Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Northern Company processes 100 gallons of raw materials Into 75 gallons of product GS-50 and 25 gallons of GS-80. GS-50 is further processed into

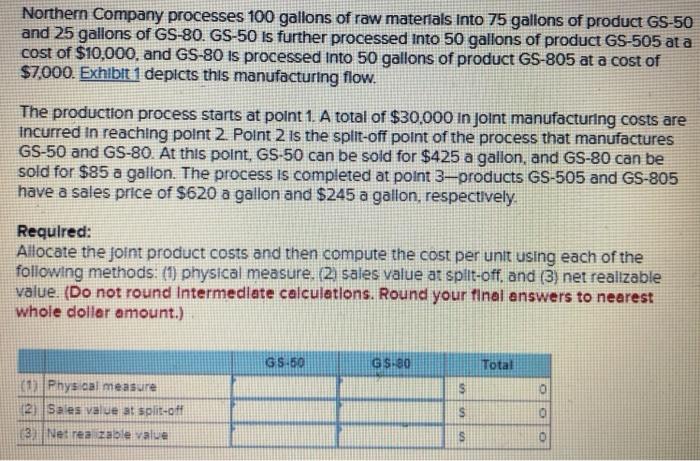

Northern Company processes 100 gallons of raw materials Into 75 gallons of product GS-50 and 25 gallons of GS-80. GS-50 is further processed into 50 gallons of product GS-505 at a cost of $10,000, and GS-80 is processed into 50 gallons of product GS-805 at a cost of $7,000. Exhibit 1 depicts this manufacturing flow. The production process starts at point 1. A total of $30,000 in Joint manufacturing costs are incurred in reaching point 2. Point 2 is the split-off point of the process that manufactures GS-50 and GS-80. At this point, GS-50 can be sold for $425 a gallon, and GS-80 can be sold for $85 a gallon. The process is completed at point 3-products GS-505 and GS-805 have a sales price of $620 a gallon and $245 a gallon, respectively. Required: Allocate the joint product costs and then compute the cost per unit using each of the following methods: (1) physical measure. (2) sales value at split-off, and (3) net realizable value. (Do not round Intermediate calculations. Round your final answers to nearest whole dollar amount.) (1) Physical measure (2) Sales value at split-off (3) Net rea zable value GS-50 GS-80 $ S S 40 Total 10 10 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Statementshowing Computations Paticulars GS50 GS80 Total Physical Meas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started