Answered step by step

Verified Expert Solution

Question

1 Approved Answer

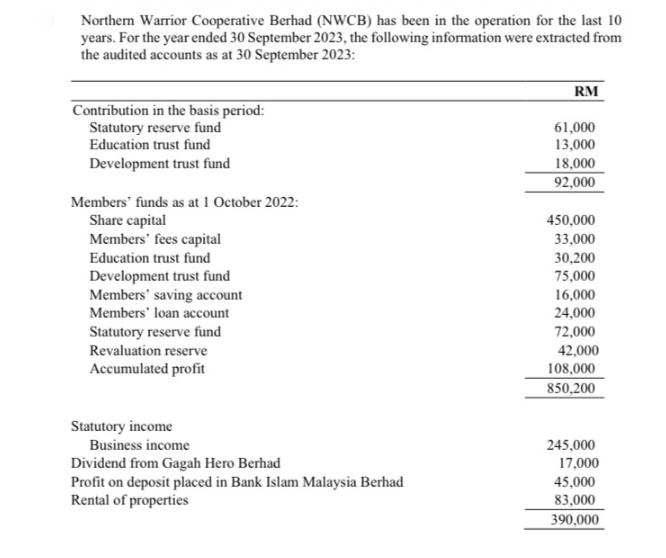

Northern Warrior Cooperative Berhad (NWCB) has been in the operation for the last 10 years. For the year ended 30 September 2023, the following

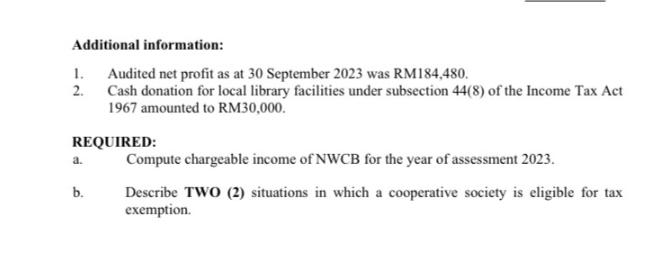

Northern Warrior Cooperative Berhad (NWCB) has been in the operation for the last 10 years. For the year ended 30 September 2023, the following information were extracted from the audited accounts as at 30 September 2023: Contribution in the basis period: Statutory reserve fund Education trust fund Development trust fund Members' funds as at 1 October 2022: Share capital Members' fees capital Education trust fund Development trust fund Members' saving account Members' loan account Statutory reserve fund Revaluation reserve Accumulated profit Statutory income Business income Dividend from Gagah Hero Berhad Profit on deposit placed in Bank Islam Malaysia Berhad Rental of properties RM 61,000 13,000 18,000 92,000 450,000 33,000 30,200 75,000 16,000 24,000 72,000 42,000 108,000 850,200 245,000 17,000 45,000 83,000 390,000 Additional information: Audited net profit as at 30 September 2023 was RM184,480. Cash donation for local library facilities under subsection 44(8) of the Income Tax Act 1967 amounted to RM30,000. REQUIRED: 1. 2. a. b. Compute chargeable income of NWCB for the year of assessment 2023. Describe TWO (2) situations in which a cooperative society is eligible for tax exemption.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the chargeable income of Northern Warrior Cooperative Berhad NWCB for the year of assessm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started