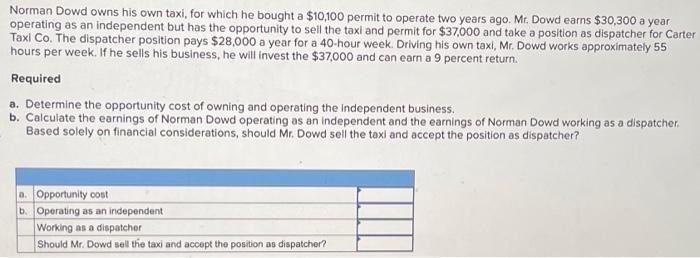

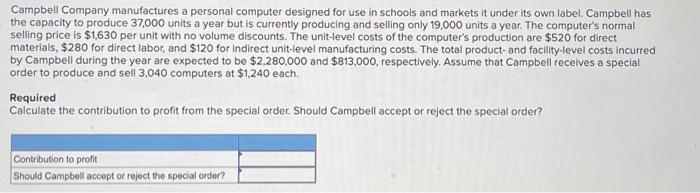

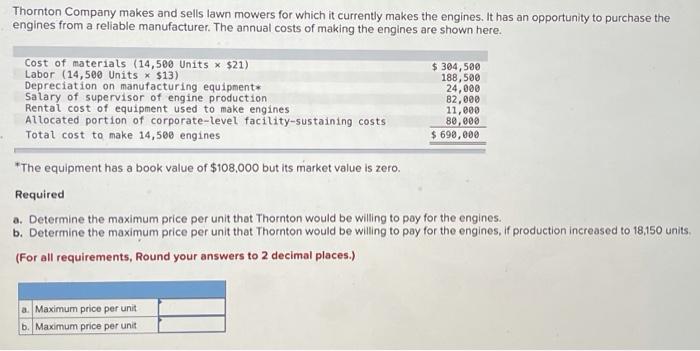

Norman Dowd owns his own taxi, for which he bought a $10,100 permit to operate two years ago. Mr. Dowd earns $30,300 year operating as an independent but has the opportunity to sell the taxi and permit for $37,000 and take a position as dispatcher for Carter Taxi Co. The dispatcher position pays $28,000 a year for a 40 hour week. Driving his own taxi, Mr. Dowd works approximately 55 hours per week. If he sells his business, he will invest the $37,000 and can earn a 9 percent return. Required a. Determine the opportunity cost of owning and operating the Independent business. b. Calculate the earnings of Norman Dowd operating as an independent and the earnings of Norman Dowd working as a dispatcher. Based solely on financial considerations, should Mr. Dowd sell the taxi and accept the position as dispatcher? D. Opportunity cost 6. Operating as an independent Working as a dispatcher Should Mr. Dowd sell the taxi and accept the position as dispatcher? Campbell Company manufactures a personal computer designed for use in schools and markets it under its own label. Campbell has the capacity to produce 37,000 units a year but is currently producing and selling only 19,000 units a year. The computer's normal selling price is $1,630 per unit with no volume discounts. The unit-level costs of the computer's production are $520 for direct materials, $280 for direct labor, and $120 for indirect unit-level manufacturing costs. The total product and facility-level costs incurred by Campbell during the year are expected to be $2,280,000 and $813,000, respectively. Assume that Campbell receives a special order to produce and sell 3,040 computers at $1,240 each. Required Calculate the contribution to profit from the special order. Should Campbell accept or reject the special order? Contribution to profit Should Campbell accopt or reject the special order? Thornton Company makes and sells lawn mowers for which it currently makes the engines. It has an opportunity to purchase the engines from a reliable manufacturer. The annual costs of making the engines are shown here. Cost of materials (14,500 Units * $21) Labor (14,500 Units * $13) Depreciation on manufacturing equipment Salary of supervisor of engine production Rental cost of equipment used to make engines Allocated portion of corporate-level facility-sustaining costs Total cost to make 14,588 engines $ 304,500 188,500 24,000 82,000 11,000 80,000 $ 690,000 *The equipment has a book value of $108.000 but its market value is zero. Required a. Determine the maximum price per unit that Thornton would be willing to pay for the engines. b. Determine the maximum price per unit that Thornton would be willing to pay for the engines, if production increased to 18,150 units (For all requirements, Round your answers to 2 decimal places.) a. Maximum price per unit b. Maximum price per unit