Answered step by step

Verified Expert Solution

Question

1 Approved Answer

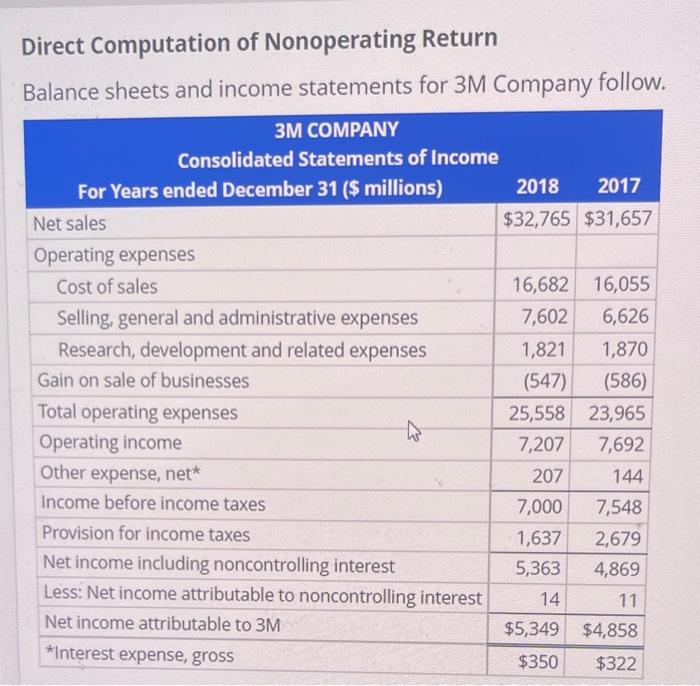

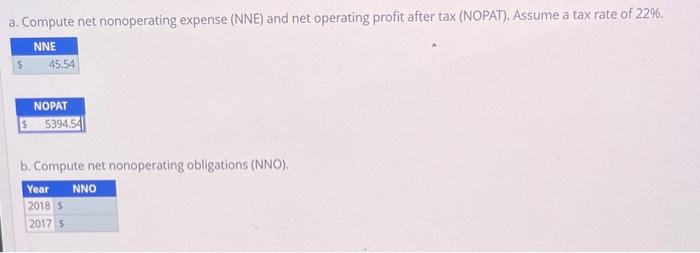

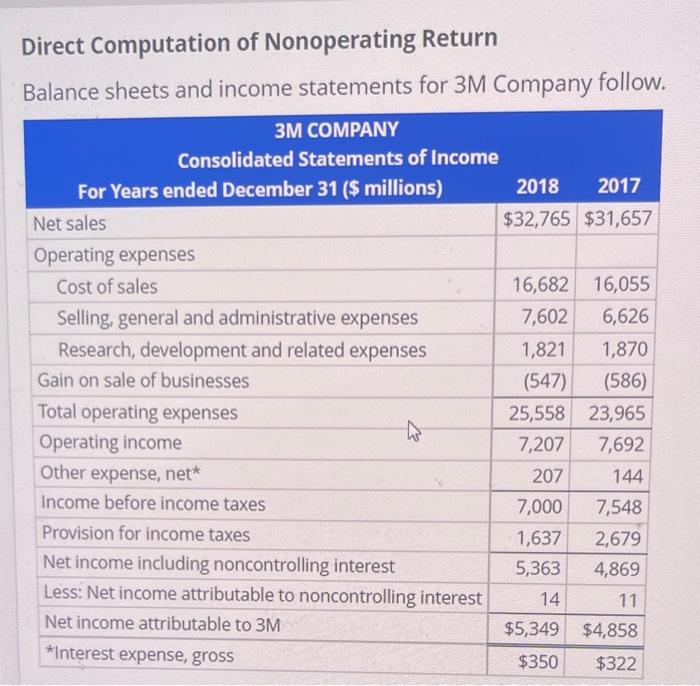

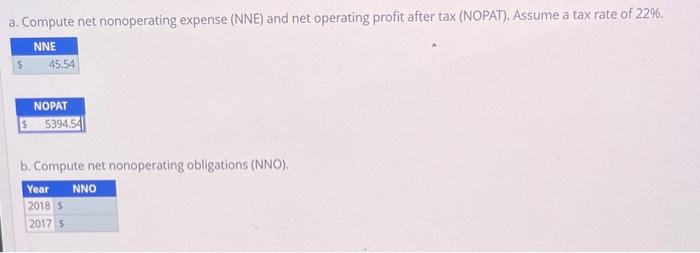

NOPAT= net income + NNE OR NOPAT = NOPBT - (provision tax expense + non operatingtax expense x tax rate) Direct Computation of Nonoperating Return

NOPAT= net income + NNE

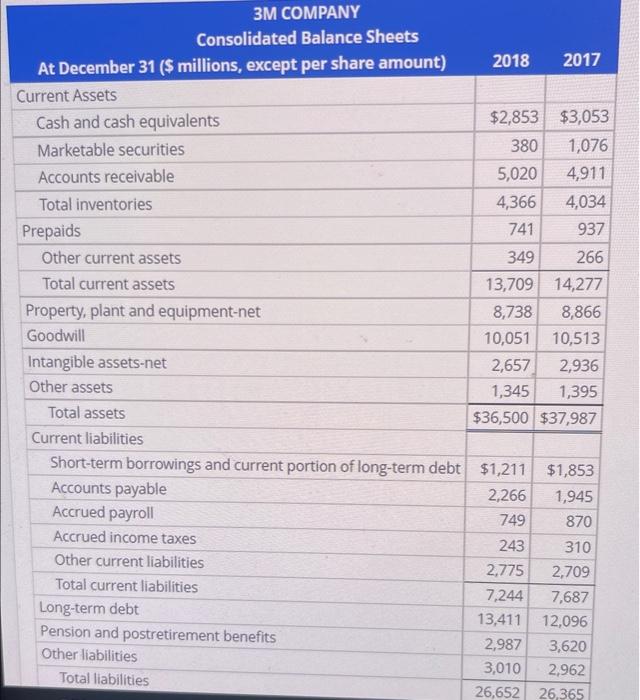

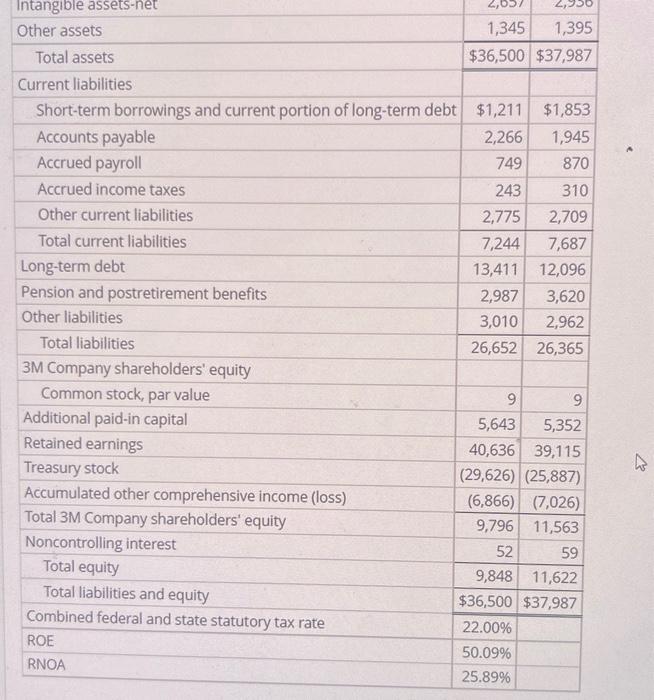

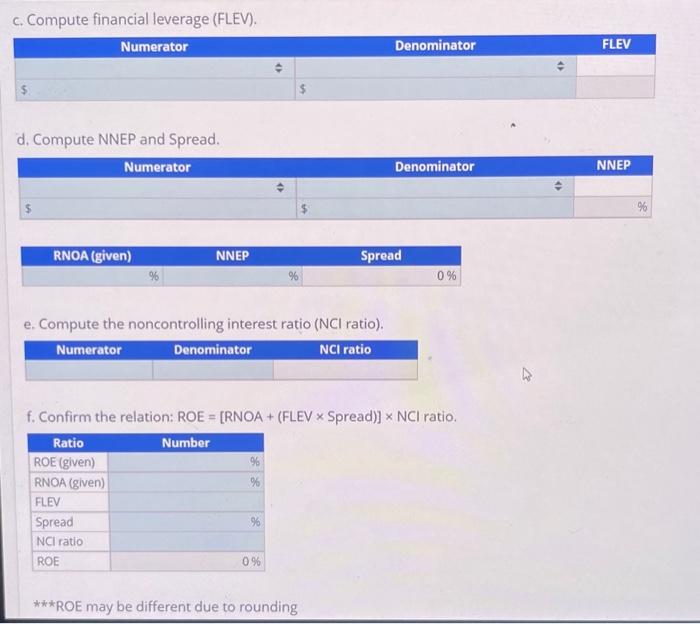

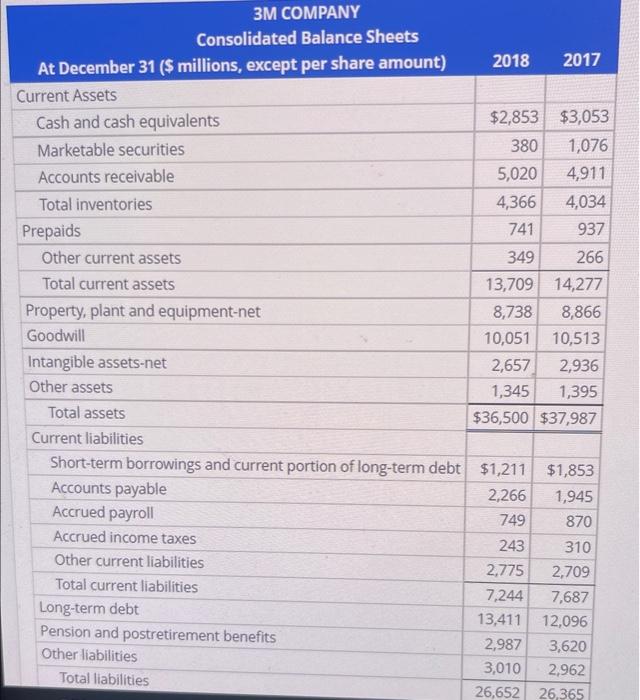

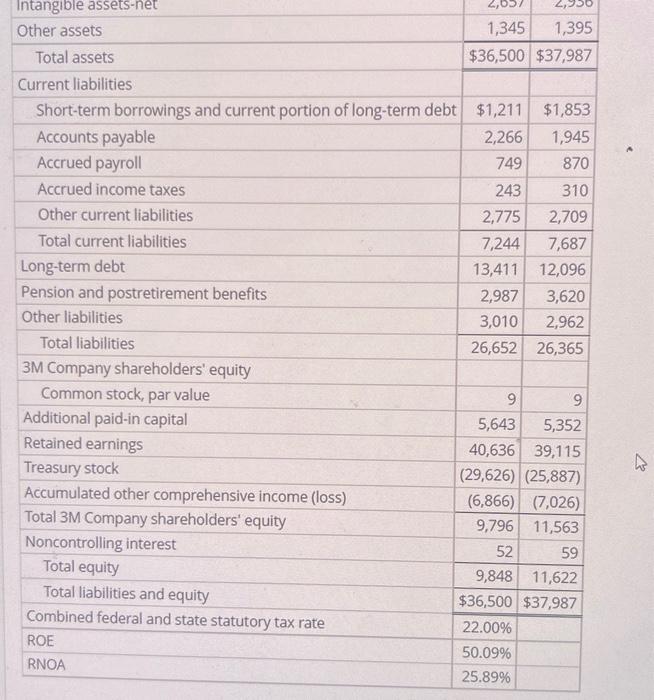

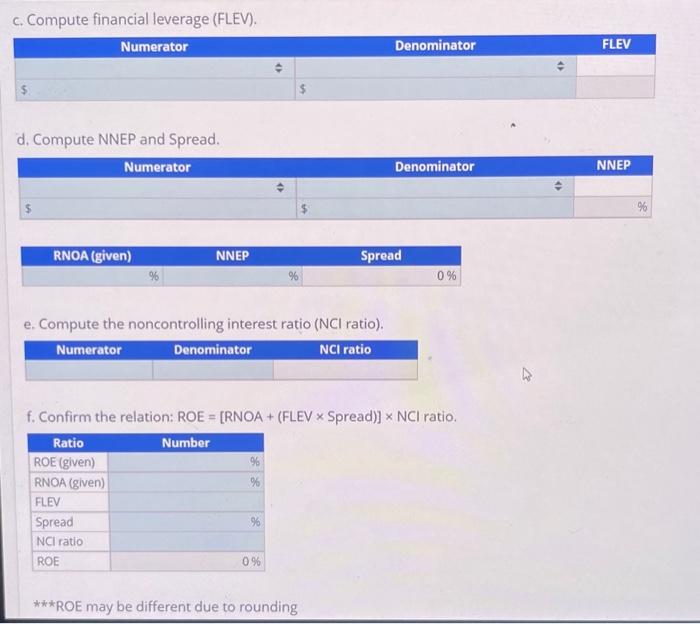

Direct Computation of Nonoperating Return a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). Assume a tax rate of 22%. b. Compute net nonoperating obligations (NNO). c. Compute financial leverage (FLEV). d. Compute NNEP and Spread. e. Compute the noncontrolling interest ratio ( NCl ratio). f. Confirm the relation: ROE=[RNOA+(FLEV Spread) ]NCI ratio. ROE may be different due to rounding Direct Computation of Nonoperating Return a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). Assume a tax rate of 22%. b. Compute net nonoperating obligations (NNO). c. Compute financial leverage (FLEV). d. Compute NNEP and Spread. e. Compute the noncontrolling interest ratio ( NCl ratio). f. Confirm the relation: ROE=[RNOA+(FLEV Spread) ]NCI ratio. ROE may be different due to rounding OR

NOPAT = NOPBT - (provision tax expense + non operatingtax expense x tax rate)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started