Question

NorthRock Investments is an asset manager that invests primarily in floating rate debt. The size of their bond portfolio is $700 million. NorthRock believes

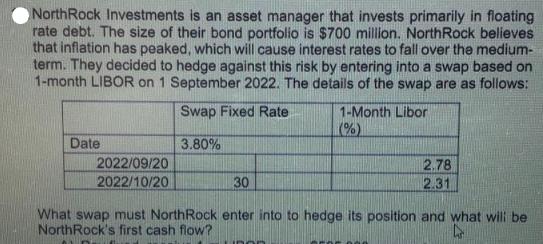

NorthRock Investments is an asset manager that invests primarily in floating rate debt. The size of their bond portfolio is $700 million. NorthRock believes that inflation has peaked, which will cause interest rates to fall over the medium- term. They decided to hedge against this risk by entering into a swap based on 1-month LIBOR on 1 September 2022. The details of the swap are as follows: Swap Fixed Rate 3.80% Date 2022/09/20 2022/10/20 1-Month Libor (%) 2.78 2.31 30 What swap must NorthRock enter into to hedge its position and what will be NorthRock's first cash flow? 4

Step by Step Solution

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To hedge its position NorthRock Investments needs to enter into an interest rate swap to offset ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

9th edition

978-0077459451, 77459458, 978-1259027628, 1259027627, 978-0073382395

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App