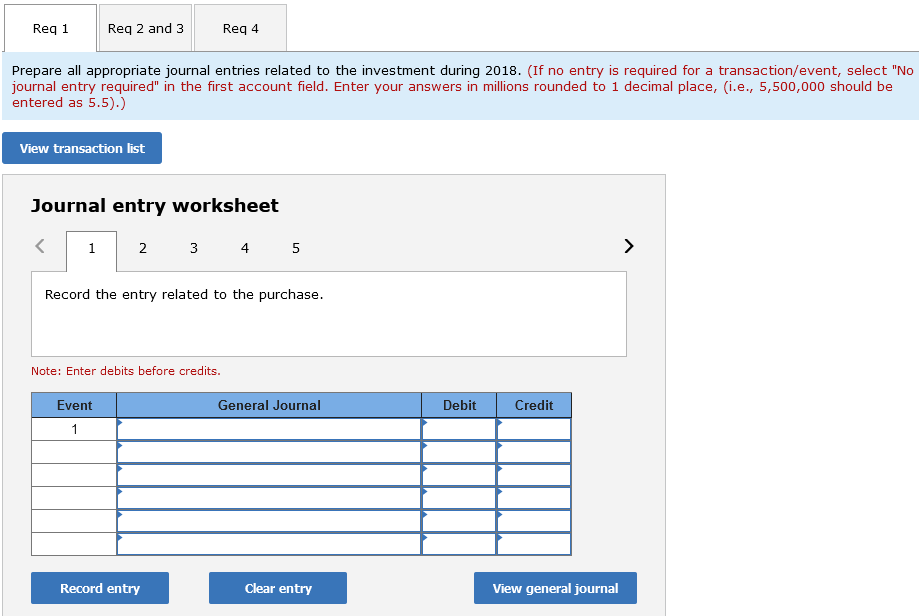

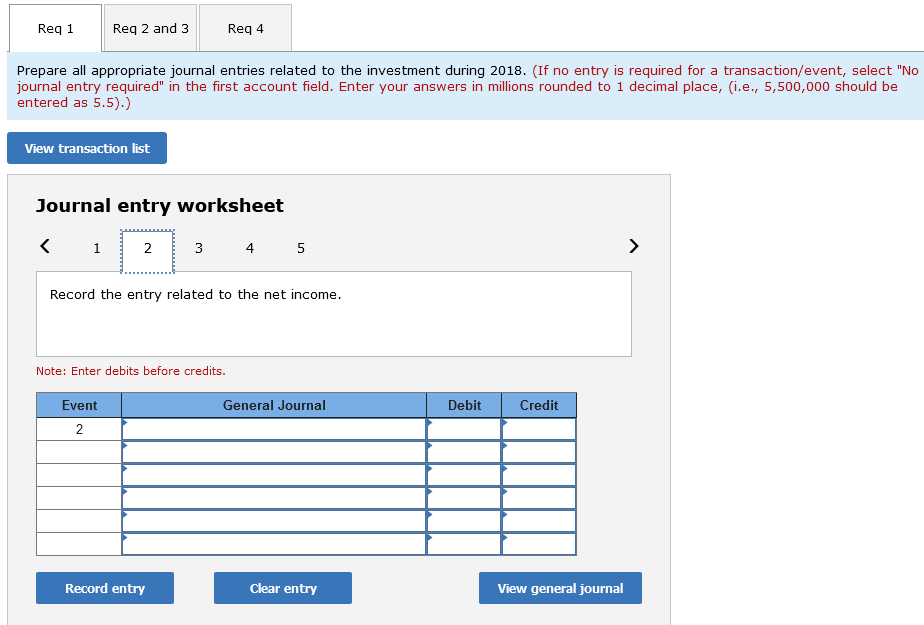

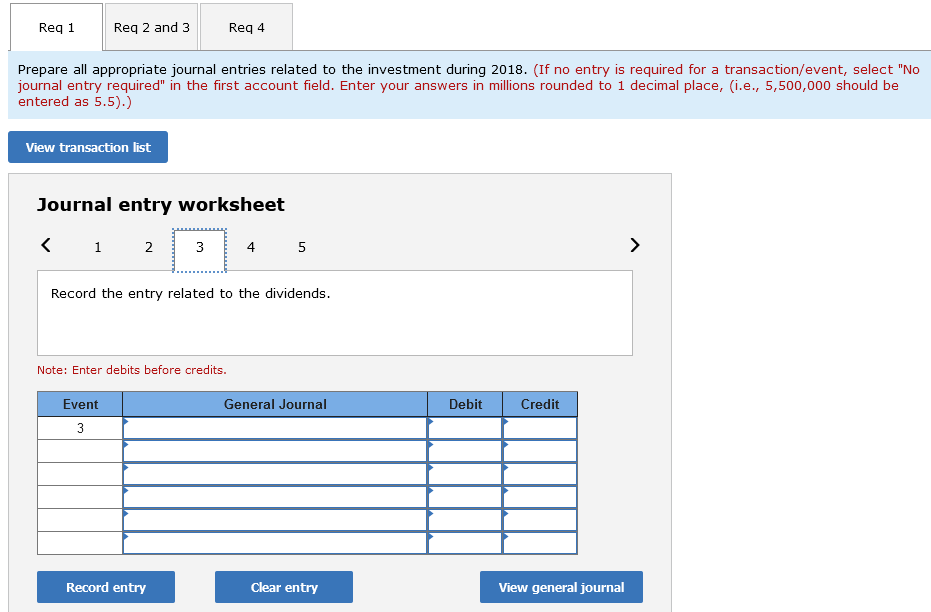

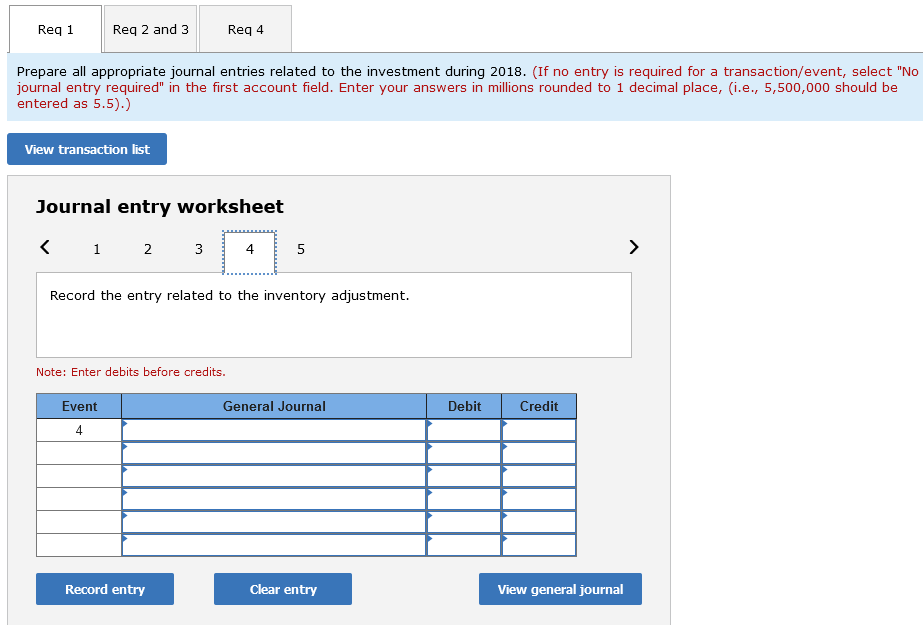

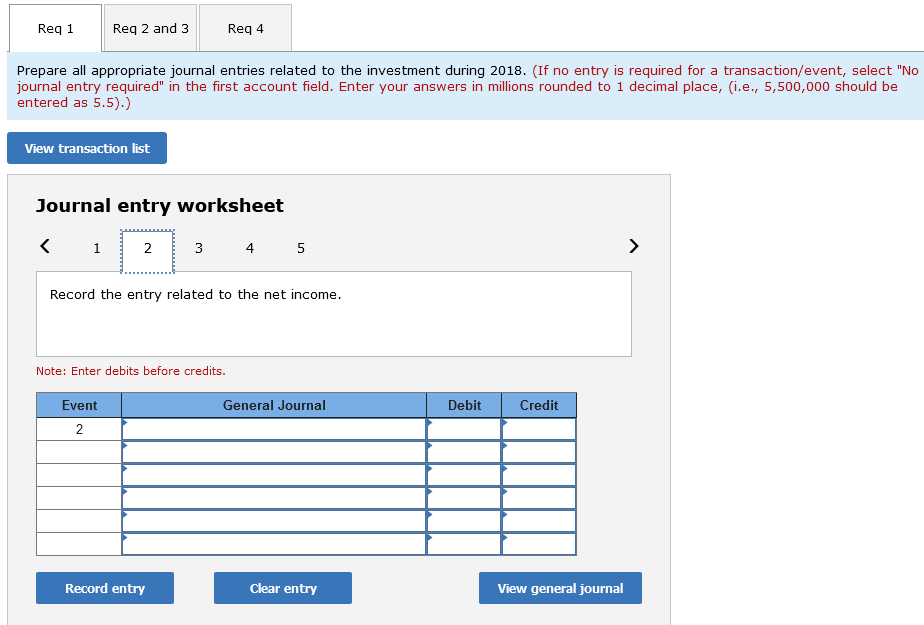

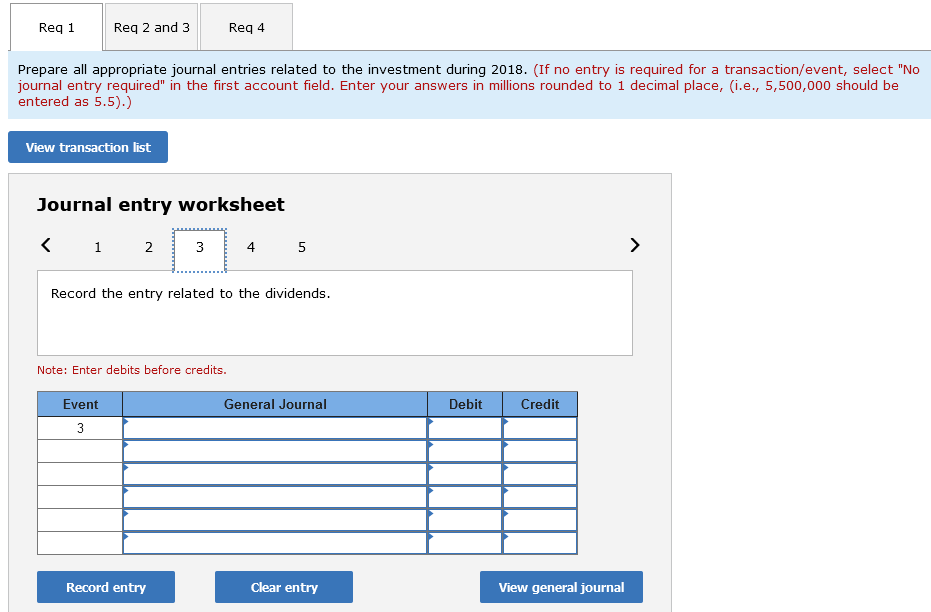

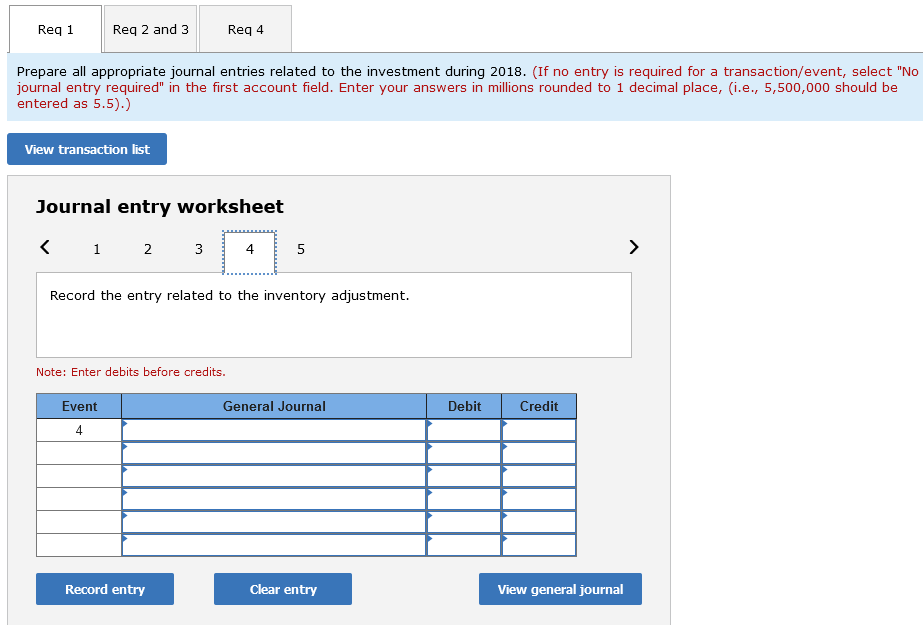

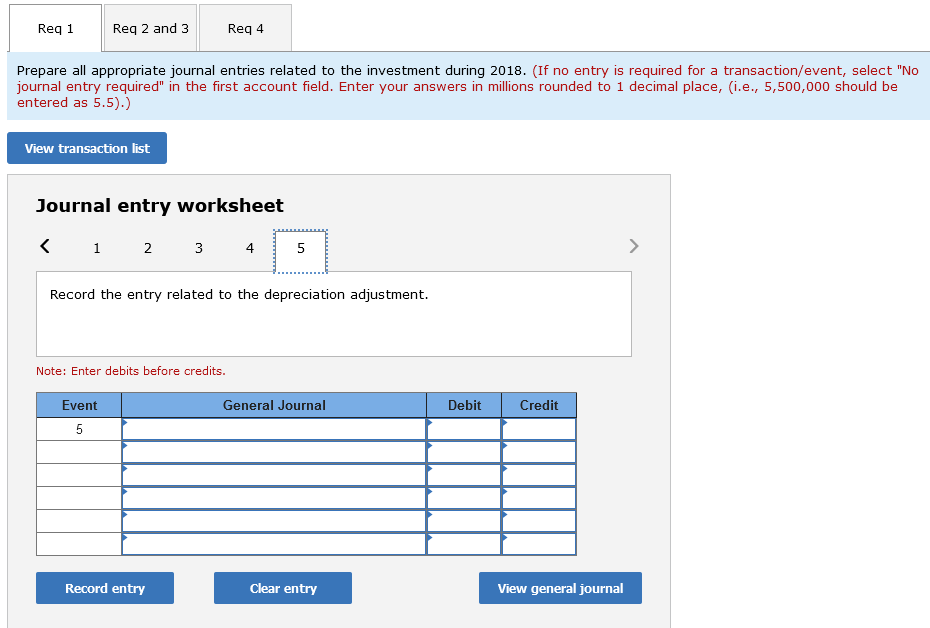

Northwest Paperboard Company, a paper and allied products manufacturer, was seeking to gain a foothold in Canada. Toward that end, the company bought 40% of the outstanding common shares of Vancouver Timber and Milling, Inc., on January 2, 2018, for $560 million. At the date of purchase, the book value of Vancouver's net assets was $855 million. The book values and fair values for all balance sheet items were the same except for inventory and plant facilities. The fair value exceeded book value by $5 million for the inventory and by $30 million for the plant facilities. The estimated useful life of the plant facilities is 15 years. All inventory acquired was sold during 2018. Vancouver reported net income of $180 million for the year ended December 31, 2018. Vancouver paid a cash dividend of $20 million. Required: 1. Prepare all appropriate journal entries related to the investment during 2018. 2. What amount should Northwest report as its income from its investment in Vancouver for the year ended December 31, 2018? 3. What amount should Northwest report in its balance sheet as its investment in Vancouver? 4. What should Northwest report in its statement of cash flows regarding its investment in Vancouver?

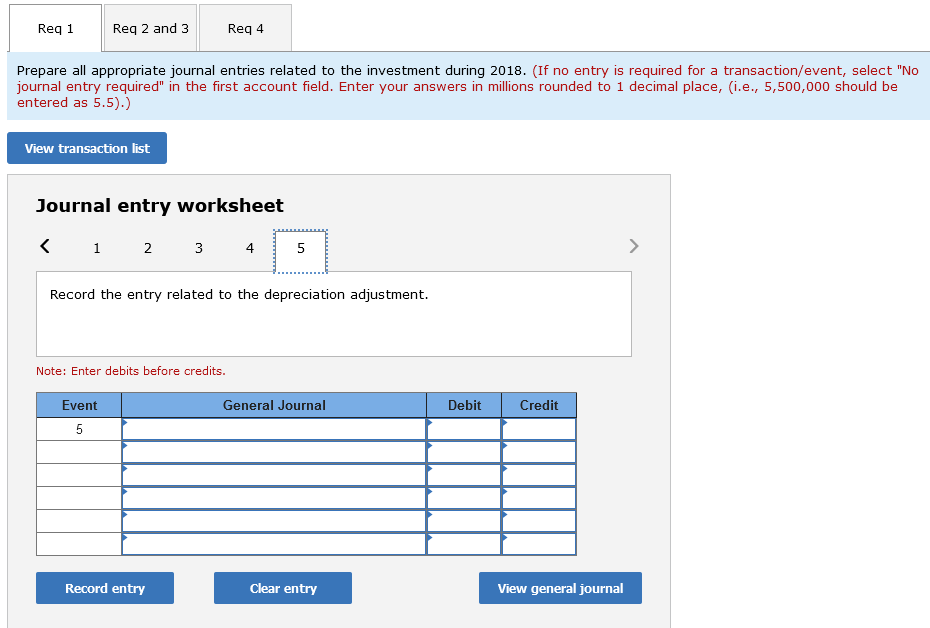

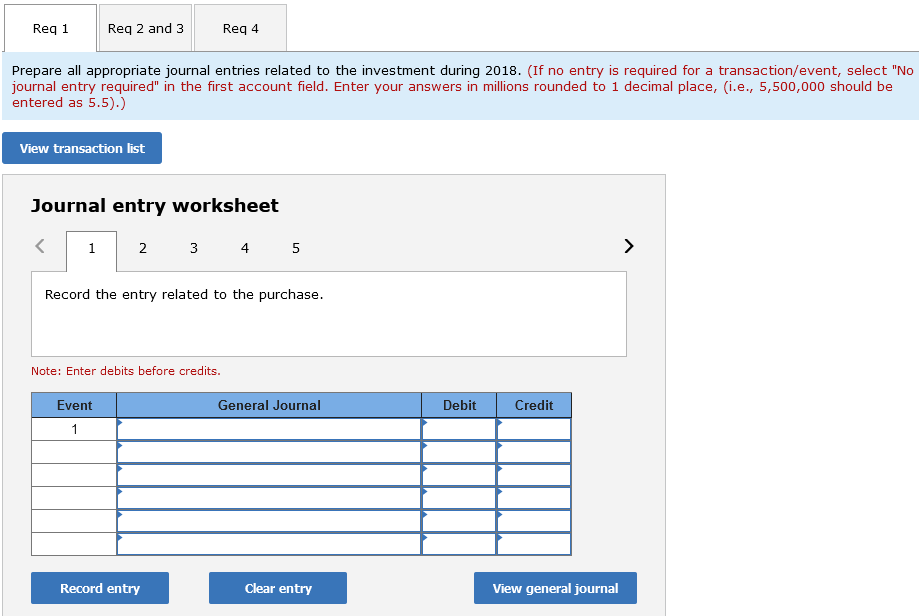

Requirement 1:

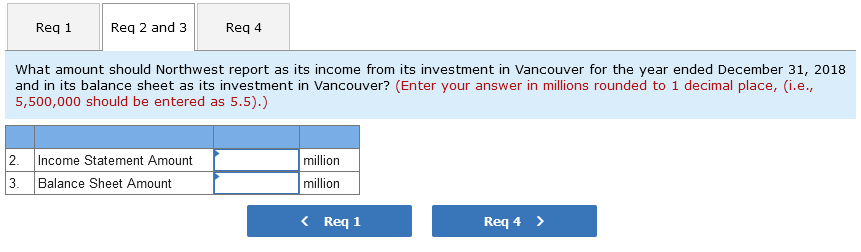

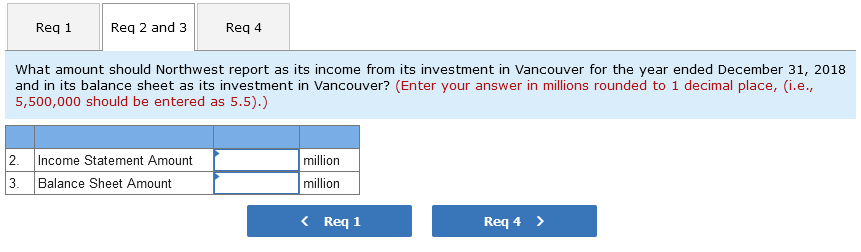

Requirements 2 & 3:

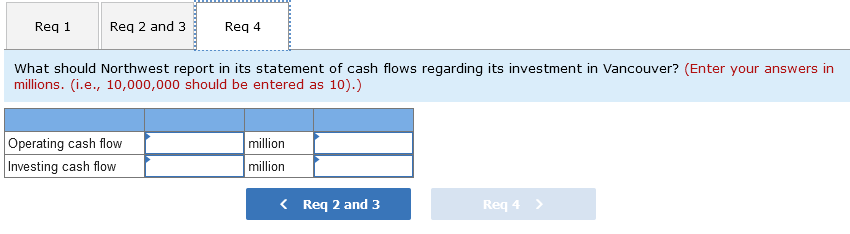

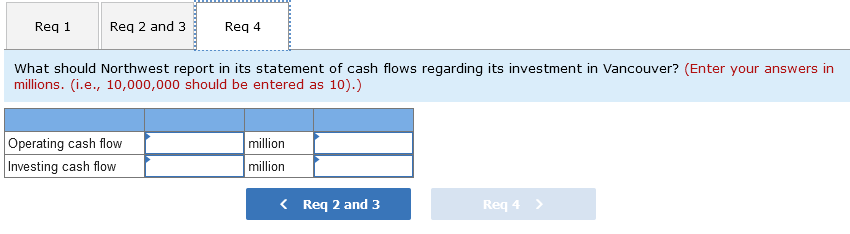

Requirement 4:

Reg 1 Req 2 and 3 Reg 4 Prepare all appropriate journal entries related to the investment during 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place, i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet 1 2 3 4 5 > Record the entry related to the purchase. Note: Enter debits before credits. General Journal Debit Credit Event 1 Record entry Clear entry View general journal Req 1 Req 2 and 3 Reg 4 Prepare all appropriate journal entries related to the investment during 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place, i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet Record the entry related to the net income. Note: Enter debits before credits. Event General Journal Debit Credit 2 Record entry Clear entry View general journal Req 1 Reg 2 and 3 Reg 4 Prepare all appropriate journal entries related to the investment during 2018. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet Record the entry related to the dividends. Note: Enter debits before credits. General Journal Debit Credit Event 3 Record entry Clear entry View general journal Reg 1 Req 2 and 3 Reg 4 Prepare all appropriate journal entries related to the investment during 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place, i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet Record the entry related to the depreciation adjustment. Note: Enter debits before credits. General Journal Debit Credit Event 5 Record entry Clear entry View general journal Reg 1 Reg 2 and 3 Reg 4 What amount should Northwest report as its income from its investment in Vancouver for the year ended December 31, 2018 and in its balance sheet as its investment in Vancouver? (Enter your answer in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5).) 2. 3. Income Statement Amount Balance Sheet Amount million million Reg 1 Reg 2 and 3 Reg 4 What should Northwest report in its statement of cash flows regarding its investment in Vancouver? (Enter your answers in millions. (i.e., 10,000,000 should be entered as 10).) Operating cash flow Investing cash flow million million