Answered step by step

Verified Expert Solution

Question

1 Approved Answer

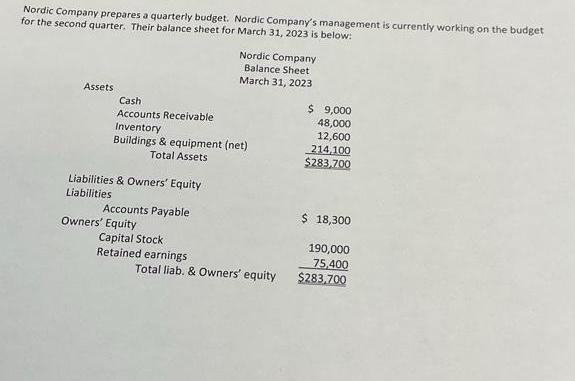

Nordic Company prepares a quarterly budget. Nordic Company's management is currently working on the budget for the second quarter. Their balance sheet for March

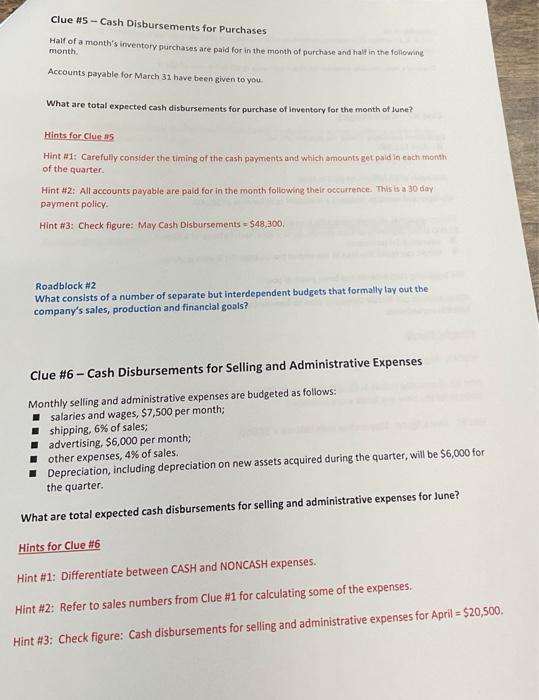

Nordic Company prepares a quarterly budget. Nordic Company's management is currently working on the budget for the second quarter. Their balance sheet for March 31, 2023 is below: Assets Cash Accounts Receivable Inventory Buildings & equipment (net) Total Assets Liabilities & Owners' Equity Liabilities Accounts Payable Owners' Equity Nordic Company Balance Sheet March 31, 2023 Capital Stock Retained earnings Total liab. & Owners' equity $ 9,000 48,000 12,600 214,100 $283,700 $ 18,300 190,000 75,400 $283,700 Clue #5 - Cash Disbursements for Purchases Half of a month's inventory purchases are paid for in the month of purchase and half in the following month. Accounts payable for March 31 have been given to you. What are total expected cash disbursements for purchase of inventory for the month of June? Hints for Clue #5 Hint #1: Carefully consider the timing of the cash payments and which amounts get paid in each month of the quarter. Hint #2: All accounts payable are paid for in the month following their occurrence. This is a 30 day payment policy. Hint #3: Check figure: May Cash Disbursements $48,300. Roadblock #2 What consists of a number of separate but interdependent budgets that formally lay out thei company's sales, production and financial goals? Clue #6 - Cash Disbursements for Selling and Administrative Expenses Monthly selling and administrative expenses are budgeted as follows: salaries and wages, $7,500 per month; shipping, 6% of sales; advertising, $6,000 per month; other expenses, 4% of sales. Depreciation, including depreciation on new assets acquired during the quarter, will be $6,000 for the quarter. What are total expected cash disbursements for selling and administrative expenses for June? Hints for Clue #6 Hint #1: Differentiate between CASH and NONCASH expenses. Hint #2: Refer to sales numbers from Clue #1 for calculating some of the expenses. Hint #3: Check figure: Cash disbursements for selling and administrative expenses for April = $20,500.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the total expected cash disbursements for the purchase of inventory for the month of Ju...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started