intermediate calculations. Round your answer to the nearest cent. Total amount Solve for the missing item in the following. Note: Do not round intermediate calculations. Round your answer to the nearest cent. Principal Interest rate Time Simple interest 4.50% 2 1/2 years $ 150 This is a numeric cell, so please enter numbers only. Complete the following, using exact Interest. (Use Days In a year table.) Note: Do not round intermediate calculations.Round the "Interest" and "Maturity value" to the nearest cent. Principal Interest rate Date borrowed Date repaid Exact time Interest Maturity value $ 2,200 6% May 24 August 22 90 Complete the following, using ordinary Interest. (Use Days In a year table.) Note: Do not round intermediate calculations. Round the "Interest" and "Maturity value" to the nearest cent. Answer is complete but not entirely correct. Principal Interest rate 1,330 6% Date borrowed June 27 Date Exact Interest repaid time Maturity value January23 238 $ 52.31 $ 1,382.31 Complete the following, using ordinary Interest. (Use Days In a year table.) Note: Do not round intermediate calculations. Round the "Interest" and "Maturity value" to the nearest cent. Principal Interest rate Date borrowed Date repaid Exact time Interest Maturity value $ 1,800 7% March 09 June 14

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Given Principal 1800 Interest Rate 7 Date Borrowed June 14 Date Repaid March 09 1 Calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started