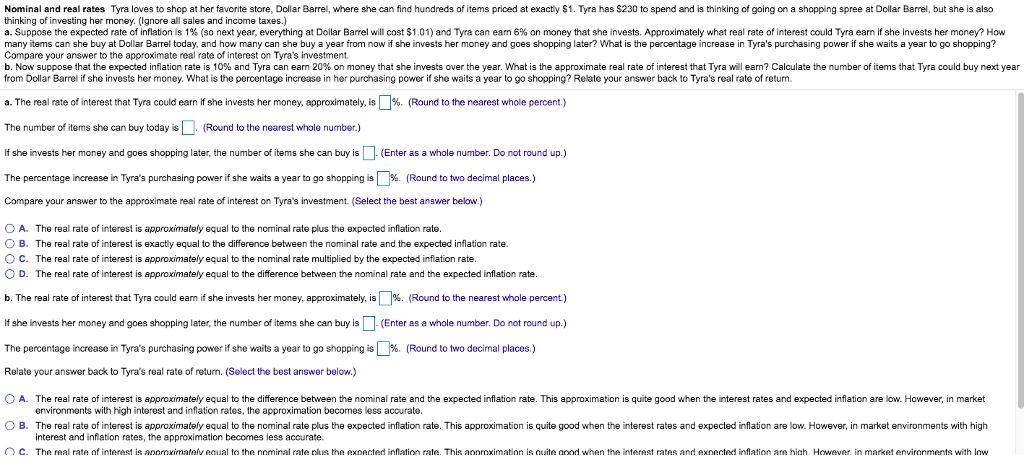

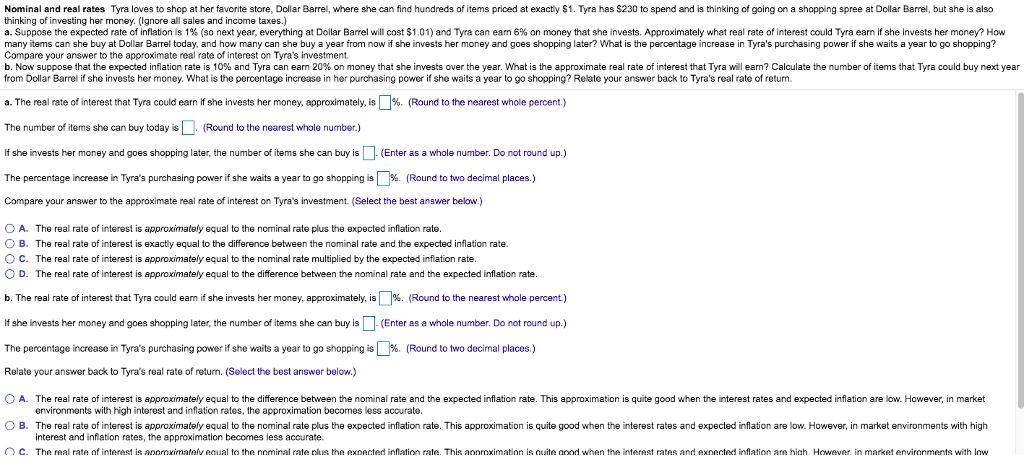

Nominal and real rates Tyra loves to shop at her favorite store, Dollar Barrel, where she can find hundreds of items priced at exactly $1. Tyra has $230 to spend and is thinking of going on a shopping spree at Dollar Barrel, but she is also thinking of investing her money. (Ignore all sales and income taxes.) a. Suppose the expected rate o inflation is 1 so next year, everything at Dollar Ba e will cost $1.01 and T a can eam 6% on money that she invests. Approximately what real rate of interest could Tyra earn she nvests her money? How many items can she buy at Dollar Barrel today, and how many can she buy a year from now if she invests her money and goes shopping later? What is the peroentage increase in Tyra's purchasing power if she waits a year to go shopping? Compare your answer to the approximate real rate of interest on Tyra's investment. b. Now suppose that the expected inflation rate is 10 and Tyra can earn 20% on money that she invests over the year what is he approximate real rate ofinterest that Tyra wil eam? Calculate he number ofitems that yra could buy next year from Dollar Barrel if she invests her money. What is the percentage increase in her purchasing power if she waits a year to go shopping? Relate your answer back to Tyra's real rate of returm. a. The real rate of interest that Tyra could earn if she invests her money, approximately, is %. (Round to the nearest whole percent.) The number of items she can buy today is (Round to the nearest whole number.) f she invests her money and goes shopping later, the number of items she can buy is(Enter as a whole number. Do not round up.) The percentage increase in Tyra's purchasing power if she waits a year to go shopping is Compare your answer to the approximate real rate of interest on Tyra's investment. (Select the best answer below.) (Round to two decimal places.) O A. B. C. ( D. The real rate of interest is approximately equal to the nominal rate plus the expected inflation rate The real rate of interest is exactly equal to the difference between the nominal rate and the expected inflation rate. The real rate of interest is approximately equal to the nominal rate multiplied by the expected inflation rate The real rate of interest is approximately equal to the difference between the nominal rate and the expected inflation rate. b. The real rate of interest that Tyra could earn if she invests her money, approximately, is ]%. (Round to the nearest whole percent) If she invests her money and goes shopping later, the number of items she can buy isEnter as a whole number. Do not round up.) The percentage increase in Tyra's purchasing power if she waits a year to go shopping is Relate your answer back to Tyra's real rate of return. (Select the best answer below.) OA. The real rate of interest is approximately equal to the difference between the nominal rate and the expected inflation rate. This approximation is quite good when the interest rates and expected inflation are low. However, in market % (Round to two decimal places.) environments with high interest and inflation rates, the approximation becomes less accurate. B. The real rate of interest is approximately equal to the nominal rate plus the expected inflation rate. This approximation is quite good when the interest rates and expected inflation are low. However, in market environments with high interest and infiation rates, the approximation becomes less accurate. he real rate interes annmxi nat a vec ual to the nc minal rate nli% th, m nected in at on a e his annr ximatinn is 1ite aood when the interest rates nd exnected in ation arn hinh Ho er. n market envirnnments with n