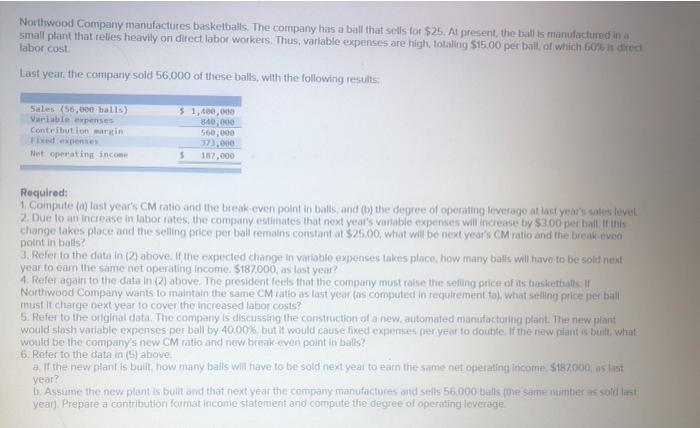

Northwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball is manufactured in a small plant that relles heavily on direct labor workers. Thus, variable expenses are high, totaling $15.00 per ball of which 60% is died labor cost Last year, the company sold 56,000 of these balls, with the following results Sales (56,000 balls) Variable penses Contribution martin 5 1,400,00 8.10,000 560,000 72,000 5 187,000 Net operating income Required: 1. Compute() last year's CM ratio and the break even point in balls, and (b) the degree of operating leverage at last year's soles level 2. Due to an increase in laborates, the company estimates that next year's variable expenses will increase ty 53.00 per ball if this change takes place and the selling price per ball remains constant at $25.00, what will be next year's CM ratio and the break even point in balls 3. Refer to the data in (2) above. If the expected change in variable expenses takes place, how many balls will have to be sold next year to eam the same net operating Income. 5187,000, as last year? 4. Refer again to the data in (2) above. The president feels that the company must raise the selling price of its basketbolls Northwood Company wants to maintain the same CM ratio as last year is computed in requirement to), what selling price per ball must it charge next year to cover the increased labor costs? 5. Refer to the original data. The company is discussing the construction of a new, automated manufacturing plant. The new plant would stash variable expenses per ball by 40.00% but it would cause liked expenses per year to double. If the new plant is built what would be the company's new CM ratio and new break even point in balls 6. Reter to the data in (5) above all the new plant is built how many balls will have to be sold next year to earn the same net operating income. 187000, as it year? b. Assume the new plant is built and that next year the company manufactures and sells 56.000 balls me same number as sold last year). Prepare a contribution format income statement and compute the degree of operating leverage