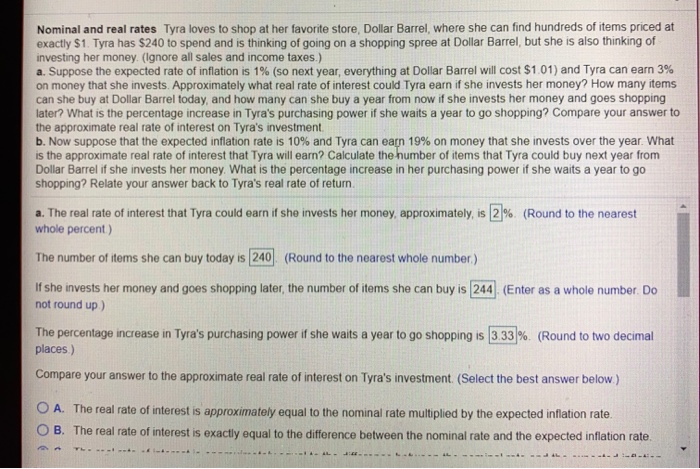

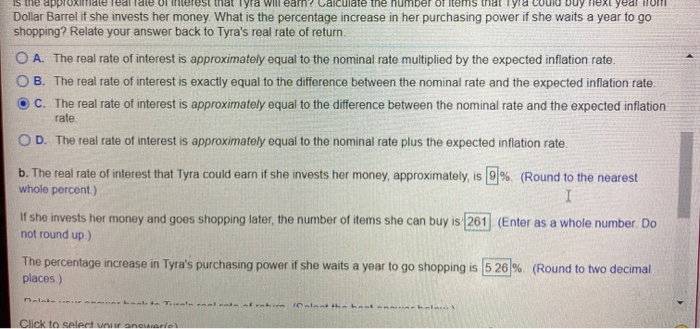

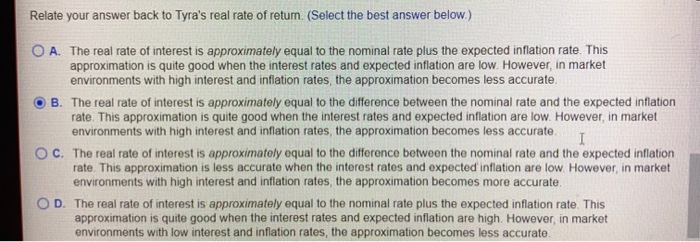

Nominal and real rates Tyra loves to shop at her favorite store, Dollar Barrel, where she can find hundreds of items priced at exactly $1. Tyra has $240 to spend and is thinking of going on a shopping spree at Dollar Barrel, but she is also thinking of investing her money (Ignore all sales and income taxes.) a. Suppose the expected rate of inflation is 1% (so next year, everything at Dollar Barrel will cost $ on money that she invests. Approximately what real rate of interest could Tyra earn if she invests her money? How many items can she buy at Dollar Barrel today, and how many can she buy a year from now if she invests her money and goes shopping later? What is the percentage increase in Tyra's purchasing power if she waits a year to go shopping? Compare your answer to the approximate real rate of interest on Tyra's investment b. Now suppose that the expected inflation rate is 10% and Tyra can earn 19% on money that she invests over the year. What is the approximate real rate of interest that Tyra will earn? Calculate the number of items that Tyra could buy next year from Dollar Barrel if she invests her money. What is the percentage increase in her purchasing power if she waits a year to go shopping? Relate your answer back to Tyra's real rate of return a. The real rate of interest that Tyra could earn if she invests her money, approximately, is 2% (Round to the nearest whole percent) The number of items she can buy today is 240. (Round to the nearest whole number) If she invests her money and goes shopping later, the number of items she can buy is 244 (Enter as a whole number. Do not round up) The percentage increase in Tyra's purchasing power if she waits a year to go shopping is 3.33%. (Round to two decimal places) Compare your answer to the approximate real rate of interest on Tyra's investment. (Select the best answer below.) O A. The real rate of interest is approximately equal to the nominal rate multiplied by the expected inflation rate. O B. The real rate of interest is exactly equal to the difference between the nominal rate and the expected inflation rate. ------ ----- - ---- -- - ---- --- - -- - --- -.. Is e aprID TUU U UTUSU at Tyra willen Laulate the number of Itulis Ulaya LUUU UUy le yua MUITI Dollar Barrel if she invests her money. What is the percentage increase in her purchasing power if she waits a year to go shopping? Relate your answer back to Tyra's real rate of return. O A. The real rate of interest is approximately equal to the nominal rate multiplied by the expected inflation rate. OB. The real rate of interest is exactly equal to the difference between the nominal rate and the expected inflation rale OC. The real rate of interest is approximately equal to the difference between the nominal rate and the expected inflation rate. OD. The real rate of interest is approximately equal to the nominal rate plus the expected inflation rate. b. The real rate of interest that Tyra could earn if she invests her money, approximately, is 9 %. (Round to the nearest whole percent) If she invests her money and goes shopping later, the number of items she can buy is 261 (Enter as a whole number. Do not round up) The percentage increase in Tyra's purchasing power if she waits a year to go shopping is 5 26% places) (Round to two decimal Click to select your anstre Relate your answer back to Tyra's real rate of return. (Select the best answer below.) U A. The real rate of interest is approximately equal to the nominal rate plus the expected inflation rate. This approximation is quite good when the interest rates and expected inflation are low. However, in market environments with high interest and inflation rates the approximation becomes less accurate OB. The real rate of interest is approximately equal to the difference between the nominal rate and the expected inflation rate. This approximation is quite good when the interest rates and expected inflation are low. However, in market environments with high interest and inflation rates the approximation becomes less accurate, O C. The real rate of interest is approximately equal to the difference between the nominal rate and the expected inflation rate. This approximation is less accurate when the interest rates and expected inflation are low. However, in market environments with high interest and inflation rates, the approximation becomes more accurate, OD. The real rate of interest is approximately equal to the nominal rate plus the expected inflation rate. This approximation is quite good when the interest rates and expected inflation are high. However, in market environments with low interest and inflation rates, the approximation becomes less accurate