Answered step by step

Verified Expert Solution

Question

1 Approved Answer

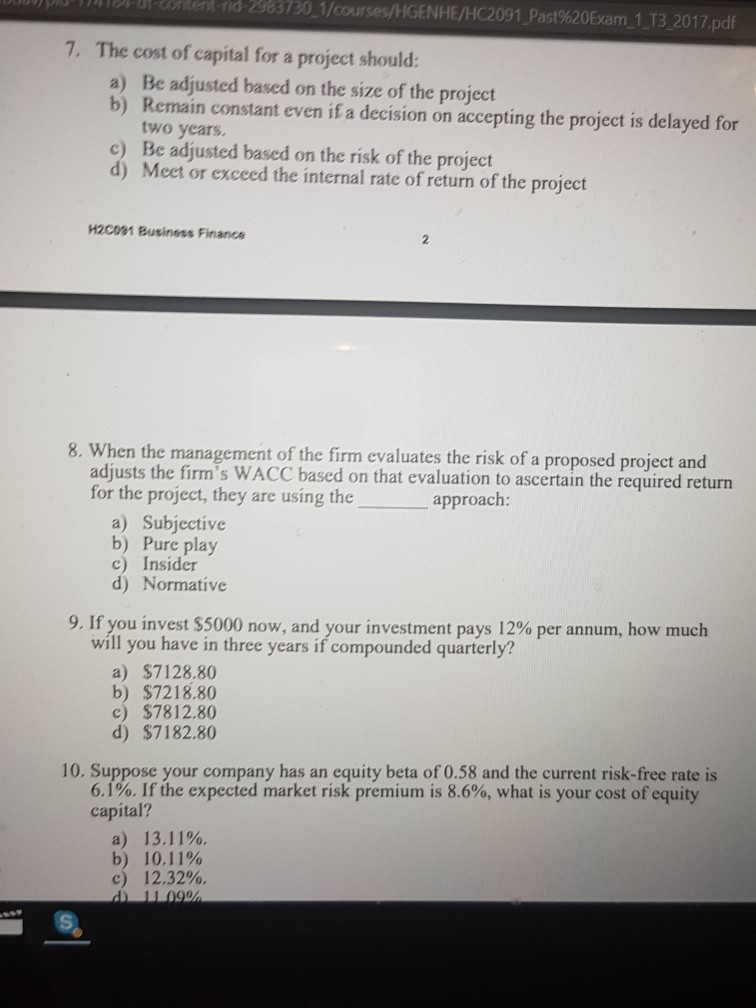

nord content rid 2983730-1 - - - /courses/HGENHE/HC2091-Past%20Exam. 1-T3201 7.pdf 7. The cost of capital for a project should: a) Be adjusted based on the

nord content rid 2983730-1 - - - /courses/HGENHE/HC2091-Past%20Exam. 1-T3201 7.pdf 7. The cost of capital for a project should: a) Be adjusted based on the size of the project b) Remain constant even if a decision on accepting the project is delayed for two years c) Be adjusted based on the risk of the project d) Meet or exceed the internal rate of return of the project H2C001 Business Finance 8. When the management of the firm evaluates the risk of a proposed project and justs the firm's WACC based on that evaluation to ascertain the required return for the project, they are using the approach: a) Subjective b) Pure play c) Insider d) Normative 9. If you invest $5000 now, and your investment pays 12% per annum, how much will you have in three years if compounded quarterly? a) $7128.80 b) $7218.80 c) $7812.80 d) $7182.80 10. Suppose your company has an equity beta of 0.58 and the current risk-free rate is 6.1%. If the expected market risk premium is 8.6%, what is your cost of equity capital? a) b) c) 13.11%. 10.11% 12.32%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started