Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nominal interest rates and yield curves Economic forecasters predict that the rate of inflation will hold steady at 1.5% per year indefinitely. The table, shows

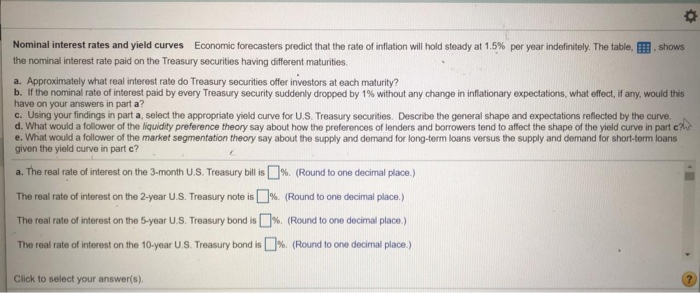

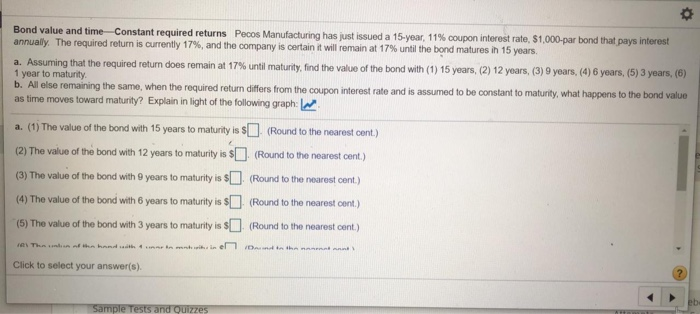

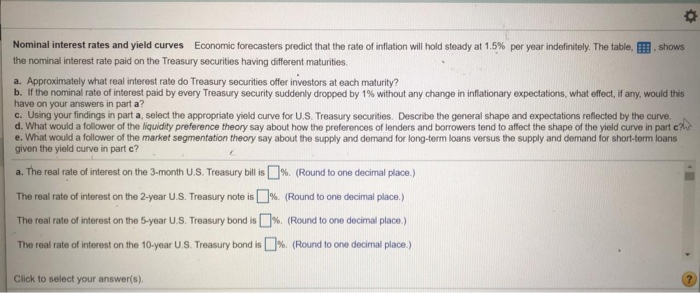

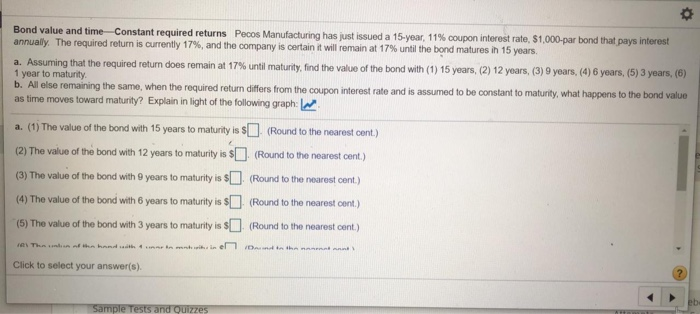

Nominal interest rates and yield curves Economic forecasters predict that the rate of inflation will hold steady at 1.5% per year indefinitely. The table, shows the nominal interest rate paid on the Treasury securities having different maturities a. Approximately what real interest rate do Treasury securities offer investors at each maturity? b. If the nominal rate of interest paid by every Treasury security suddenly dropped by 1% without any change in inflationary expectations, what effect, if any, would this have on your answers in part a? c. Using your findings in part a, select the appropriate yield curve for U.S. Treasury securities. Describe the general shape and expectations reflected by the curve. d. What would a follower of the liquidity preference theory say about how the preferences of lenders and borrowers tond to affect the shape of the yield curve in parte e. What would a follower of the market segmentation theory say about the supply and demand for long-term loans versus the supply and demand for short-term loans given the yield curve in part c? a. The real rate of interest on the 3-month U.S. Treasury bill is %. (Round to one decimal place.) The real rate of interest on the 2-year U.S. Treasury note is The real rate of interest on the 5-year U.S. Treasury bond is The real rate of interest on the 10-year U.S. Treasury bond is %. (Round to one decimal place.) % (Round to one decimal place.) % (Round to one decimal place.) Click to select your answer(s). Bond value and timeConstant required returns Pocos Manufacturing has just issued a 15-year, 11% coupon interest rate, $1,000-par bond that pays interest annually. The required return is currently 17%, and the company is certain it will remain at 17% until the bond matures in 15 years. a. Assuming that the required return does remain at 17% until maturity, find the value of the bond with (1) 15 years, (2) 12 years, (3) 9 years, (4) 6 years, (5) 3 years (6) 1 year to maturity b. All else remaining the same, when the required return differs from the coupon interest rate and is assumed to be constant to maturity, what happens to the bond value as time moves toward maturity? Explain in light of the following graph: I a. (1) The value of the bond with 15 years to maturity is S . (Round to the nearest cont.) (2) The value of the bond with 12 years to maturity is $ (Round to the nearest cent.) (3) The value of the bond with 9 years to maturity is $ (4) The value of the bond with 6 years to maturity is $ (5) The value of the bond with 3 years to maturity is $ (Round to the nearest cent.) (Round to the nearest cent.) (Round to the nearest cent.) Click to select your answer(s)

Nominal interest rates and yield curves Economic forecasters predict that the rate of inflation will hold steady at 1.5% per year indefinitely. The table, shows the nominal interest rate paid on the Treasury securities having different maturities a. Approximately what real interest rate do Treasury securities offer investors at each maturity? b. If the nominal rate of interest paid by every Treasury security suddenly dropped by 1% without any change in inflationary expectations, what effect, if any, would this have on your answers in part a? c. Using your findings in part a, select the appropriate yield curve for U.S. Treasury securities. Describe the general shape and expectations reflected by the curve. d. What would a follower of the liquidity preference theory say about how the preferences of lenders and borrowers tond to affect the shape of the yield curve in parte e. What would a follower of the market segmentation theory say about the supply and demand for long-term loans versus the supply and demand for short-term loans given the yield curve in part c? a. The real rate of interest on the 3-month U.S. Treasury bill is %. (Round to one decimal place.) The real rate of interest on the 2-year U.S. Treasury note is The real rate of interest on the 5-year U.S. Treasury bond is The real rate of interest on the 10-year U.S. Treasury bond is %. (Round to one decimal place.) % (Round to one decimal place.) % (Round to one decimal place.) Click to select your answer(s). Bond value and timeConstant required returns Pocos Manufacturing has just issued a 15-year, 11% coupon interest rate, $1,000-par bond that pays interest annually. The required return is currently 17%, and the company is certain it will remain at 17% until the bond matures in 15 years. a. Assuming that the required return does remain at 17% until maturity, find the value of the bond with (1) 15 years, (2) 12 years, (3) 9 years, (4) 6 years, (5) 3 years (6) 1 year to maturity b. All else remaining the same, when the required return differs from the coupon interest rate and is assumed to be constant to maturity, what happens to the bond value as time moves toward maturity? Explain in light of the following graph: I a. (1) The value of the bond with 15 years to maturity is S . (Round to the nearest cont.) (2) The value of the bond with 12 years to maturity is $ (Round to the nearest cent.) (3) The value of the bond with 9 years to maturity is $ (4) The value of the bond with 6 years to maturity is $ (5) The value of the bond with 3 years to maturity is $ (Round to the nearest cent.) (Round to the nearest cent.) (Round to the nearest cent.) Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started