Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NorthCo changed to the straight-line method of depreciating its capital assets. It had previously been using the declining balance method. This change will be

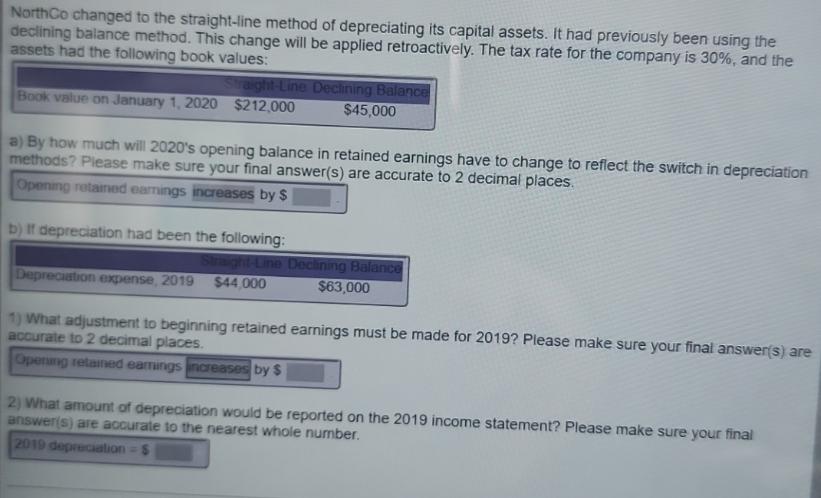

NorthCo changed to the straight-line method of depreciating its capital assets. It had previously been using the declining balance method. This change will be applied retroactively. The tax rate for the company is 30%, and the assets had the following book values: Straight-Line Declining Balance $45,000 Book value on January 1, 2020 $212,000 a) By how much will 2020's opening balance in retained earnings have to change to reflect the switch in depreciation methods? Please make sure your final answer(s) are accurate to 2 decimal places. Opening retained earnings increases by $ b) If depreciation had been the following: Straight-Line Declining Balance Depreciation expense, 2019 $44,000 $63,000 1) What adjustment to beginning retained earnings must be made for 2019? Please make sure your final answer(s) are accurate to 2 decimal places. Opening retained eamings increases by $ 2) What amount of depreciation would be reported on the 2019 income statement? Please make sure your final answer(s) are accurate to the nearest whole number. 2019 depreciation - $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Straightline depreciation expense for 2020 Book value on January 1 2020 212000 Remaining useful li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started