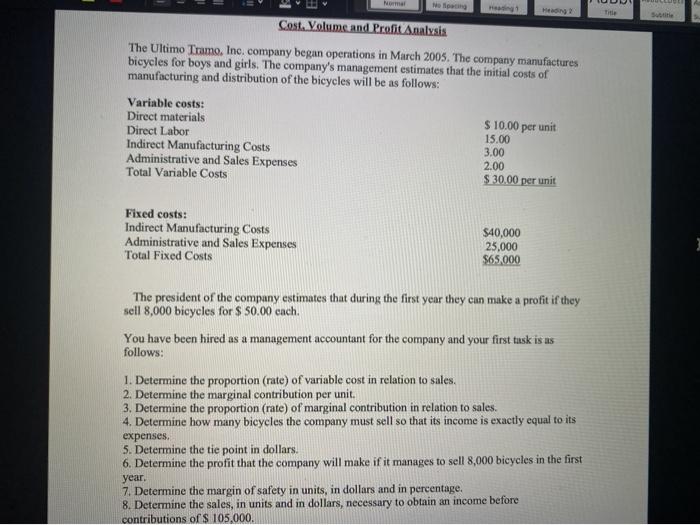

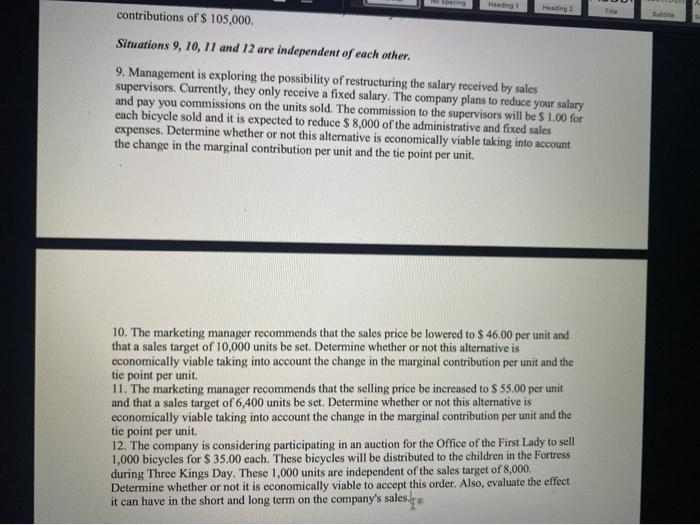

Normal Title Cost. Volume and Profit Analysis The Ultimo Tramo, Inc. company began operations in March 2005. The company manufactures bicycles for boys and girls. The company's management estimates that the initial costs of manufacturing and distribution of the bicycles will be as follows: Variable costs: Direct materials $ 10.00 per unit Direct Labor 15.00 Indirect Manufacturing Costs 3.00 Administrative and Sales Expenses 2.00 Total Variable Costs $ 30.00 per unit Fixed costs: Indirect Manufacturing Costs Administrative and Sales Expenses Total Fixed Costs $40,000 25,000 $65.000 The president of the company estimates that during the first year they can make a profit if they sell 8,000 bicycles for $ 50.00 each. You have been hired as a management accountant for the company and your first task is as follows: 1. Determine the proportion (rate) of variable cost in relation to sales. 2. Determine the marginal contribution per unit. 3. Determine the proportion (rate) of marginal contribution in relation to sales. 4. Determine how many bicycles the company must sell so that its income is exactly equal to its expenses. 5. Determine the tie point in dollars. 6. Determine the profit that the company will make if it manages to sell 8,000 bicycles in the first year. 7. Determine the margin of safety in units, in dollars and in percentage. 8. Determine the sales, in units and in dollars, necessary to obtain an income before contributions of $ 105,000. Heading contributions of $ 105,000. Situations 9, 10, 11 and 12 are independent of each other. 9. Management is exploring the possibility of restructuring the salary received by sales supervisors. Currently, they only receive a fixed salary. The company plans to reduce your salary and pay you commissions on the units sold. The commission to the supervisors will be $ 1.00 for each bicycle sold and it is expected to reduce $ 8,000 of the administrative and fixed sales expenses. Determine whether or not this alternative is economically viable taking into account the change in the marginal contribution per unit and the tie point per unit, 10. The marketing manager recommends that the sales price be lowered to $ 46.00 per unit and that a sales target of 10,000 units be set. Determine whether or not this alternative is economically viable taking into account the change in the marginal contribution per unit and the tie point per unit 11. The marketing manager recommends that the selling price be increased to $ 55.00 per unit and that a sales target of 6,400 units be set. Determine whether or not this alternative is economically viable taking into account the change in the marginal contribution per unit and the tie point per unit. 12. The company is considering participating in an auction for the Office of the First Lady to sell 1,000 bicycles for $35.00 each. These bicycles will be distributed to the children in the Fortress during Three Kings Day. These 1,000 units are independent of the sales target of 8,000. Determine whether or not it is economically viable to accept this order. Also, evaluate the effect it can have in the short and long term on the company's sales.ru Normal Title Cost. Volume and Profit Analysis The Ultimo Tramo, Inc. company began operations in March 2005. The company manufactures bicycles for boys and girls. The company's management estimates that the initial costs of manufacturing and distribution of the bicycles will be as follows: Variable costs: Direct materials $ 10.00 per unit Direct Labor 15.00 Indirect Manufacturing Costs 3.00 Administrative and Sales Expenses 2.00 Total Variable Costs $ 30.00 per unit Fixed costs: Indirect Manufacturing Costs Administrative and Sales Expenses Total Fixed Costs $40,000 25,000 $65.000 The president of the company estimates that during the first year they can make a profit if they sell 8,000 bicycles for $ 50.00 each. You have been hired as a management accountant for the company and your first task is as follows: 1. Determine the proportion (rate) of variable cost in relation to sales. 2. Determine the marginal contribution per unit. 3. Determine the proportion (rate) of marginal contribution in relation to sales. 4. Determine how many bicycles the company must sell so that its income is exactly equal to its expenses. 5. Determine the tie point in dollars. 6. Determine the profit that the company will make if it manages to sell 8,000 bicycles in the first year. 7. Determine the margin of safety in units, in dollars and in percentage. 8. Determine the sales, in units and in dollars, necessary to obtain an income before contributions of $ 105,000. Heading contributions of $ 105,000. Situations 9, 10, 11 and 12 are independent of each other. 9. Management is exploring the possibility of restructuring the salary received by sales supervisors. Currently, they only receive a fixed salary. The company plans to reduce your salary and pay you commissions on the units sold. The commission to the supervisors will be $ 1.00 for each bicycle sold and it is expected to reduce $ 8,000 of the administrative and fixed sales expenses. Determine whether or not this alternative is economically viable taking into account the change in the marginal contribution per unit and the tie point per unit, 10. The marketing manager recommends that the sales price be lowered to $ 46.00 per unit and that a sales target of 10,000 units be set. Determine whether or not this alternative is economically viable taking into account the change in the marginal contribution per unit and the tie point per unit 11. The marketing manager recommends that the selling price be increased to $ 55.00 per unit and that a sales target of 6,400 units be set. Determine whether or not this alternative is economically viable taking into account the change in the marginal contribution per unit and the tie point per unit. 12. The company is considering participating in an auction for the Office of the First Lady to sell 1,000 bicycles for $35.00 each. These bicycles will be distributed to the children in the Fortress during Three Kings Day. These 1,000 units are independent of the sales target of 8,000. Determine whether or not it is economically viable to accept this order. Also, evaluate the effect it can have in the short and long term on the company's sales.ru