Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Norman Company has an opportunity to produce and sell a revolutionary new smoke detector for homes, and the project would expect to last for

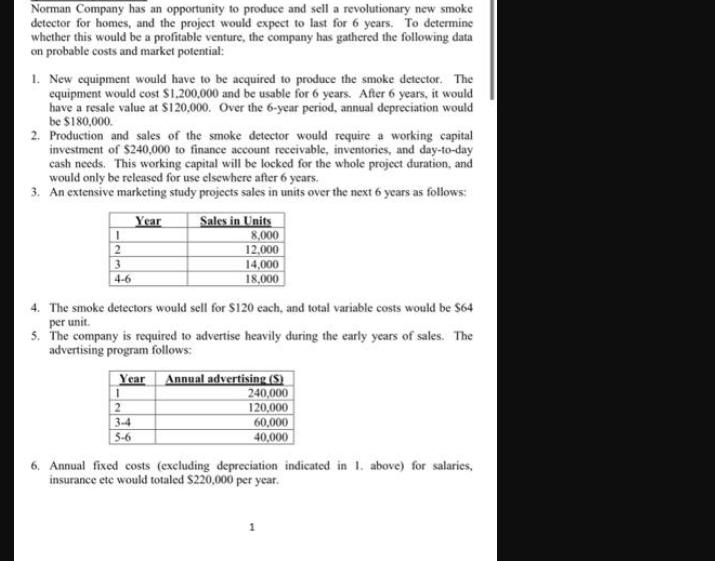

Norman Company has an opportunity to produce and sell a revolutionary new smoke detector for homes, and the project would expect to last for 6 years. To determine whether this would be a profitable venture, the company has gathered the following data on probable costs and market potential: 1. New equipment would have to be acquired to produce the smoke detector. The equipment would cost $1,200,000 and be usable for 6 years. After 6 years, it would have a resale value at $120,000. Over the 6-year period, annual depreciation would be $180,000. 2. Production and sales of the smoke detector would require a working capital investment of $240,000 to finance account receivable, inventories, and day-to-day cash needs. This working capital will be locked for the whole project duration, and would only be released for use elsewhere after 6 years. 3. An extensive marketing study projects sales in units over the next 6 years as follows: Year 1 2 3 4-6 Sales in Units 8,000 12,000 4. The smoke detectors would sell for $120 each, and total variable costs would be $64 per unit. 5. The company is required to advertise heavily during the early years of sales. The advertising program follows: 1 2 14,000 18,000 Year Annual advertising (S) 240,000 120,000 60,000 40,000 3-4 5-6 6. Annual fixed costs (excluding depreciation indicated in 1. above) for salaries, insurance ete would totaled $220,000 per year.

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To determine the profitability of the smoke detector venture for Norman Company we need to calculate the annual revenues costs and the net cash flow f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started