Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Northwood Company manufactures basketballs. The company has a ball that sells for $36. At present, the ball is manufactured in a small plant that

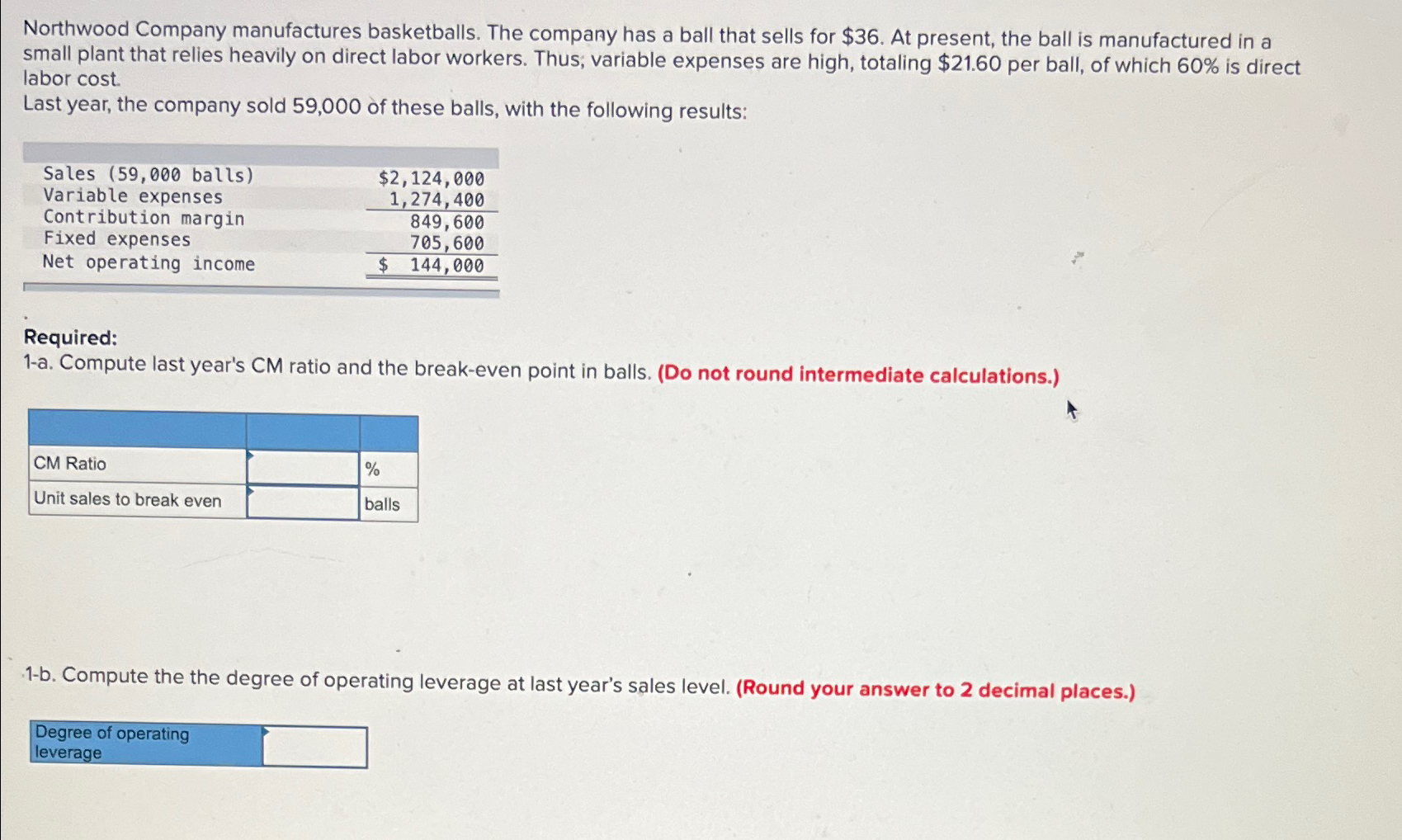

Northwood Company manufactures basketballs. The company has a ball that sells for $36. At present, the ball is manufactured in a small plant that relies heavily on direct labor workers. Thus, variable expenses are high, totaling $21.60 per ball, of which 60% is direct labor cost. Last year, the company sold 59,000 of these balls, with the following results: Sales (59,000 balls) Variable expenses Contribution margin Fixed expenses Net operating income $2,124,000 1,274,400 849,600 705,600 $ 144,000 Required: 1-a. Compute last year's CM ratio and the break-even point in balls. (Do not round intermediate calculations.) CM Ratio Unit sales to break even % balls 1-b. Compute the the degree of operating leverage at last year's sales level. (Round your answer to 2 decimal places.) Degree of operating leverage

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem well first calculate the contribution margin CM then use it to find the CM rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started