Answered step by step

Verified Expert Solution

Question

1 Approved Answer

North Ltd (North) received December's bank statement from Credit Swisse Bank showing a balance of $59,782 at 31 December 2021. The cash account in

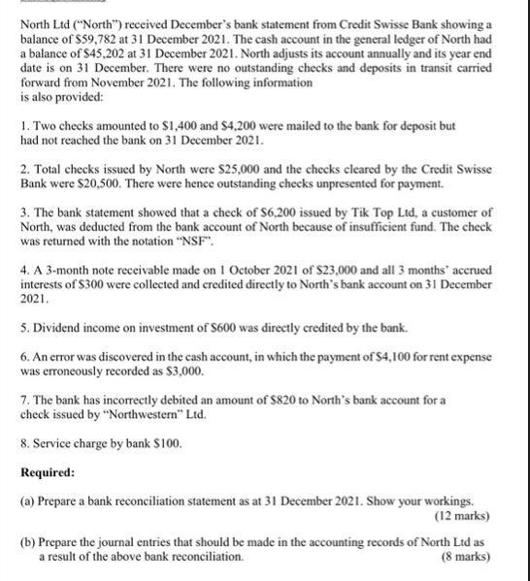

North Ltd ("North") received December's bank statement from Credit Swisse Bank showing a balance of $59,782 at 31 December 2021. The cash account in the general ledger of North had a balance of $45,202 at 31 December 2021. North adjusts its account annually and its year end date is on 31 December. There were no outstanding checks and deposits in transit carried forward from November 2021. The following information is also provided: 1. Two checks amounted to $1,400 and $4,200 were mailed to the bank for deposit but had not reached the bank on 31 December 2021. 2. Total checks issued by North were $25,000 and the checks cleared by the Credit Swisse Bank were $20,500. There were hence outstanding checks unpresented for payment. 3. The bank statement showed that a check of $6,200 issued by Tik Top Ltd, a customer of North, was deducted from the bank account of North because of insufficient fund. The check was returned with the notation "NSF". 4. A 3-month note receivable made on 1 October 2021 of $23,000 and all 3 months' accrued interests of $300 were collected and credited directly to North's bank account on 31 December 2021. 5. Dividend income on investment of $600 was directly credited by the bank. 6. An error was discovered in the cash account, in which the payment of $4,100 for rent expense was erroneously recorded as $3,000. 7. The bank has incorrectly debited an amount of $820 to North's bank account for a check issued by "Northwestern" Ltd. 8. Service charge by bank $100. Required: (a) Prepare a bank reconciliation statement as at 31 December 2021. Show your workings. (12 marks) (b) Prepare the journal entries that should be made in the accounting records of North Ltd as a result of the above bank reconciliation. (8 marks)

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Bank Reconciliation Statement as at 31 December 2021 for North Ltd Starting Balance per Bank Statement 59782 Starting Balance per Cash Account 45202 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started